“You know it's time to sell when shoeshine boys give […]

The True “Inflation Hedge”

January 28, 2022

Bitcoin’s scarcity and globally recognized value have earned it the moniker “digital gold.” Bitcoin bulls often suggest that BTC has made gold obsolete as a store of wealth.

While Bitcoin has certainly outperformed gold in recent years, underlying volatility brings its “inflation hedge” status into question.

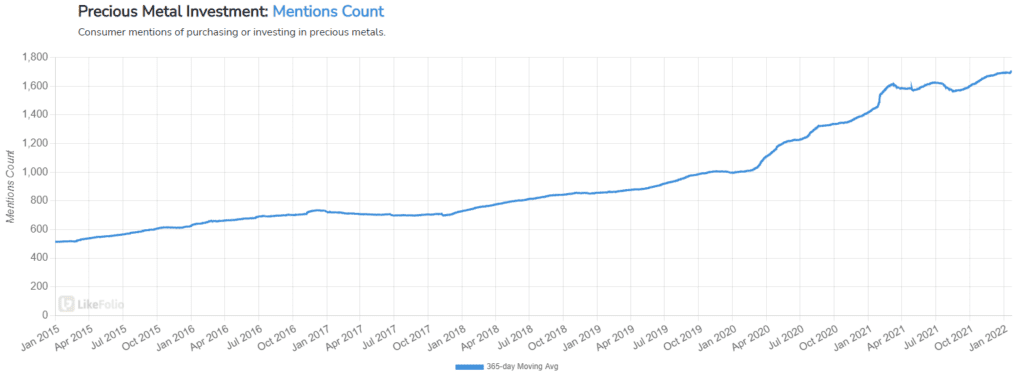

Meanwhile, investment demand for precious metals (gold, silver, and platinum) has risen steadily in the face of mounting inflation, trending +17% YoY on a 365-day moving average.

The price of these assets has underperformed risk-on assets like stocks and Bitcoin over the past 2 years. But, growing concern about the USD has prompted many consumers, central banks, and forward-looking companies to begin accumulating precious metals.

Want deeper insights? Get Free Access to The Vault.

Tags: