Here's what LikeFolio data was showing heading into the Walmart earnings report that sent the stock 10% higher.

Target vs. Walmart: Apples vs. Oranges?

September 16, 2021

Target vs. Walmart: Apples vs. Oranges?

Everyone loves to pit Target and Walmart against each other. While it's true the retailers have crossover -- especially in recent omnichannel efforts to compete with Amazon -- the companies are specializing in different areas.

Here's where Target and Walmart's paths diverge in the woods...

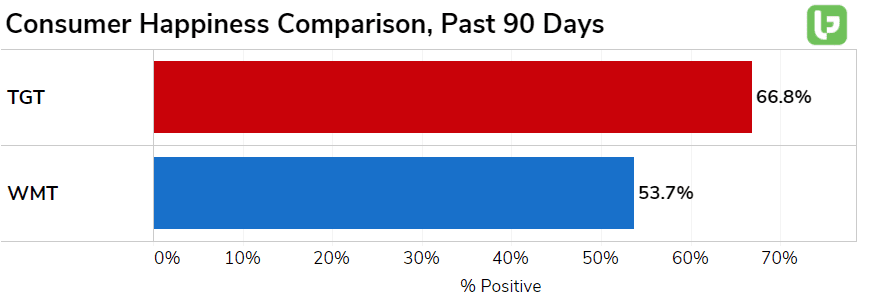

- In-Store Experience. Target excels when consumers shop in its stores. Some consumers even call a Target trip a treat. In contrast, Walmart excels when consumers DON'T have to step a foot inside its doors. Consumer mentions of trips to Walmart describe a chore vs. a treat. You can see this divergence very clearly in consumer happiness levels, where Target maintains a significant edge: +13 points higher.

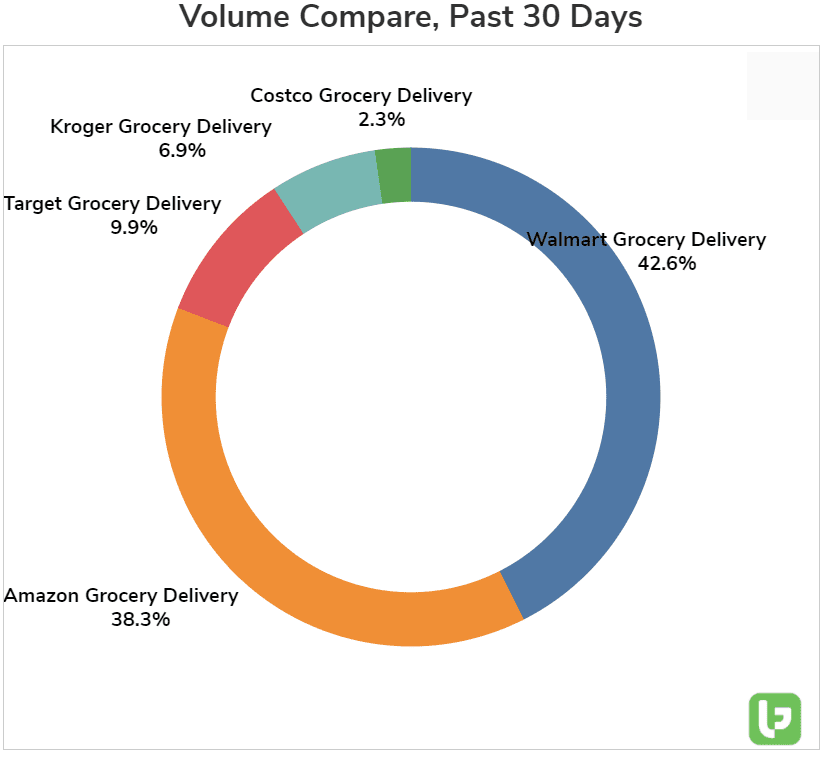

- Walmart is dominating grocery delivery. The company overtook Amazon to cement its lead in grocery eCommerce sales in 2020. Walmart online grocery sales increased +84% YoY to $27.1 billion (vs. Amazon's $25.79 billion). LikeFolio grocery delivery data highlights this dominance and confirms Walmart is maintaining its market share advantage even in the last month.

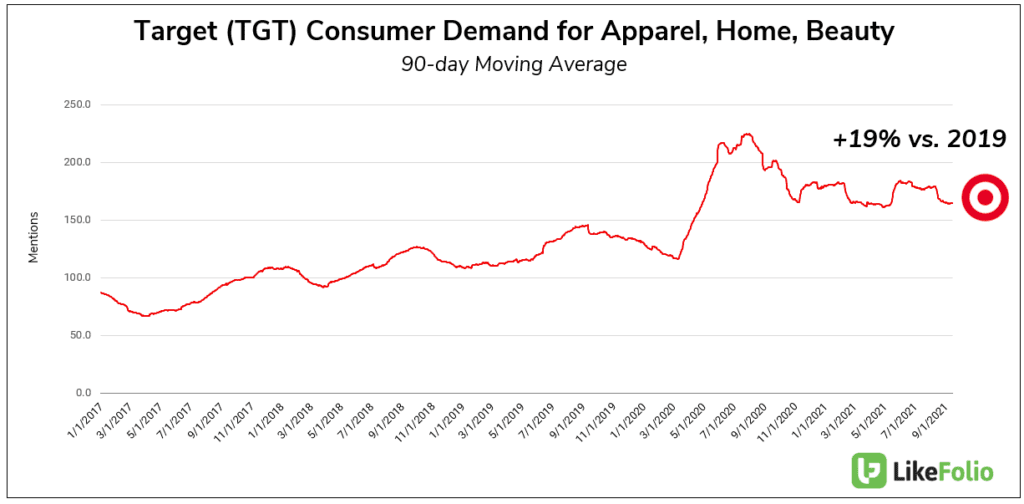

- Target is excelling in Apparel, Home and Beauty. Target's recent partnership with Ulta demonstrates where the company thinks it can add value to consumers. Last quarter, Target Apparel sales grew at a double-digit rate, followed by essentials and beauty in the high single-digits. LikeFolio data shows continued growth in these target areas: +19% vs. 2019.

Stay tuned -- both companies are gearing up for a big holiday shopping season.