Last September we used Purchase Intent data to predict that […]

Should you take a bite out of Apple (AAPL)?

Apple shares have shed -14% in value over the last 6 months for 2 big reasons:

1) Growth is slowing.

In 2021 Apple revenue grew by nearly +65% YoY. In 2022, this growth rate was about +8%. A high bar certainly, but a serious drop off.

And future growth headwinds are expected, including a slow-down in consumer discretionary spending and weakness in China.

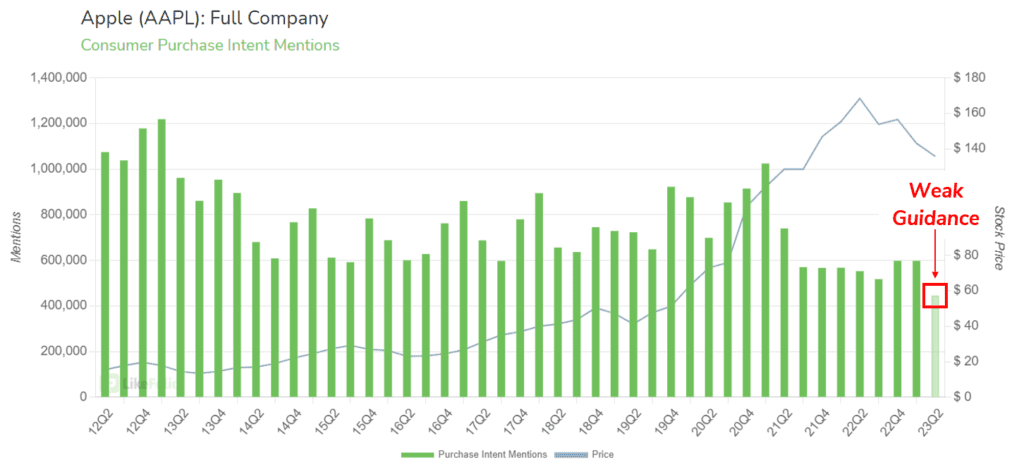

LikeFolio data mirrors a slowdown in growth…Purchase Intent mentions have slipped by -4% YoY.

While the Holiday season looked decent, the current quarter is off to a slow start.

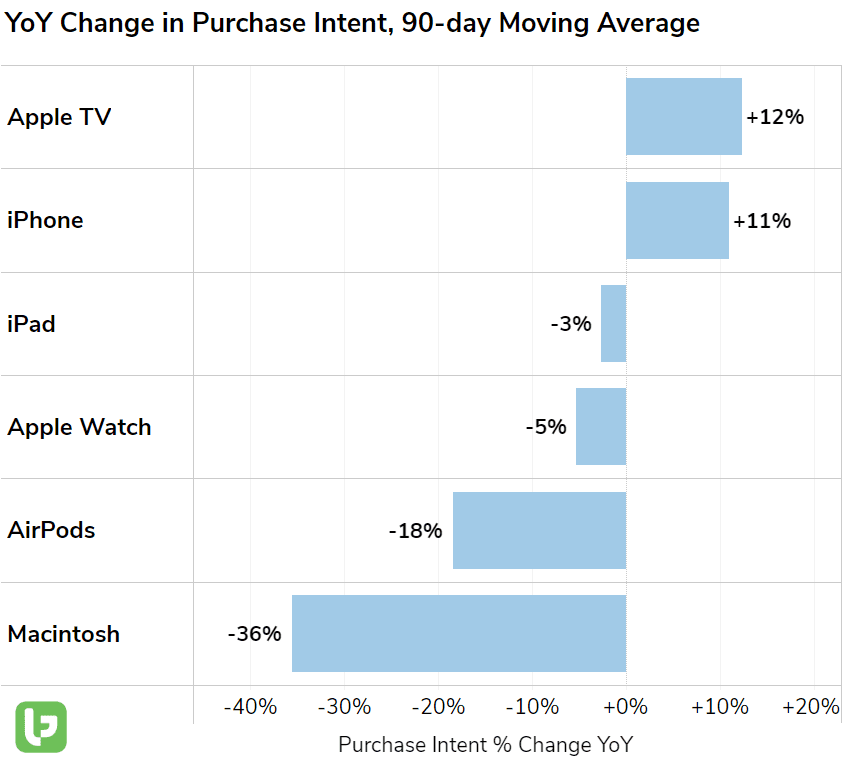

2) The market is anticipating iPhone weakness.

iPhone sales comprised 47% of Apple revenue in the 4th quarter – making the iPhone its most significant revenue driver.

When Apple launched its new iPhone line-up at its Keynote event in September 2022, initial demand looked strong...things were looking up! But after asking suppliers to increase iPhone production ahead of the holiday season, Apple reportedly reined in these plans.

However, LikeFolio data suggests iPhone skepticism may be overblown.

Consumer mentions of purchasing a new iPhone were +11% higher in 23Q1 vs. 22Q1.

While this growth has tempered in January, demand may be higher than the market is expecting.

Heading into earnings, we're officially neutral.

Data supports a strong holiday quarter, and the recent sell-off suggests the bar may be lower than normal for the tech behemoth. However, weakness in demand developing across the board in January has us sidelined for the event. Guidance may ruin an earnings surprise.

Longer-term, we like the Bullish setup. We featured the consumer case for Apple in depth in our September MegaTrends report.

In a nutshell:

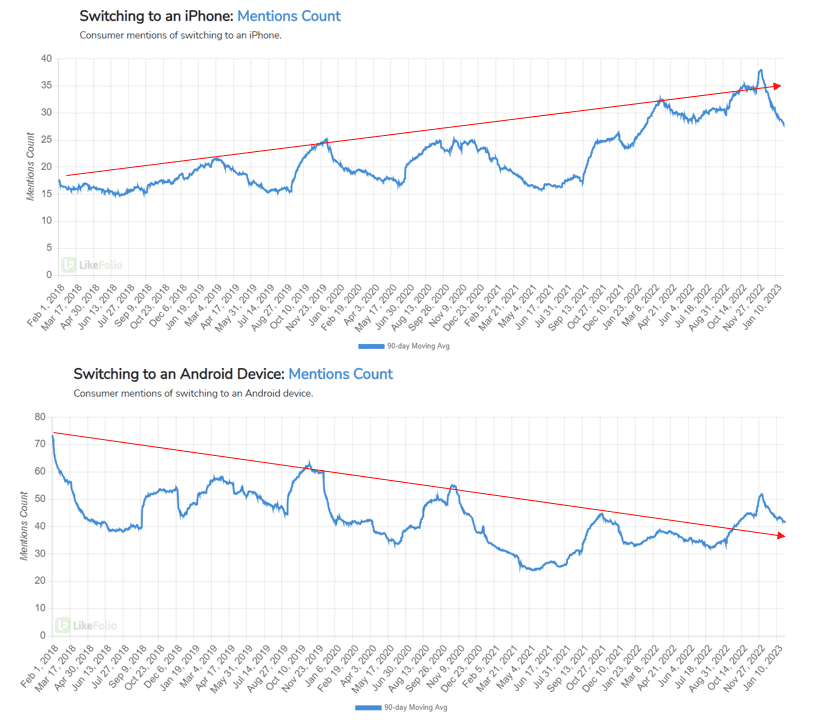

1) Apple is building its loyal following.

I.e. converting Android users (Landon included!)

Check out the trend trajectory for "Switching to iPhone" vs. "Switching to Android". Once Apple lands a device in the consumer's hands, the ripple-effect-dollar-spend per consumer begins cascading in.

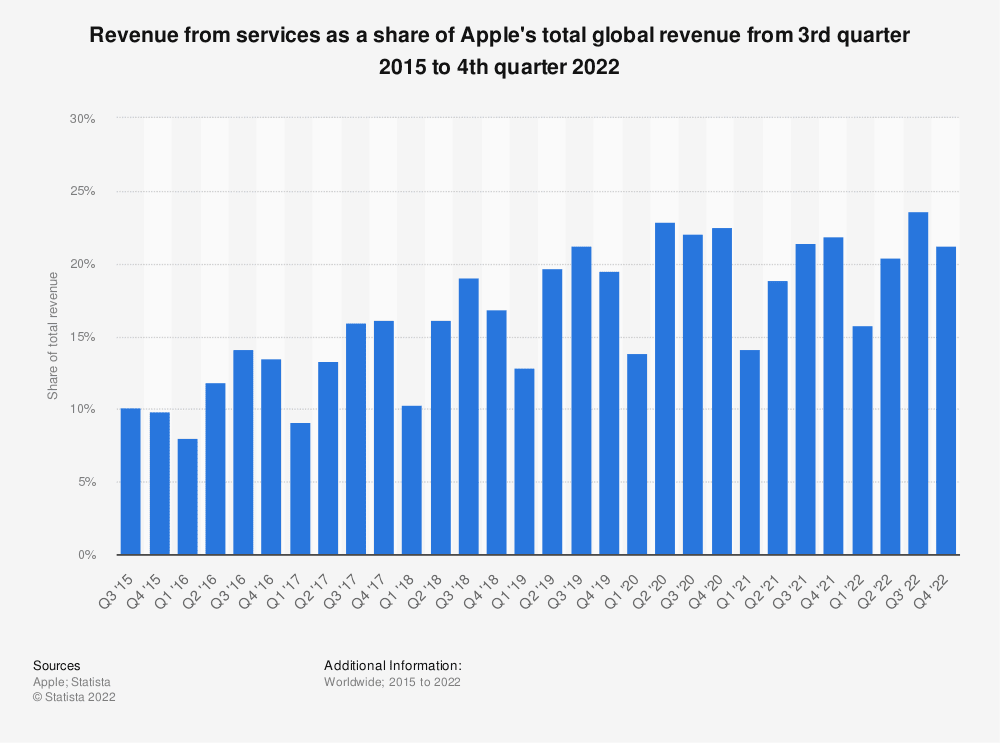

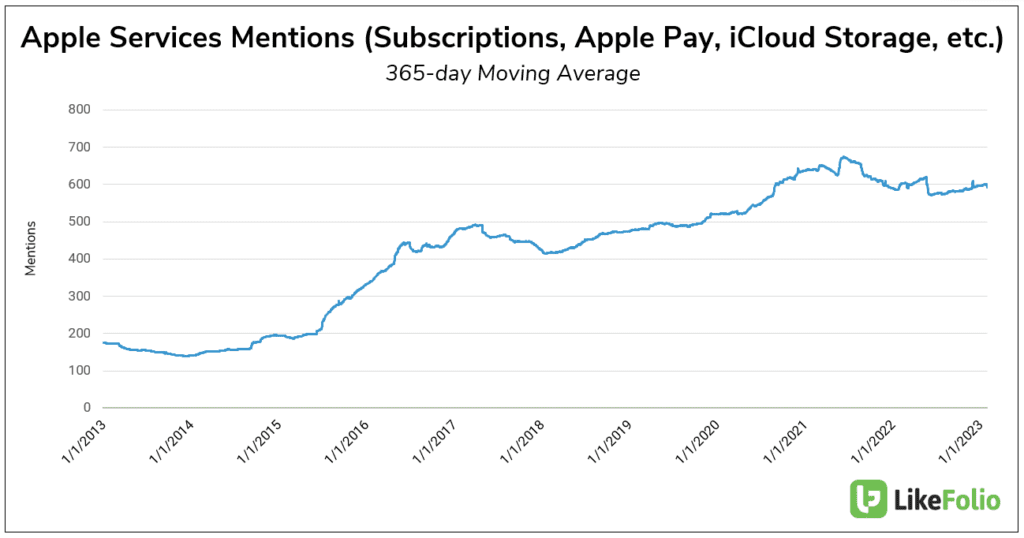

2) This growing audience is boosting Apple's growing services division.

Last quarter, services comprised more than 21% of the company's revenue. In 2015, this number was less than 10%.

LikeFolio data shows that consumer mentions of splurging on Apple services (from subscription renewals to checking out with Apple Pay) increased by +11% YoY in the 1st quarter.

Any sell-off on relative weakness may prove to be a lucrative buying opportunity for investors.