The Walt Disney Company (DIS) Exactly a year ago today, […]

Post Earnings, Disney is Flowing

Fresh off of earnings last week, Disney is seeing some strong bullish action on the stock that can certainly continue if the data has anything to say about it.

The stock reported first-quarter earnings last week and revenue was up 34% at $21.8 billion which just smashed Wall Street’s estimates. The stock traded to a high of around $157 the morning of the earnings and is, as of current, targeting that level again this week.

The big theme in the stock was the theme parks business line which suffered dramatically during Covid.

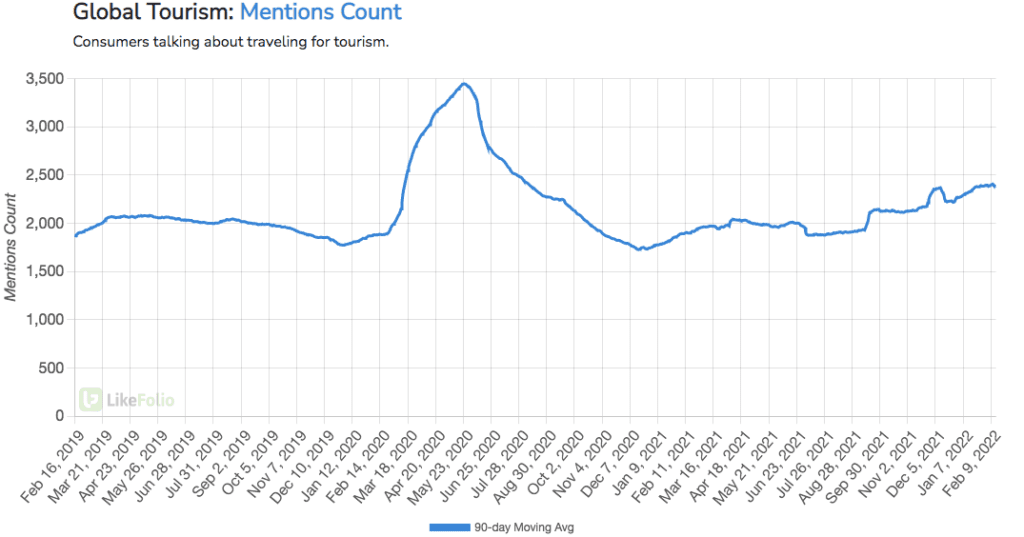

Operating profit was at $2.45 billion which is a BIG change from the loss of $119 million a year prior. LikeFolio trend data supports this claim, YoY consumer engagement mentions of Global Tourism are up +25%.

While Disney's streaming business has been a bit rocky, it seems that the parks revenue and global tourism opening back-up are enough to bring investors back into this name.

We’ll keep an eye on more consumer engagement data heading forward but this is a name to watch as we are, hopefully, heading into the post-covid era.