Over the years, LikeFolio has delivered a remarkable series of […]

The Underdogs are Winning $HIMS $WW

If you’re sick, the worst place to be is a doctor’s office waiting room.

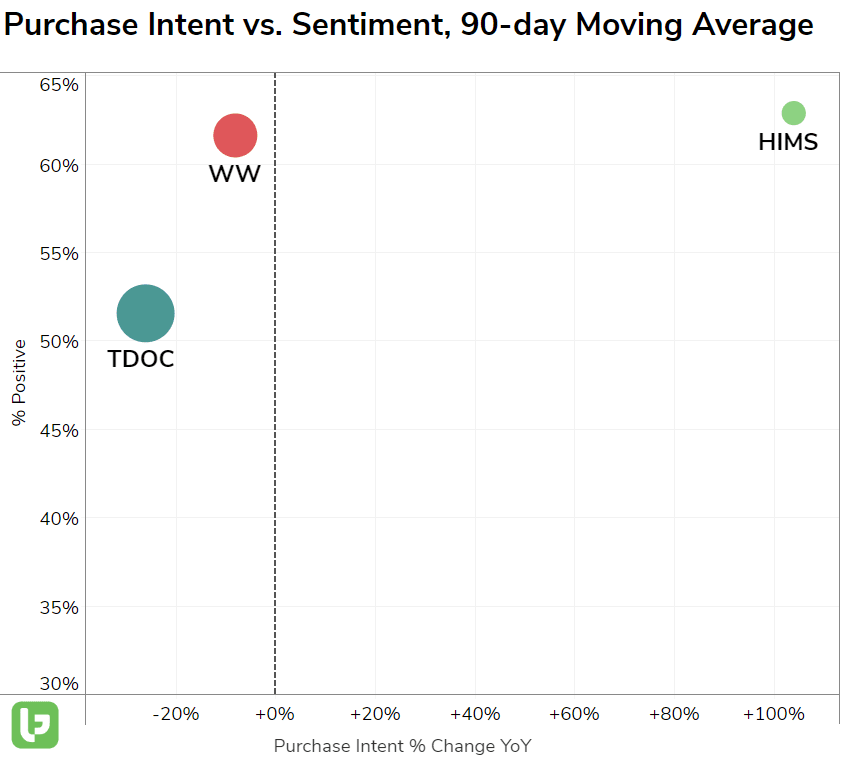

If you’re a publicly traded company, the worst place to be is the bottom left corner of a LikeFolio outlier grid.

Because this means that compared to peers, you’ve recorded the lowest level of consumer demand growth (x-axis) and the lowest level of consumer happiness (y-axis).

We’ve got bad news, Teladoc…

Teladoc is under fire of late due to its handling of customer data.

The FTC has banned Teladoc's BetterHelp from sharing mental-health data with companies like Facebook and Snapchat who use the data to deliver targeted ads. The company allegedly misused customer data for 3 years.

As part of a settlement, BetterHelp will pay consumers nearly $8 million.

What is BetterHelp?

BetterHelp (owned by Teladoc) provides users with online mental health services like counseling and therapy sessions.

Platform demand has risen consistently since the onset of the pandemic, currently pacing +13% higher YoY. Consumers are extremely receptive to the convenience and anonymity of online mental health services.

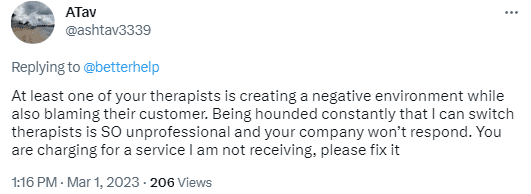

However, complaints are rising as BetterHelp grows. Brand happiness has slipped by -13 points YoY to 50% positive as users complain of poor customer service, high pricing and unprofessional therapists.

But Teladoc’s uphill battle may be attributed to more than BetterHelp complaints.

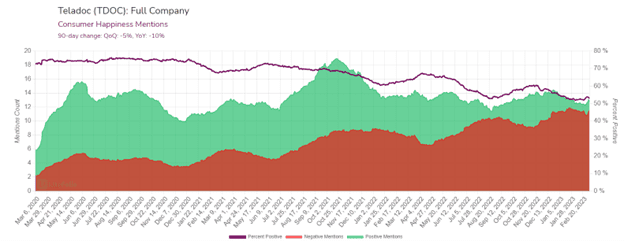

On the company level, Teladoc demand continues to fade, at least among first-time users who are most likely to tweet about their experience. Purchase Intent mentions have slipped by -27% YoY, with a steeper drop in 23Q1 vs. the prior quarter.

Consumer Happiness levels have slipped alongside demand, currently -10% lower YoY as consumers report scheduling glitches, a restrictive messaging system and cancelled appointments.

Landon talked about this in detail Tuesday on the TD Ameritrade Network.

The company won’t report earnings for some time…and we’d like to see a resolution in consumer happiness to give us confidence in company execution before we dive in on a Bullish position.

But here’s the good news.

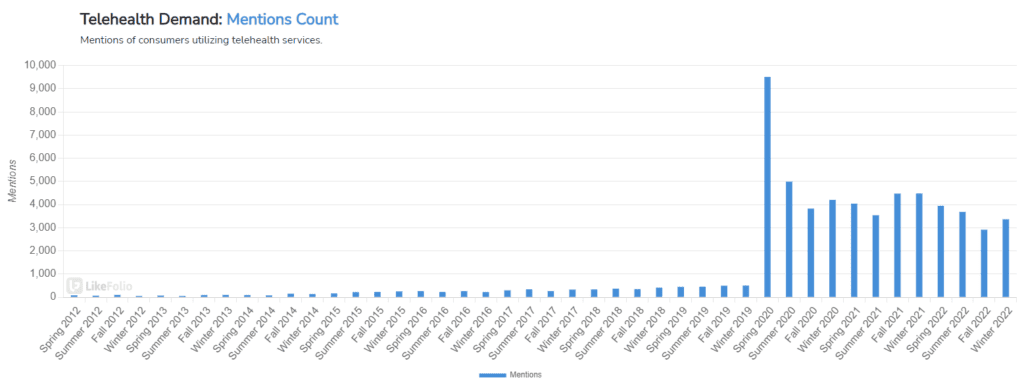

Macro trends suggest significant growth potential in telehealth companies remains.

Consumers struggling with inflation are noting the cost of healthcare is an increasing burden – “healthcare is too expensive” mentions have risen by +14% YoY.

And data suggests on average, telehealth appointments are cheaper than in-person office care.

On a large scale, consumer mentions of seeking virtual health services have tempered since Covid but remain more than +570% higher vs. 2019 levels.

Here are 2 names to watch in the telehealth sector gaining momentum among consumers and investors:

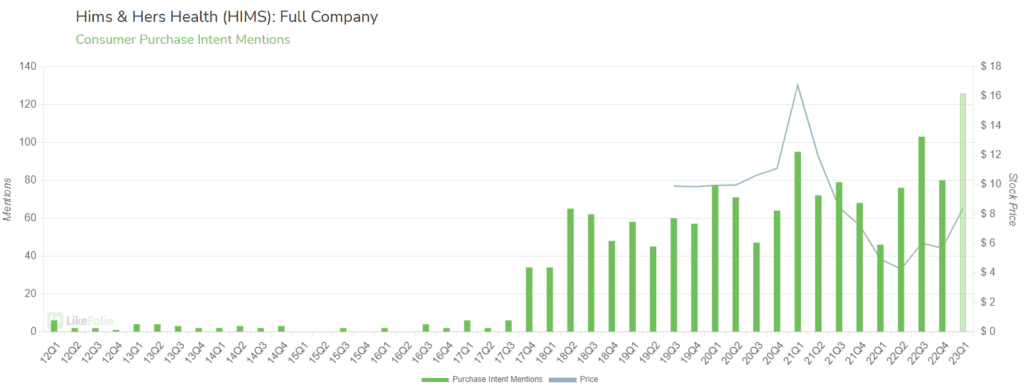

Hims & Hers (HIMS)

HIMS specializes in telehealth, prescriptions and over-the-counter drugs online, and personal care products.

This company is less than half the size of Teladoc by market cap, but it’s strategic in its offerings.

It caters to the needs of Millennials and Gen Z and offers efficient treatment paths for otherwise embarrassing ailments including hair loss, erectile dysfunction, mental health concerns, and acne…all in trendy monochrome packaging.

Consumer mentions of using HIMS for medical treatment and personal care products are pacing for all-time highs in the first quarter and happiness levels are +11 points higher vs. TDOC.

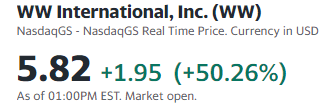

Weight Watchers (WW)

Yes, that’s right. Weight Watcher is dipping its toes in the telehealth market.

In fact, shares soared more than 50% yesterday when the company announced it is acquiring Sequence, which offers telehealth appointments.

What’s the big deal?

This gives WW access to a niche digital market: overweight consumers.

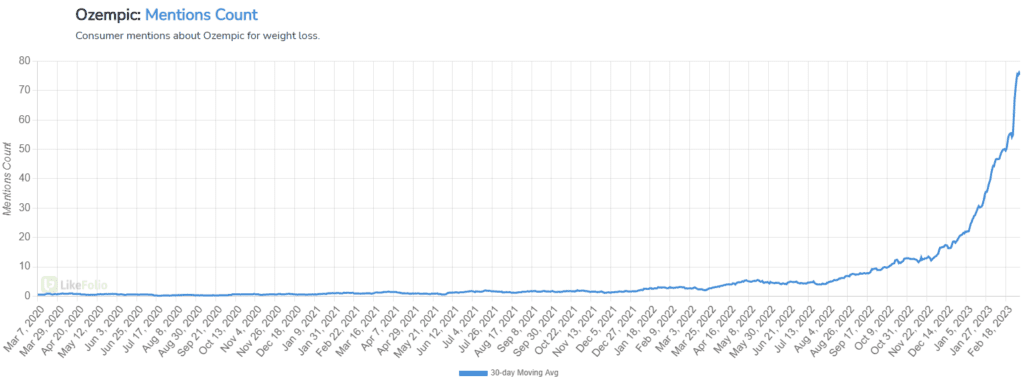

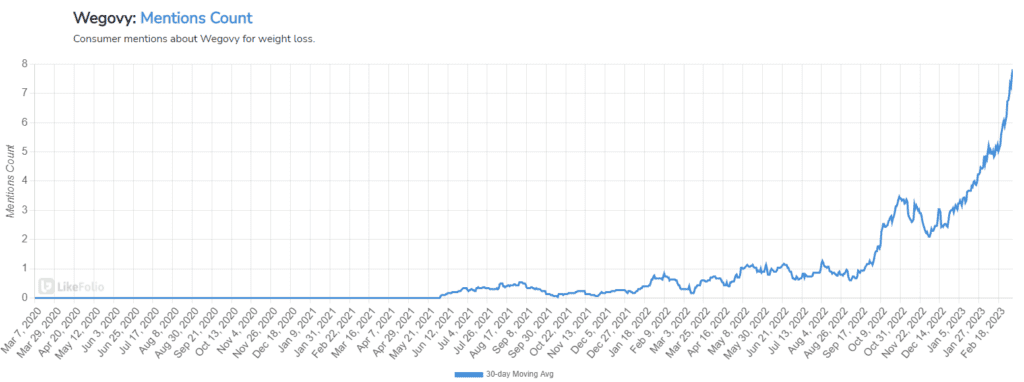

More importantly, the acquisition will give WW the ability to connect its users via medical doctors to prescription drugs Ozempic, Wegovy and Mounjaro.

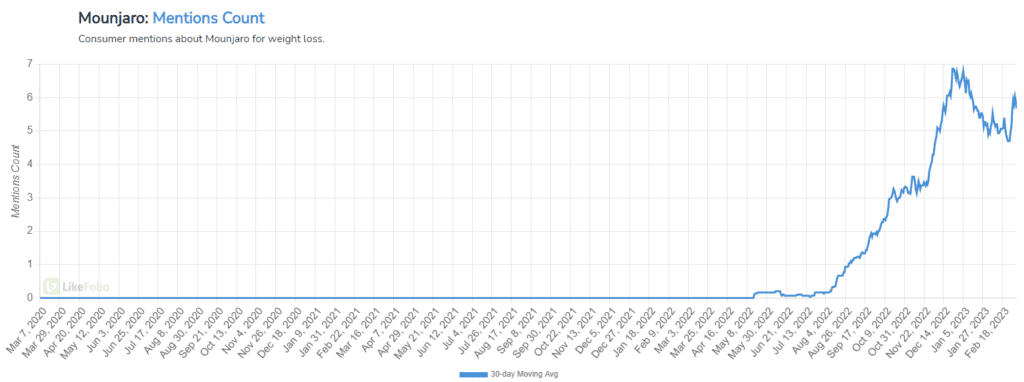

We featured the rising popularity of prescription weight loss drugs a month ago, and you can see the rocketing demand clearly on the charts below:

We also featured WW as a long-term winner last December, noting the company was ripe for a turnaround.

This acquisition could be just what the doctor ordered.

Bottom line: the digital nature of telehealth means companies can move and adjust very quickly.

In the near-term, smaller, niche companies with user-friendly platforms – the Underdogs – are winning over consumers.