Lowe's (LOW) Home Depot is trading ~3% lower today after […]

Sonos Crushed 2020, but Can its Growth Continue?

Sonos Crushed 2020, but Can its Growth Continue?

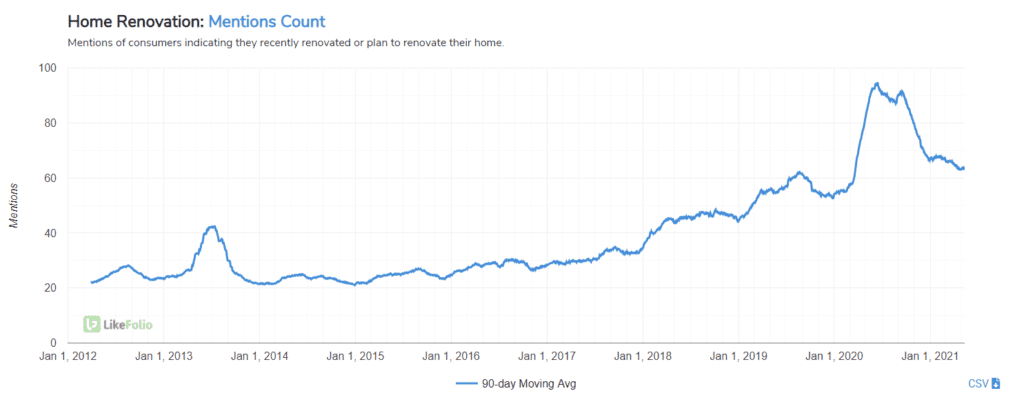

SONO shares are trading +260% YoY, thanks in part to pandemic related macro trends. Home Renovation mentions increased +41% YoY in 2020 as consumers reshuffled and re-did areas of their home, boosting home speaker demand.

We saw this opportunity developing in SONO and featured the company on our June MegaTrends report -- when shares were trading below $15. So what is driving growth for the company, aside from consumer behavior tailwinds?

- Premium Products

- Consistent Upgrade Cycle

- Accelerating DTC Performance

Product categories showing strength:

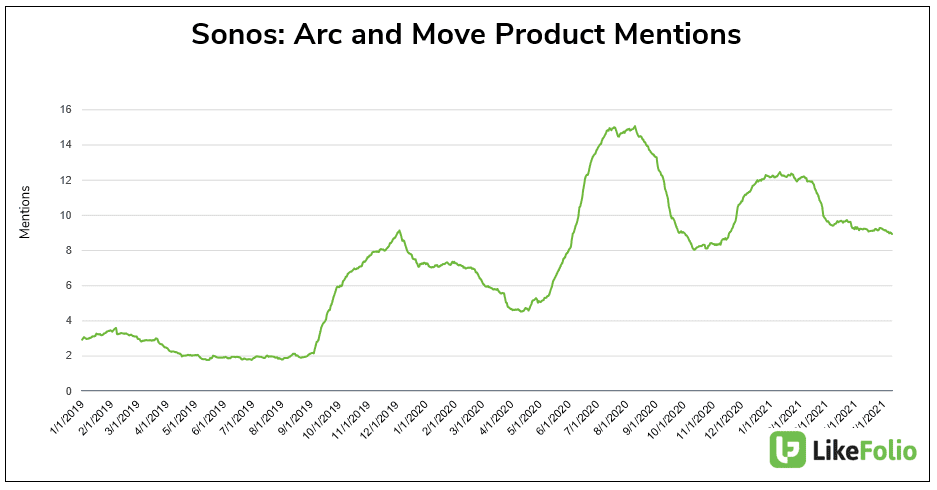

- Sonos speaker revenue: +13% year over year, driven by the continued success of Arc and Move. This is where LikeFolio data excels.

We can see continued demand elevation for Arc and Move (+65% YoY), but notably lower QoQ. Some of this QoQ weakness may be expected following a strong Holiday season, but the bar is certainly high.

- Sonos system products revenue: +59%, driven by installed channel and component products.

This is a top-notch company with high-quality products. But they've crushed it on previous reports. Without a Holiday season boost, can they sustain explosive growth AND continue to guide accordingly? SONO reports 21Q2 results Monday after the bell.