Trend Watch: Federal Reserve Awareness We’re continuing to track an […]

The Fed is Crushing Consumers

The Federal Reserve has approved another quarter-percentage-point interest-rate rise, the tenth consecutive increase aimed at battling inflation and taking its benchmark federal-funds rate to a range between 5% and 5.25%, a 16-year high.

There is a hint that officials could pause rate increases after the latest move, and they have cut a phrase from their previous policy statement that said some additional policy increases might be appropriate.

Until now, officials have been looking for clear signs of a slowdown to justify ending rate rises, but after this week, they might need to see signs of stronger-than-expected growth, hiring, and inflation to continue raising rates.

At LikeFolio, we’re especially tuned in to how rising rates influence consumer purchasing decisions.

Here are the top trends we’re watching that suggest the Fed may already have taken rates too far:

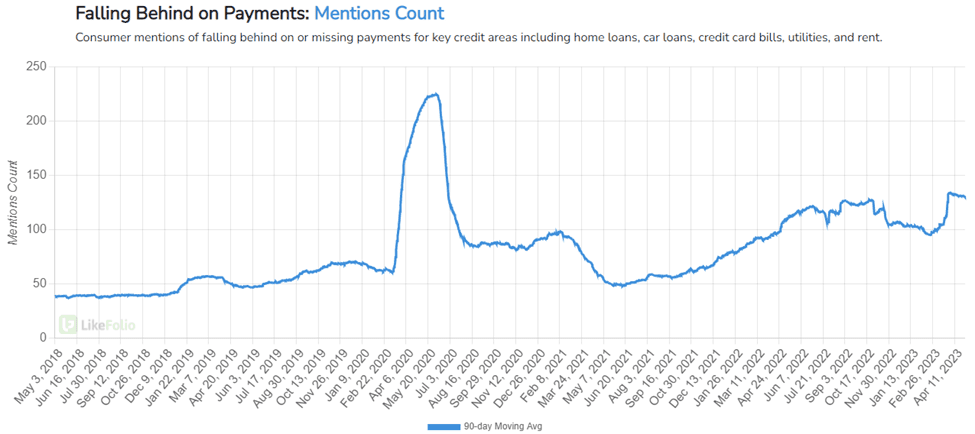

- Consumers are Falling Behind on Payments

Consumer mentions of being able to cover their bills each month has risen to multi-year highs (+21% higher vs. last year).

Mentions of depleted savings (+7% YoY) and maxed out credit cards (+42% YoY) are seriously reducing consumer spending power.

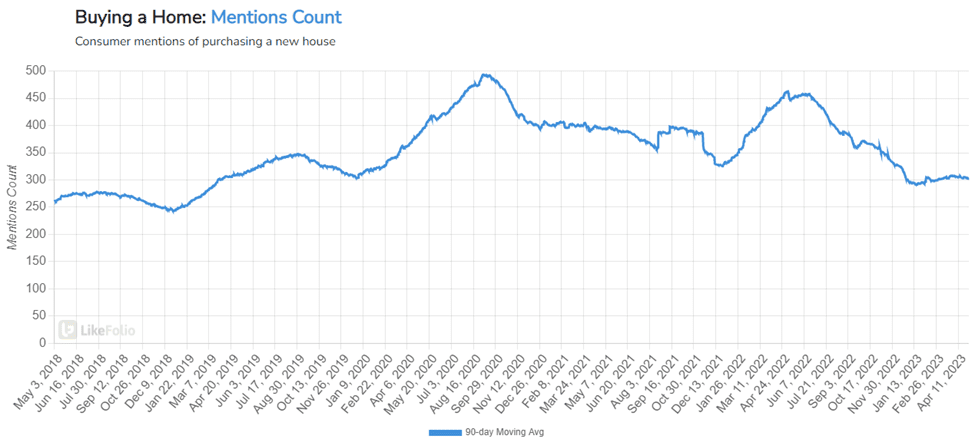

- Consumers are Halting Big Purchases

Consumer mentions of purchasing a new house continue to weaken, currently pacing -36% lower YoY. New home sales in March dropped -22% YoY…and LikeFolio data isn’t recording a typical seasonal uptick.

Many homeowners with low rates are postponing any moving plans until rates settle and economic conditions improve.

In addition, new car demand mentions have slipped by -23% in same time frame, with slightly-more-costly electric vehicle demand falling at an even steeper clip.

This could be bad news for auto makers struggling to achieve profitability on EV investments, like Ford (F).

It could be good news for auto parts retailers, like AZO, AAP, and ORLY as consumers are forced to repair the vehicle they already own.

3. Consumer Spending was Already slowing in March

Bank of America credit and debit card spending per household moderated in March to 0.1% YoY, the slowest pace since February 2021.

This was attributed to slowing wages, lower tax refunds, and the expiration of SNAP emergency allotments.

Despite lower credit card utilization rates compared to 2019, a sustained deceleration in wages and a cooling labor market could pose downside risks for spending going forward.

Bottom line: traders and investors should remain cautious when analyzing companies with significant discretionary spend exposure.

LikeFolio will continue to monitor for best-of-breed outliers and companies that may already be in serious near-term trouble.