Black Friday Weekend (leading into Cyber Monday) can make or […]

Target “Gets” its Consumers

Target “Gets” its Consumers

“Target really gets me,” I think, my Apple Watch dings.

It’s almost 8 p.m. on a Tuesday and I’m grinding away on my Peloton, cramming in a workout during a busy work week.

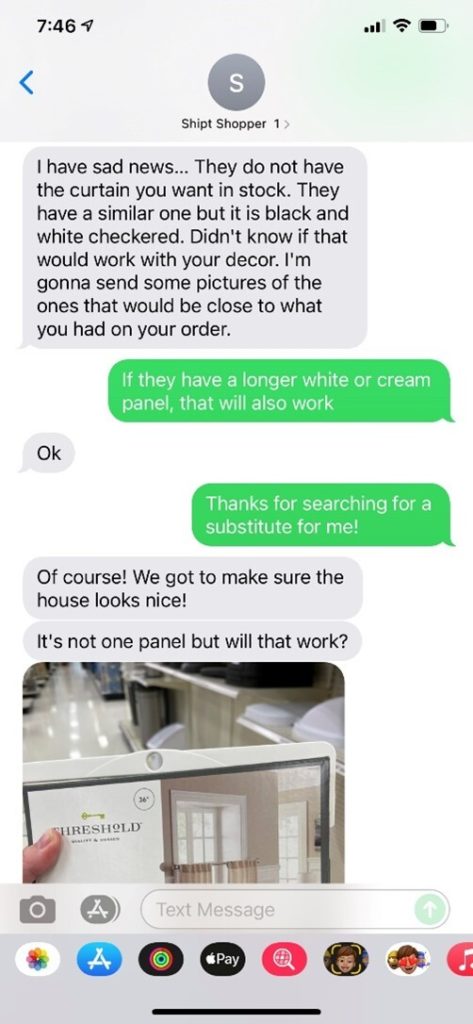

The notification is from my Shipt shopper, Target’s Same-Day Delivery service provider.

I use Target’s same-day delivery service so frequently that I have this particular Shipt contact already saved in my phone.

Unfortunately the curtains I selected for my order are no longer available, but my personal shopper wants to be sure the replacement item suits my home décor.

LikeFolio’s founder, Andy Swan, calls my allegiance to the service ‘evangelical’, to which I say, if the shoe fits…

But there is a lesson to be learned from this story (aside from my impressive multi-tasking abilities mid-workout).

Mainly, why Target is winning with consumers.

At a high-level, it’s pretty simple.

The company makes shopping easy and fun.

I was able to commission curtains whilst pedaling in my top power zone, from the comfort of my living room.

A couple of years ago, this was unthinkable.

But positive results speak for themselves.

TGT shares have surged more than 185% YoY in the last 2 years, greatly outperforming retail peers WMT(+31%) and AMZN (+76%).

Here’s how Target pulled this off.

And how LikeFolio harnesses real-time consumer insights to spot winners like this all the time, well-before the market…

Target Got Ahead of Consumer Trends

Target is a smaller player vs. Walmart and Amazon, comparatively.

Target has ~1,900 stores in the U.S. compared to Walmart’s ~4,700, and both Amazon and Walmart generate much more revenue.

But Target knows its niche, and it knows its customers.

It got way ahead of consumer trends, namely how consumers like to shop.

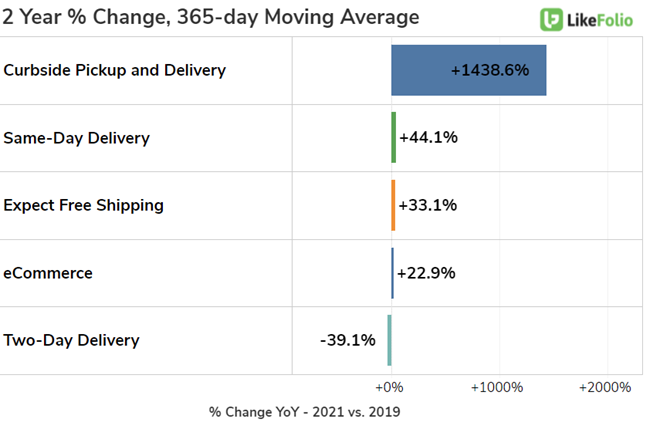

Check out the top growing “fulfillment” trends in the LikeFolio universe.

Do you see a theme?

Consumer Mentions of using Same-Day Delivery options, including curbside pickup, have boomed.

Meanwhile, two-day delivery standards established by Amazon are no longer fast enough.

What can I say, consumers are greedy.

But Target had the foresight to meet this rising demand.

In 2017, Target acquired same-day delivery service Shipt and began rolling out same-day delivery.

In 2017.

The company also realized it could leverage its physical presence to support curbside pickup AND delivery.

In 2019, Target noted it cost 90% less to fulfill online orders by store pick-up and drive-up compared to fulfilling them from a warehouse, and 45% less to ship orders from stores.

At that time, ~80% of digital orders were fulfilled by stores. Now, that number exceeds 95%.

And Target is sticking with its strategy, arguing that its store-based fulfillment model translates to more productive inventory.

On its Q2 report released earlier this week, Target’s digital comparable sales grew +10% (on top of last year’s growth of +195%), driven by same-day services.

LikeFolio data confirms this omnichannel stickiness. These mentions remain +20% higher vs. 2019.

Key Takeaway: Target makes it EASY to shop.

But that’s only half of its success story...

Target Has Happy Customers

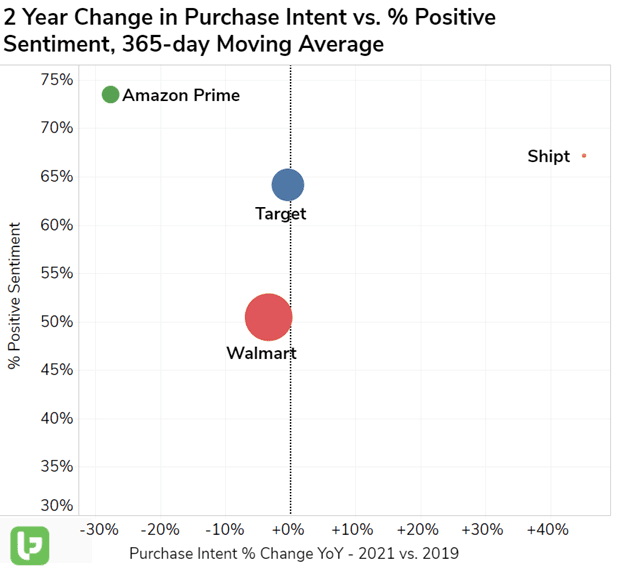

Target Consumer Happiness is 14 points higher vs. Walmart, and its Shipt brand bests the Target brand by 3 points.

Amazon Prime tops the Happiness list, but the service’s Purchase Intent mentions growth is slowing considerably.

You can see this playing out on the chart below:

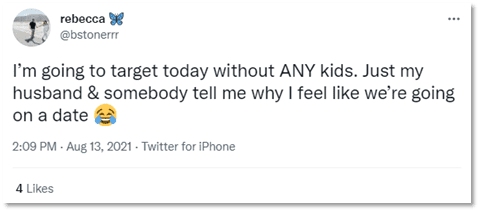

Tweets showcase an extremely positive in-store and digital experience…

Good to know I’m not alone.

But better to know that Target can support growth in different environments.

Bottom line: Target is well-positioned to capitalize on a return to the store AND has the infrastructure to support continued digital adoption.

Playing TGT from here: Keep it Simple

LikeFolio first featured Target’s successful omnichannel model on one of our very first MegaTrends reports (delivered in August 2019).

Short-term we've got our eye on two categories: Apparel and Beauty.

Back-to-School shopping mentions have increased +92% YoY vs. a muted 2020 season, and Target is a natural beneficiary from clothes to supplies. Generic "shopping for new clothes" mentions have risen +7% YoY.

Ulta at Target is now live online, and mini-stores within stores are opening too. Investors expect synergy here, and we'll be monitoring closely.

But long-term what really matters is, can Target keep its shopping experience EASY and FUN?

So far, LikeFolio’s data suggests the company is doing just that.

And we’re watching for additional opportunities to capitalize on massive gains like the ones we recorded in Target.

Whenever we spot these Winners, our members are the first to know.

And for those who are curious…the curtains look great.