Last September we used Purchase Intent data to predict that […]

Tough Comps Looming for Apple (AAPL)

Tough Comps Looming for Apple (AAPL)

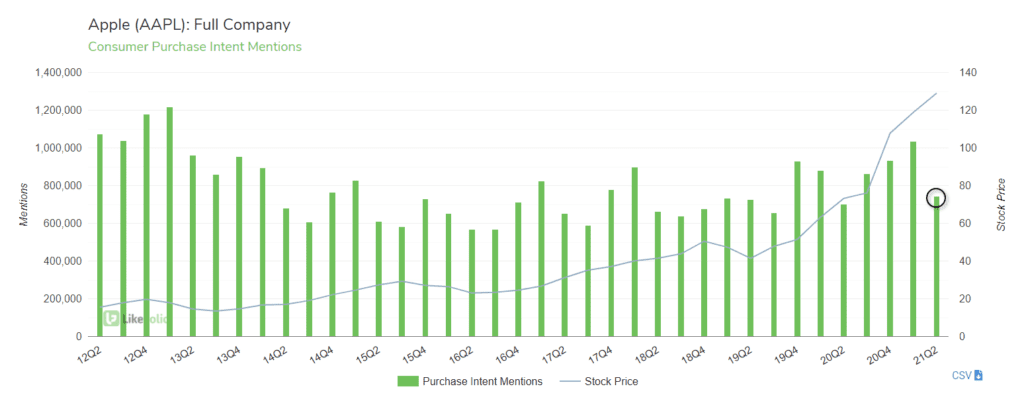

In 21Q2, Apple demand growth slowed: +6% YoY. In the prior quarter, demand increased +17% YoY. Seasonally speaking, this is not a big quarter for AAPL (Q4 and Q1 encompass keynote drops and holiday season).

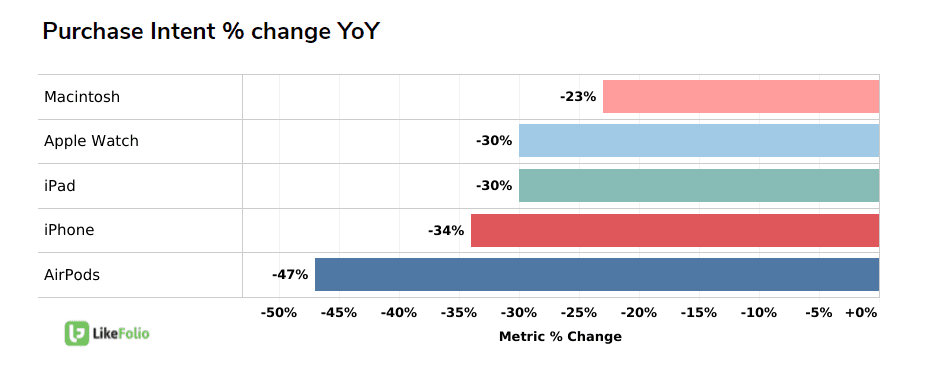

Work-from-home trends boosted iPads and Macs last year, but normalization is occurring and evident in a product breakdown: comparative weakness across the board on a YoY basis.

Apple Happiness is stable (64% positive), so existing customers are happy. This isn't a consumer flee event, rather a slow down vs. Covid-induced growth recorded last year.

It's also important to keep in mind our data is capturing English-speaking mentions.

Last quarter, International sales accounted for 64% of total revenue, up from 61% in 20Q1. Cook noted, “China was strong across the board,” with revenue up +57% YoY to $21.3 billion.

Potential bright spots lie in ongoing services revenue and a new Mac lineup.

- Its new M1 chips have very high consumer happiness (95% positive). Its new line of iMacs stole the show at its event last week.

- Apple Service usage mentions (Apple Music, Apple Fitness, Apple TV subscriptions, Apple Pay, Apple One, etc.) have increased 23% YoY but are lower vs. last quarter.

Apple reports 21Q2 April 28 after the bell.