Apple (AAPL) iPhone 12 Update Apple delayed (and then staggered) the release of […]

Shopify's Dominance Is Growing

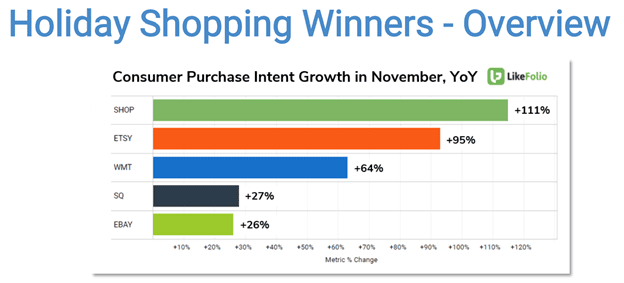

In early December, we crowned Shopify the Holiday Shopping winner (based on this data) in a special MegaTrends report to LikeFolio clients.

Clients are already reaping gains: shares have gained +36% in value since then.

Shopify will release 20Q4 results Feb. 17 before the bell.

LikeFolio data shows Shopify demand is holding at extremely high levels, and recurring usage mentions are accelerating (Shop Pay).

- Shopify Purchase Intent mentions increased +120% YoY in 20Q4. This is a slight deceleration vs. Q2 and Q3, but makes sense due to Covid-onboarding spark.

- Transaction mentions are strong indicator of continued (and accelerated) adoption of payment services -- mentions of consumers using Shopify Pay increased +163% YoY and just capped off a record high Holiday Season.

- Consumer Happiness is extremely high, 84% positive -- and actually improved during massive adoption spark. Pretty remarkable

Last quarter, Shopify shares fell ~15% in three trading sessions post-earnings release, despite a significant beat. Some attributed this to management's caution on monthly recurring revenue growth rate, and others suggested broad market factors played a role (wrong week to report).

Data supports robust adoption. We are remaining Bullish long-term as Shopify continues to expand its eCommerce prowess.