Activision Blizzard (ATVI), Take-Two Interactive (TTWO) Gaming is gaining steam […]

The Gaming Sector is Cooling Down

The gaming sector is hotly contested.

More so now than ever, with the rise of esports (organized video game competitions) and the metaverse.

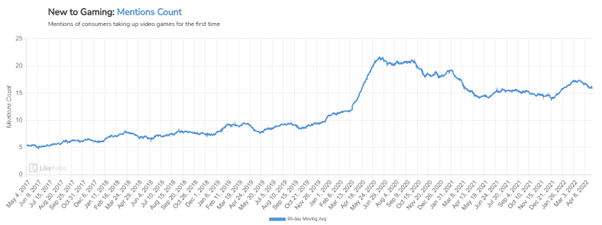

We already know the pandemic brought more gamers to the table than ever before. First-time gaming mentions remain +85% higher right now vs. 3 years ago.

You can see the massive adoption uptick on the chart below.

In fact, in December 2020 the gaming industry was said to be bigger than sports and movies combined.

Although growth is cooling down (video game spending dropped by an estimated 8% in 22Q1 vs. 21Q1) the industry expansion on a large scale continues to support opportunities in the gaming sector.

But now, we’re reaching a crossroads.

The tide is rising, but some ships are lifting faster and higher than others.

Who has momentum now, at least in the eyes of consumers? The answer might surprise you.

Take-Two Interactive Demand Flexes alongside Game Release

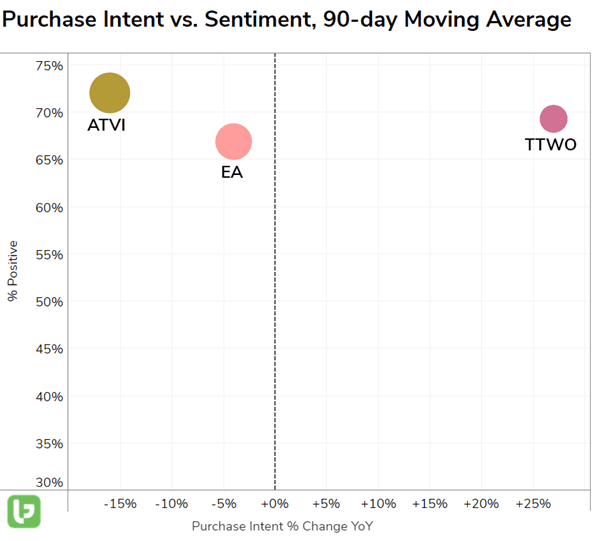

While gaming peers Activision (ATVI) and Electronic Arts (EA) show signs of demand cooling, Take-Two is coming hot out of the gate.

Take-Two, which has Grand Theft Auto creator Rockstar Games and well-known sports game publisher 2k under its banner, is outpacing its peers when it comes to consumer demand growth, currently pacing +27% higher YoY.

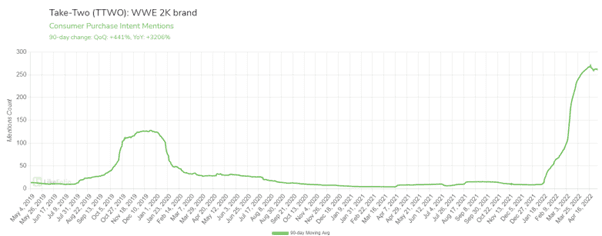

What’s driving this surge in demand? A new game update.

WWE 2K22 was released in March of this year, the first major brand refresh since 2019 (WWE 2K21 was canceled).

Gamers are gobbling this release up…at a much higher rate than the last release ~3 years ago.

You can see this moving the needle in overall consumer demand– note the first major Purchase Intent bump for Take-Two since Summer of 2020.

This unexpected demand momentum and rising levels of consumer happiness is setting up an interesting opportunity for investors.