Despite recent market volatility and some arguing for a bear […]

Pinterest (PINS) is at a Critical Juncture

Pinterest (PINS) is at a Critical Juncture

We've spoken at length about the massive user adoption of Pinterest (PINS) over the past year. Short-term, market outlook may be more uncertain.

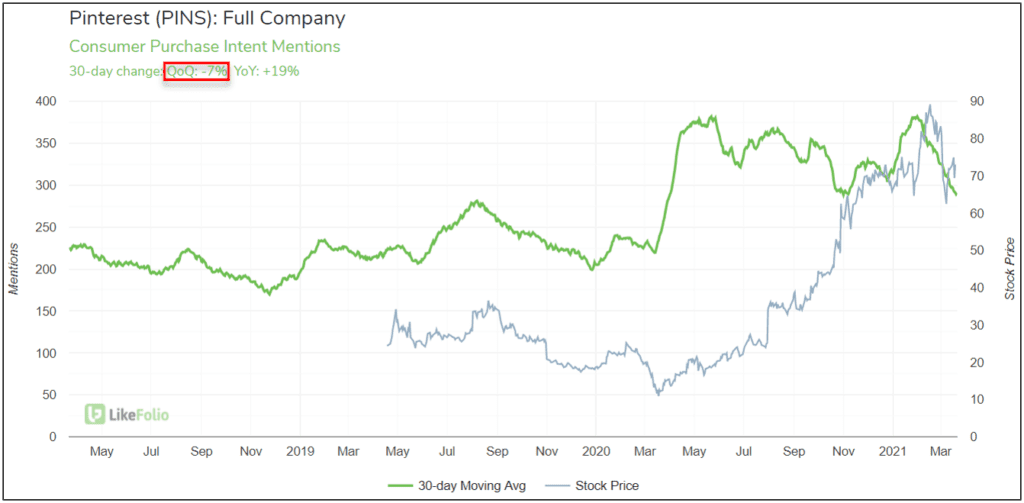

It's no secret that the COVID-19 lockdowns were a boon for PINS. Note the sharp and permanent increase in Consumer Demand that occurred in the month following the initial shutdown orders... Is this user growth sustainable?

Purchase Intent Mentions are showing some near-term weakness, down -7% QoQ on a 30-day moving average, following a robust Holiday season.

A downgrade from Bank of America has the stock trading lower today, and the general 're-opening' trade mindset isn't working in its favor either. Still, we're maintaining a bullish outlook.

Pinterest has done a phenomenal job of monetizing it's U.S. userbase, which we expect to continue. Last quarter, Pinterest's U.S. revenue increased +67% YoY and its international revenue increased +145% YoY, both driven by growth in average revenue per user. Furthermore, we're intrigued by PINS massive (and largely untapped) international userbase. International revenue currently accounts for ~17% of total revenue, and the company plans to roll-out advertising tech (like automation) into these markets: "Part of the reason that we've focused so much on things like automation is we want Pinterest to be an easy place to buy, an easy place to spend, an easy place to get really great results."