Expedia (EXPE) Soaring on Investor Optimism Today the online travel […]

Travel is Back & Expedia is Benefiting

March 15, 2022

Travel is starting to heat up and so is the LikeFolio Data we’re seeing for this trend. Expedia is something that caught my eye in a potentially bearish market, and this could be so good!

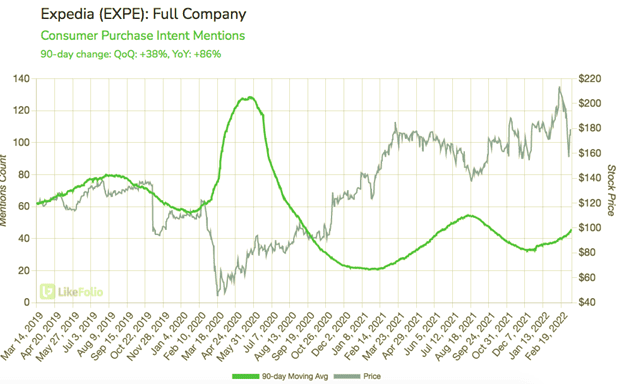

Purchase Intent Mentions are booming: on a 90-day moving average, they’re +86% YoY.

This is indicating demand for traveling again, despite concerns of rising gas prices. But given the macro trend in back to travel and flights, the data is very promising.

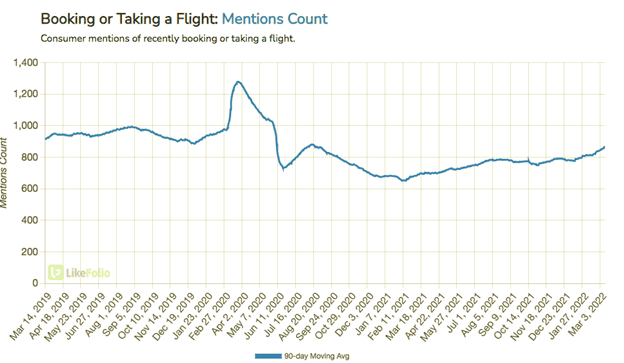

Mentions for Booking or Taking a Flight are up +26% YoY, which is a great start to 2022, and if this holds it can be a great year for Expedia.

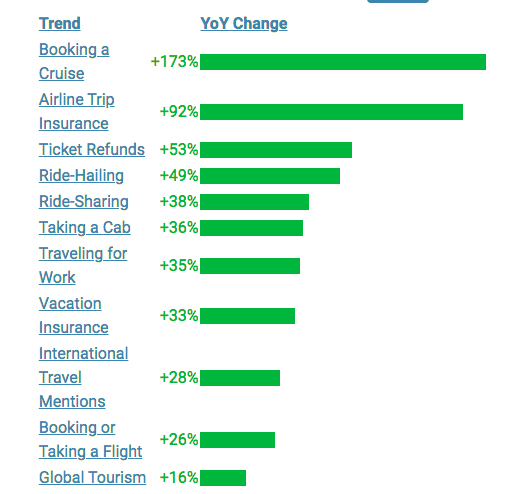

And finally, trends related to travel are all up significantly to the year which leads us to be optimistic...

...Especially for a travel stock like Expedia.