Cava (CAVA) is a Mediterranean fast-casual chain known for its […]

This stock looks unstoppable...

CAVA, fast-casual restaurant chain that specializes in Mediterranean cuisine, is on fire.

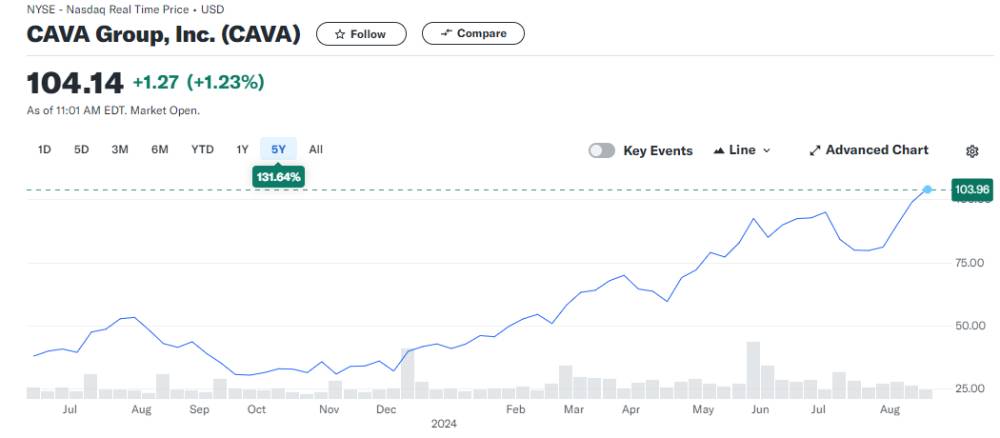

The stock has rocketed over the past year and is currently trading near all-time highs heading into earnings.

If you've eaten there and its food feels a little familiar, it might be because CAVA acquired Zoes Kitchen (formerly traded under ticker symbol ZOES) in 2019, revamped the menu and streamlined operations.

In addition to its restaurant offerings, Cava also sells a selection of dips and spreads in grocery stores.

The company's rapid expansion in footprint and beefy menu options are likely to drive growth for quarters to come.

Here's how we're approaching THIS earnings event...

CAVA Earnings Deep Dive

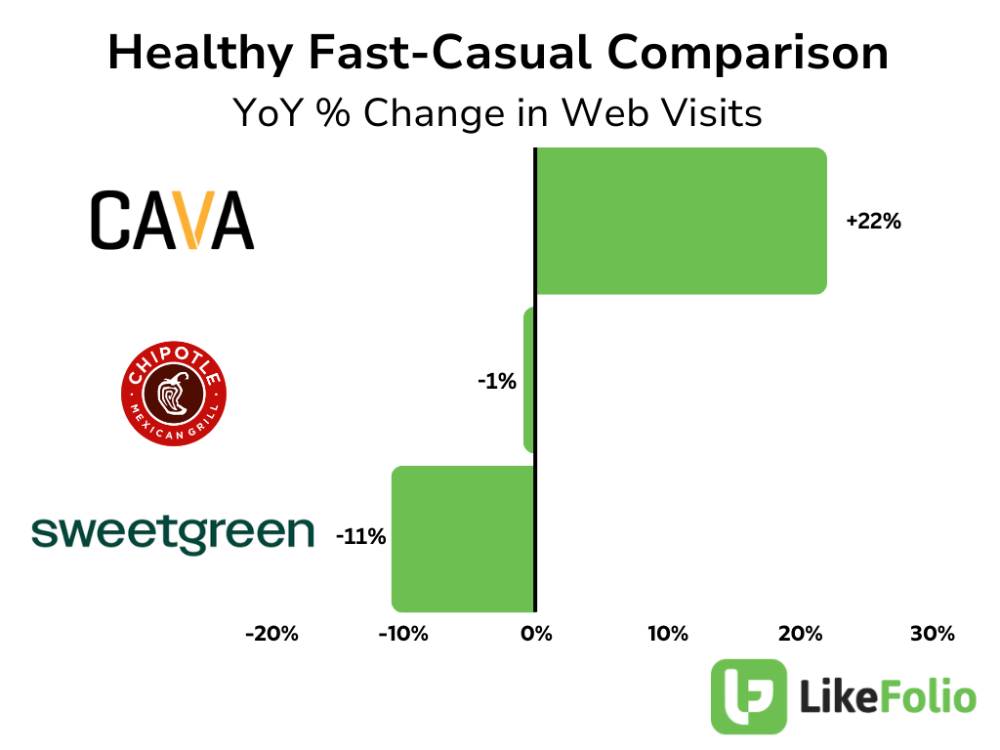

LikeFolio data shows considerable outperformance when it comes to web visits vs. other "healthy" fast-casual chains like Chipotle and Sweetgreen.

Cava web visits are up +22% YoY vs. Chipotle down a percent and Sweetgreen growth tapering off, down -11%.

The Mediterranean chain has just over 320 restaurants and plans to expand into rural america, which it believes is underserved in regard to fresh, nourishing "fast" food. This footprint expansion is boosting revenue growth, which jumped +30% YoY in Q1.

But the bar is high for a growth stock like CAVA.

Despite besting earnings and revenue expectations last quarter, the stock dipped because of a slowdown in same store sales growth (+2.3% vs. +11% in the prior quarter). The company attributed this to fewer trips from customers who were pulling back on eating out to save money by cooking at home.

It didn't take long for the stock to rebound. CAVA is currently trading at all-time highs, up more than 140% YTD.

What can we expect for this earnings event? It could be a similar reaction like last quarter.

Web visits hit all-time highs in June just as the company rolled out steak, seasoned with sundried tomato, oregano and aleppo pepper. Activity was also bolstered by new store openings in June, including a second location in Chicagoland, as well as new stores in Florida, California and Arizona.

Revenue growth is likely to meet or beat expecations, especially as consumers splurge on higher-priced steak.

Here is the only red flag we see...

This section is restricted to LikeFolio Pro Members only.