Trend Watch -- Looking Ahead We knew this day would […]

This Company is Bucking the Tech Downtrend

At LikeFolio, we talk a lot about stickiness.

Not the gum-on-your-shoe kind of sticky.

We’re listening for indications that a consumer behavior change has staying power.

This is more important than ever right now because the pandemic forced many behavior changes on consumers that are unwinding.

We’re traveling again. We’re shopping in stores. We’re skipping the DoorDash and grabbing dinner out with friends!

And the Street knows it.

Once darling “work from home” stocks are getting pummeled.

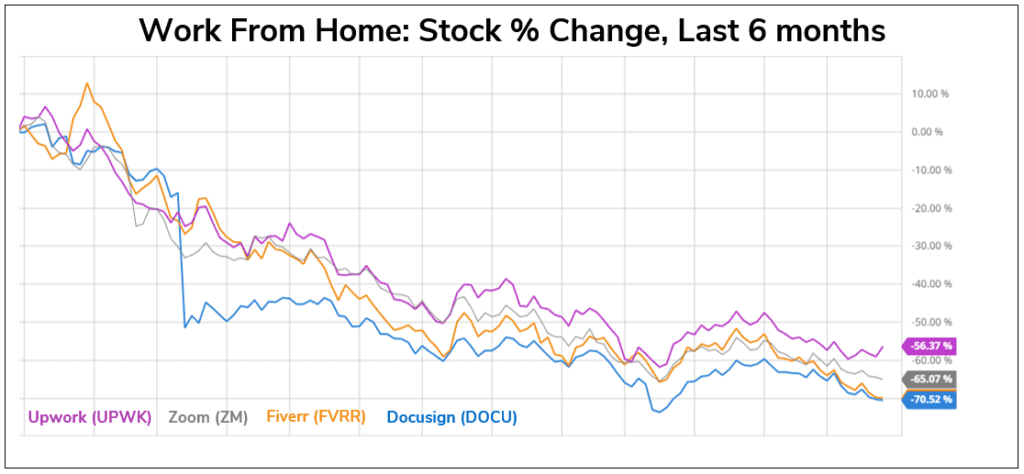

Upwork (UPWK), Zoom (ZM), Fiverr (FVRR), and DocuSign (DOCU) have all shed more than -50% in value in the last 6 months.

But should the street be treating all of these names the same?

This is where LikeFolio comes in.

We’re listening to consumers in real-time, and we know which trends (and companies) are exhibiting signs of stickiness.

And in this case, two companies on the chart above are showing signs of continued growth but are being thrown out with the bathwater.

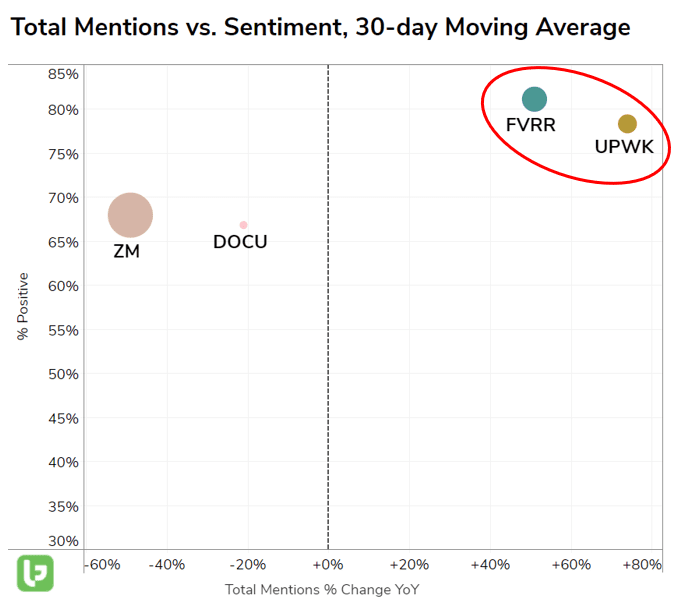

Check out this outlier grid, highlighting mention volume growth and consumer happiness for each of the work from home darlings:

Zoom and DocuSign are struggling. Consumer buzz is dying down, and happiness is low.

But consumer mentions for Fiverr and Upwork are booming, both increasing by more than +45% YoY.

AND both FVRR and UPWK boast consumer happiness levels +10 points higher vs. remote work peers.

What’s happening?

It turns out the pandemic sparked employees and employers to realize that remote work is a viable long-term option.

Mentions from consumers working remotely are on the rise again and remain more than +235% higher vs. pre-pandemic levels.

More importantly, this acceptance of a remote team is helping to spark an uptick in the utilization of freelance workers.

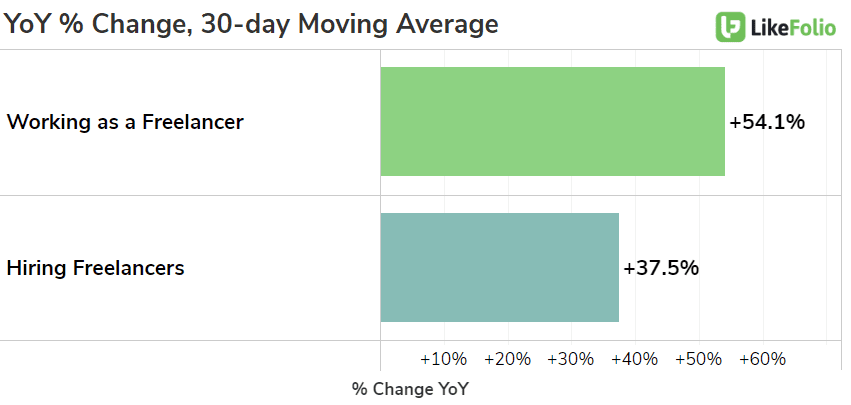

LikeFolio data shows that mentions from consumers working as a freelancer AND hiring freelance talent have risen by double digits over the last year.

This makes sense.

Freelancers give businesses more flexibility to support highly targeted projects with the right talent, for the right amount of time. And now, remote teams are standard practice.

This certainly helped fuel Upwork’s flames when it reported earlier this week, sending shares as much as +16% higher on Thursday.

The key: Upwork reported more new users AND more spending per client. The gross sales volume (GSV) per active client increased +18% YoY.

This bodes well for FVRR, which is set to report earnings in a couple of weeks (May 11)...