Spotify (SPOT) purchase intent surging Spotify Purchase Intent was the […]

Spotify Shares Surge as the company dismisses role as content censor

Last week we highlighted a common phenomenon playing out for the company, Spotify: the boycott effect.

At LikeFolio, history has taught us that politically-motivated tweeters rarely impact the bottom line for a company.

That’s why we put out a note on Friday, suggesting the Spotify battle unfolding between Neil Young and Joe Rogan was more reminiscent of a “flash in the pan” event. Turns out, we were right.

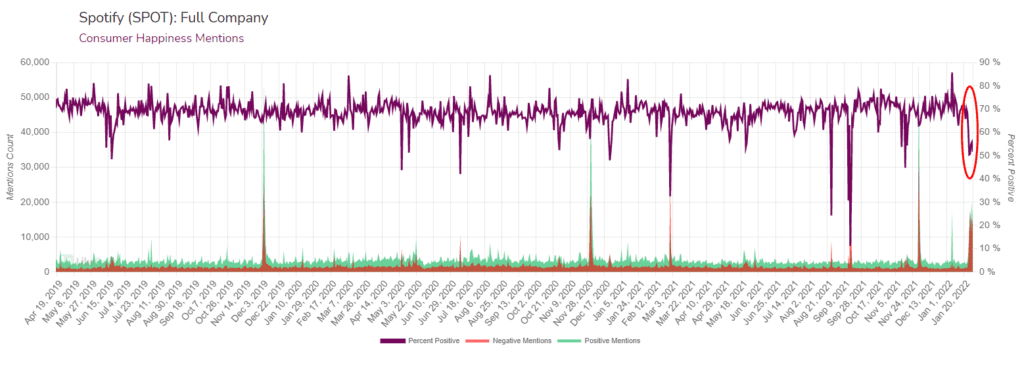

The chart below showcases that sentiment levels “bottomed” out on January 26 near 51% positive. Since then, mention volume and sentiment show signs of normalization.

Meanwhile, Spotify shares closed more than +13% higher on Monday.

What’s going on? Spotify formally established that it will NOT assume the role of content censor – a position that many users and investors are relieved to hear.

The CEO explained in an open post over the weekend: “To our very core, we believe that listening is everything. Pick almost any issue and you will find people and opinions on either side of it. Personally, there are plenty of individuals and views on Spotify that I disagree with strongly. We know we have a critical role to play in supporting creator expression while balancing it with the safety of our users. In that role, it is important to me that we don’t take on the position of being content censor…”

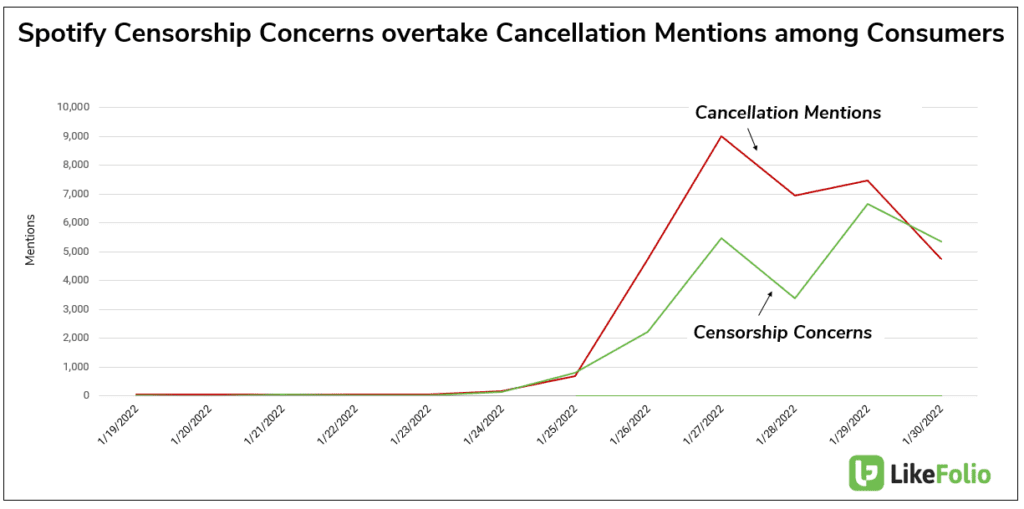

In fact, consumer mentions related to censorship spiked significantly alongside this event and continue to grow while “cancel Spotify” mentions wane.

Bottom line: despite the media’s best efforts to amplify the impact of this event, data suggests many consumers would rather the company stay out of their listening libraries.

After the dust settles, Spotify’s official rejection of content-policing may actually benefit the company long-term.

We’ll continue to monitor consumer happiness and demand moving forward to understand any additional implications.