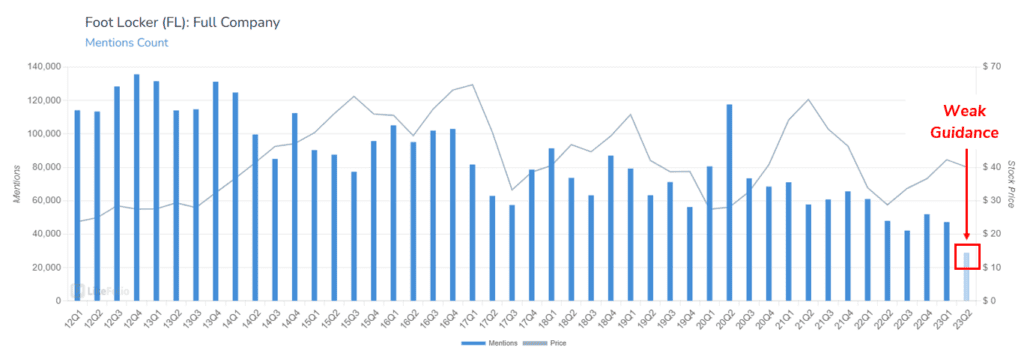

Footlocker (FL) Last quarter, Footlocker stole our thunder when it […]

Retail Earnings on Deck! $DKS $AEO $ANF $URBN

Foot Locker set an ominous tone last week when it posted a report that missed on the top and bottom lines and issued lowered guidance from 2 months ago.

The bad news? Middle-to-lower income shoppers continue to pull back on discretionary spending, impacting a retailer like Foot Locker specializing in trendy athletic shoes.

The good news? LikeFolio data saw it coming.

This chart below highlights the downturn in Foot Locker brand mentions, with the highlighted quarter showcasing the pace volume for the month of May.

Talk about foreshadowing – Andy talked about this ahead of Foot Locker’s Q1 earnings last week on the TD Ameritrade Network.

This week, a slew of other retailers are set to report earnings.

Will they suffer the same fate as Foot Locker?

Here are the highlights:

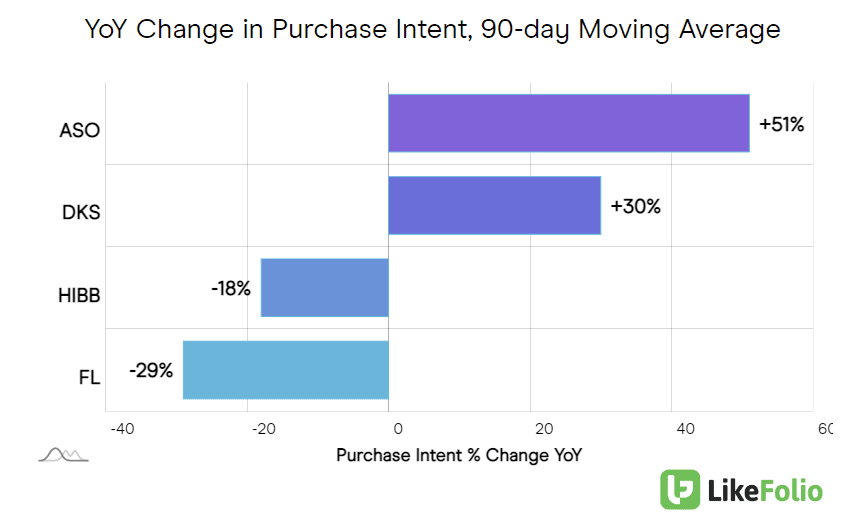

Dicks Sporting Goods (DKS) reports earnings Tuesday before the bell -- LikeFolio's earnings score is Bullish, +55, driven by robust demand growth. The company is NOT recording the same degradation in demand or mentions as LikeFolio recorded in Foot Locker ahead of its earnings. In fact, DKS is gaining steam and increasingly a best of breed retailer for athletic wear.

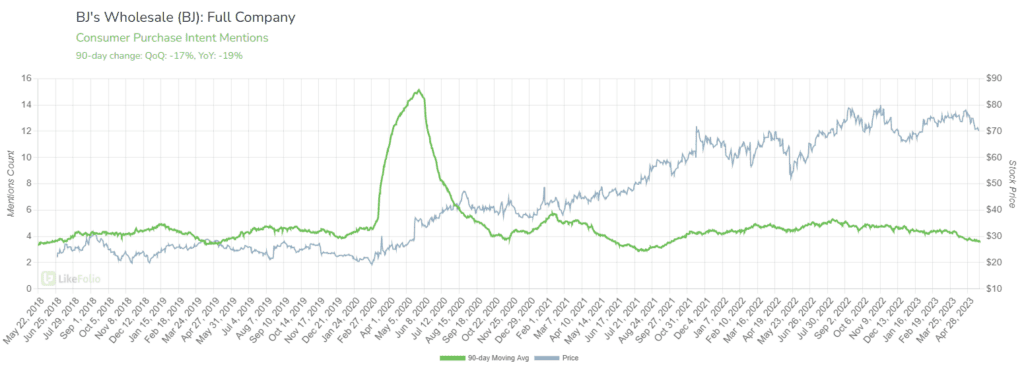

Bj’s Wholesale (BJ) reports Tuesday before the bell and has logged a Bearish earnings score. The company’s report follows a weak April sales report from Costco, with many consumers struggling to support the high costs of bulk purchases. Bj’s consumer purchase intent (including mentions of signing up for a membership and shopping at the bulk-retailer) have slipped by -19% YoY and appear to be weakening in Q2, a bad nod for guidance.

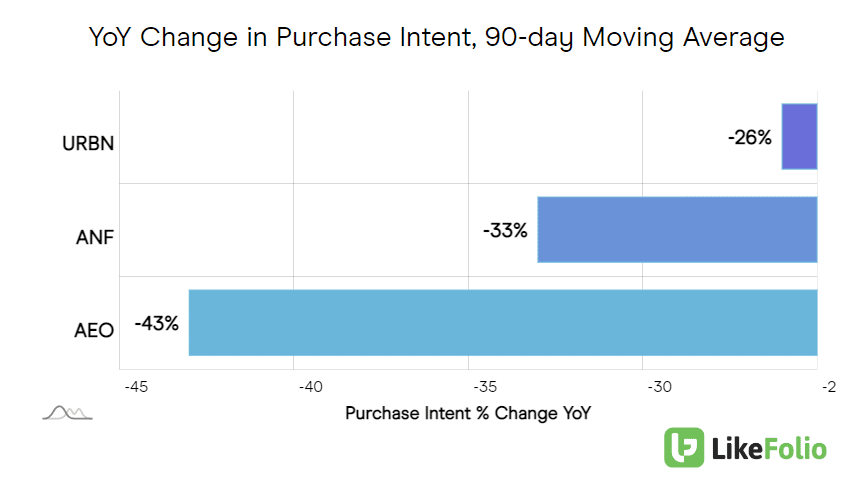

Teen retailers American Eagle Outfitters (AEO) and Abercrombie & Fitch (ANF) report on Wednesday, and both have recorded serious demand weakness, reflective of cautious consumer discretionary spending. Urban Outfitters (URBN) shows some comparative resilience, driven mostly by its brand positioning catering to a higher-earning consumer base. A top at URBN’s Anthropologie store will cost upwards of $75 vs. $30 at AEO, ANF. Across the board, consumer mentions of shopping for new clothes have dropped by -29% YoY.

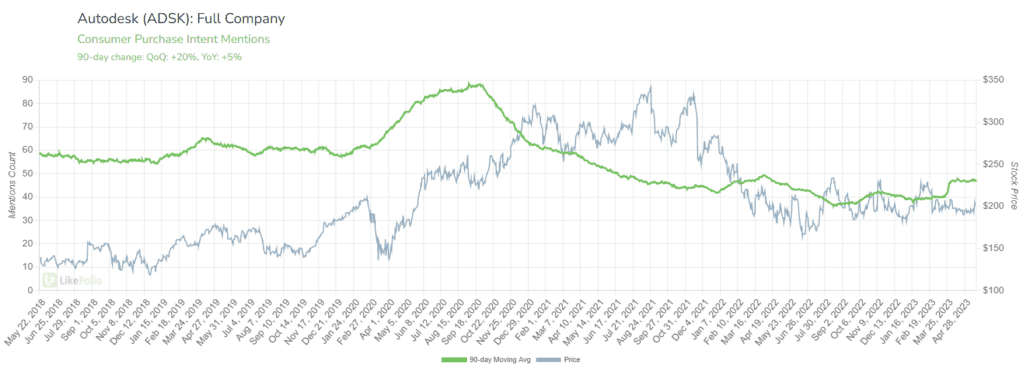

Subscription-based software provider, AutoDesk (ADSK) is showing signs of recovery from Winter lows. ADSK consumer happiness has improved by +3% alongside a +5% YoY boost in consumer demand, a positive indicator especially as shares consolidate lower. The company reports Thursday after the bell, and LikeFolio has recorded Bullish momentum ahead of its report.

Bottom line: discretionary retail spending looks weak as consumer buying power declines in May. Look for outperformers to play to the upside, and for recovering companies with low expectations.