Travel Headwinds Show No Signs of Easing

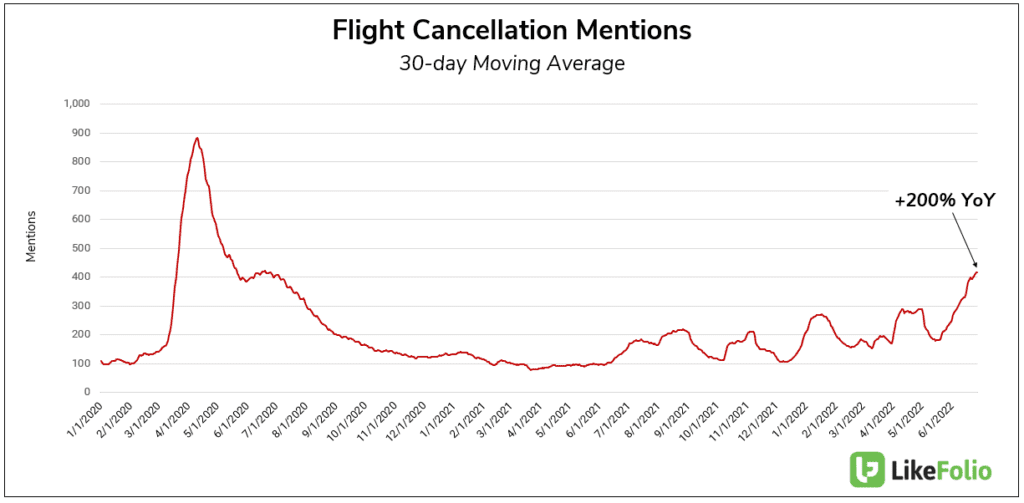

| The travel boom is turning into somewhat of a travel nightmare for both passengers and airlines. The surge in travelers has resulted in airlines and airports being unable to cope. More than 1,500 domestic flights were canceled on Saturday and Sunday of this past weekend (June 25th & 26th). While cancelation mentions are certainly elevated YoY (+200%), they have spiked significantly in the last month. Mentions are +83% higher in June vs. May. |

| The Covid pandemic has had a lasting impact on the aviation industry, which across the board, had to lay off staff as a result of the almost standstill. With air traffic control, TSA, and airlines across the board all being short-staffed, the industry is unable to hire enough workers, and even more importantly, qualified workers, in time to keep up with demand. |

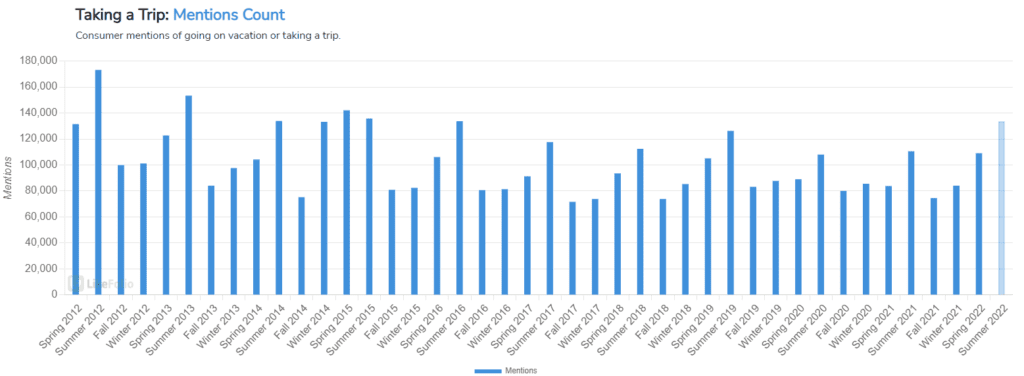

And there has been no let-up in the passenger demand either…

Consumer mentions of going on vacation or taking a trip on course to close the current period at their highest level since the summer of 2016, trending +23% QoQ and +21% YoY.

Furthermore, TSA checkpoint data shows travel numbers are only just under 2019 levels. On all but two days of June, TSA throughput data has been at or over 2 million travelers per day.

So, with the travel industry in chaos, here’s what we will be watching over the next few weeks:

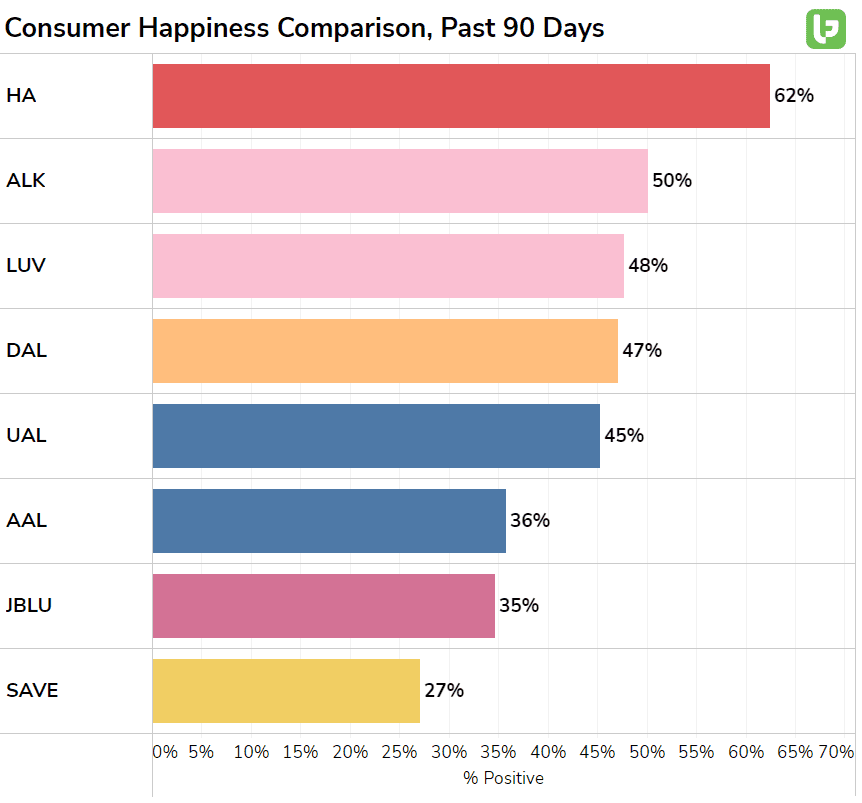

| Airline Happiness |

| The fact that none of the Consumer Happiness scores are great is not surprising. As expected, budget carrier Spirit is at the bottom of the Consumer Happiness list, with the company that could acquire it, JetBlue, just above. Hawaiian Holdings, which owns Hawaiian Airlines, is the outlier at 62% positive, trending +12% YoY. If the cancelations and chaos continue, as expected given the July 4th weekend surge, airline consumer unhappiness will grow even further. Refunds |

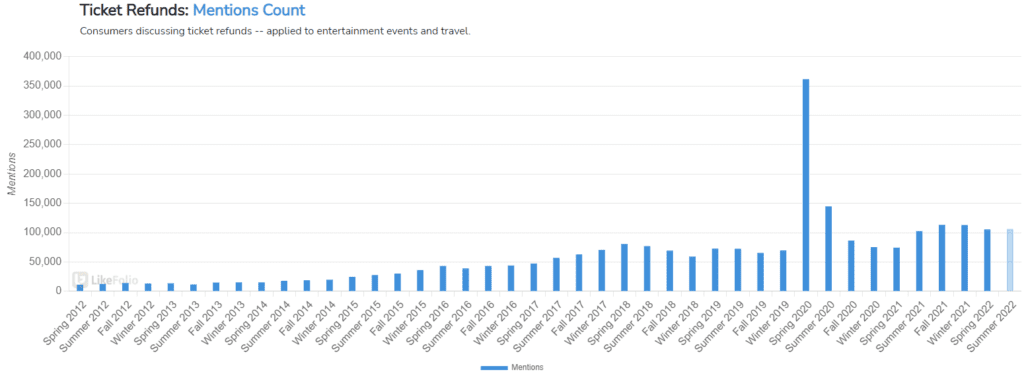

Consumers discussing ticket refunds have not yet seen a significant jump, but they have remained elevated compared to pre-pandemic levels, pacing +37% YoY.

With airline ticket refunds usually taking some time, I expect talk to grow over the next few weeks as more travelers become disgruntled.

In addition, with the July 4th weekend fast approaching, we could see a jump in consumers demanding their money back.

Insurance

Even in chaos, there is a winner somewhere.

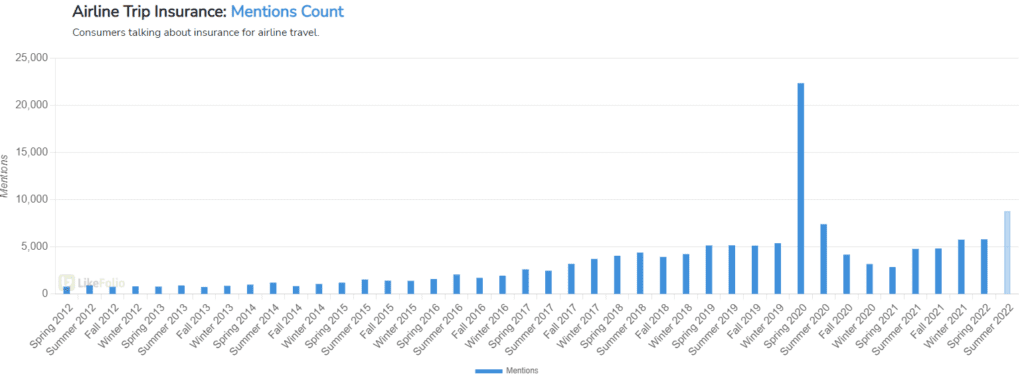

With cancelations surging, mentions of insurance for airline travel have jumped.

Consumer mentions of travel insurance are trending at +9% QoQ and +100% YoY, the highest level since the start of the pandemic, and the second-highest since LikeFolio records began.

Bottom Line: We are bullish on airline stocks over the long-term, but near-term labor shortage headwinds, along with fuel prices has us on the sidelines for now.

In the meantime, we will be watching the trends above for signs of the headwinds easing.