PayPal (PYPL), Square (SQ) Consumer mentions of investing in cryptocurrency […]

Square Surprises the Market ($SQ)

Square Surprises the Market ($SQ)

Square, a leading digital payment and financial services company, caught investors off guard today, posting its 21Q2 earnings results roughly 4 days ahead of schedule.

However, the reported numbers have been largely overshadowed by a concurrent announcement: Square plans to acquire the buy-now-pay-later company ‘Afterpay’ for $29 billion, an all-stock transaction.

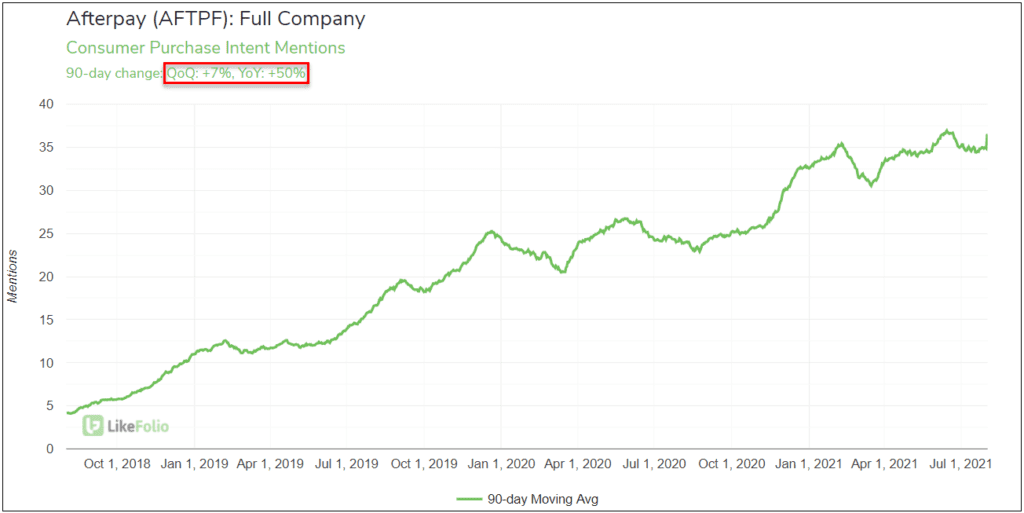

A brief glance at LikeFolio’s data for Afterpay (OTC:AFTPF) shows that this was an excellent purchase -- Consumer Purchase Intent Mentions for the (relatively young) company have exploded in recent years, currently trending +50% YoY on a 90-day moving average.

Despite reporting mediocre numbers, the massive buyout has SQ share up +11% today.

Buy-Now-Pay-Later at a Glance

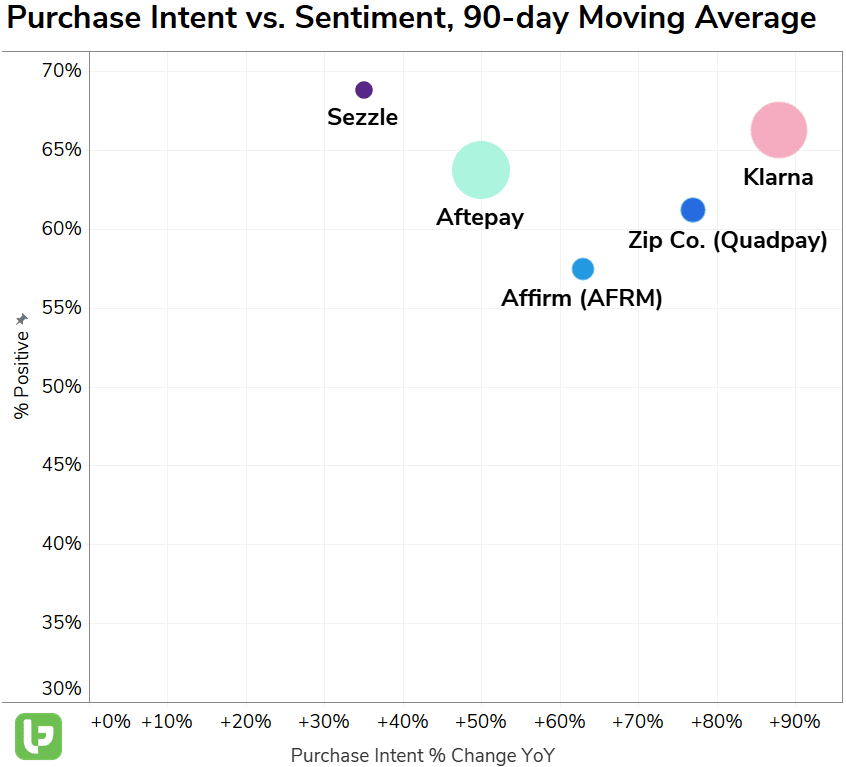

Looking at underlying Mentions for companies in the ‘buy-now-pay-later’ (BNPL) space reveals a lasting change in consumer behavior…Many shoppers now prefer to take out individualized loans on a per-purchase in lieu of traditional credit cards. LikeFolio tracks 5 of the foremost names in the burgeoning industry -- All 5 are showing impressive YoY Purchase Intent growth. Of the companies shown above, Affirm (AFRM) is the only US-based company available to investors.

Although its Consumer Happiness is lagging behind peers, we're still bullish on AFRM long-term, as well as the BNPL industry at large. Shares of AFRM are up +15% today on news of Afterpay's acquisition.