Stitch Fix (SFIX) Last quarter, SFIX shares fell 14% after […]

Can Stitch Fix Benefit from a New Fashion Cycle?

Stitch Fix could benefit from emerging fashion cycle

Right now, consumers are updating their wardrobes. Generic mentions of shopping for and buying new clothes have increased +26% YoY since the start of 2021.

We noted this theme last week ahead of AEO earnings: consumers are buying more jeans.

This returning demand for fashionable clothing items could serve as a major tailwind for a styling service like Stitch Fix...especially as consumers return to public activities.

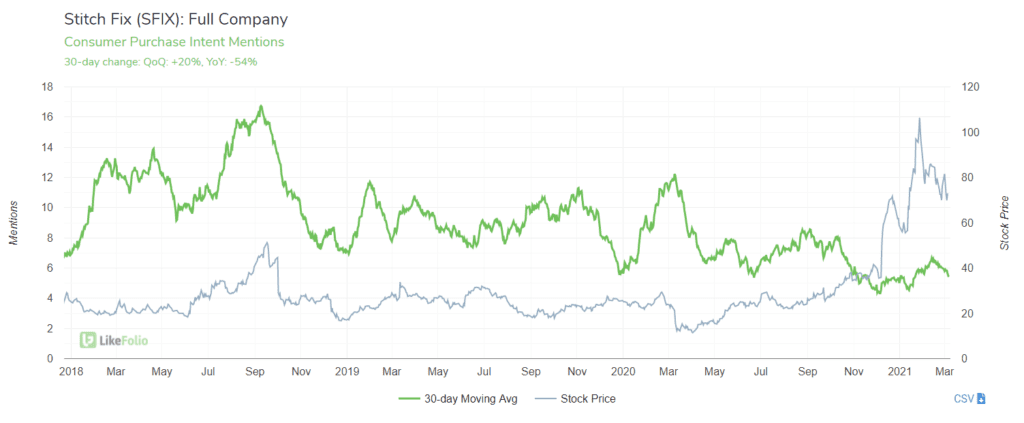

In the last quarter, SFIX Purchase Intent Mentions declined. But we're watching the seasonal uptick in demand begin sooner this year.

In addition, Stitch Fix Consumer Happiness remains extremely high: 82% positive.

This is an important metric to monitor to gauge the company's success rate with existing consumers.

Last quarter, the company noted its styling algorithm is getting smarter: "We previously shared a measure that we internally refer to as a successful first Fix, which we define as the percent of clients who purchase at least one item in their first Fix and look forward to their second Fix. In each of the last two quarters, nearly 80% of our first Fixes met this criteria, which is the highest level we've seen in five years."

Stitch Fix is well positioned: consumers increasingly seek eCommerce options (+29% YoY) and personalized shopping experiences (+28% YoY).

We'll be listening to see if the company can meet investor expectations after an unexpected beat in the first quarter sent shares soaring.