Travel Update: Airline Earnings It's time for the airline industry to report […]

Travel is back! (Sort of)

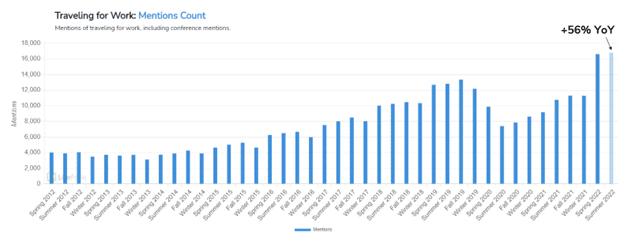

| Within the span of just a few minutes last weekend, I heard each of the following: “No, I think we’ll stay around here this summer. Plane tickets and everything are just too expensive to justify a big vacation.” AND “Ya, I’m traveling a lot more for work now. Our company has really opened up recently.” Of course, this dichotomy caught my attention. But did these anecdotes really represent what was going on in the travel industry as a whole? For that, I turned to the LikeFolio Research Dashboard. Here’s what I found: Travel FOR WORK Is Taking Off General travel trends are very insightful, and LikeFolio has tons of them. But what I really wanted to know is the REASON for the travel. Because right now, flight prices are high, choices can be limited, and large numbers of cancellations can make flying frustrating. And generally speaking, professional travelers are less price-sensitive and more willing to tough it out through rerouting frustrations than family vacationers. Here’s what the LikeFolio “Travel For Work” macro trend looks like now: |

| So far in the Summer of 2022, we’re seeing an even larger increase in work travel demand than the prior “snapback” quarter. A 56% year-over-year increase is impressive, to say the least. Airline Winners & Losers So if work travel is doing the heavy lifting for the industry, which airlines are winning – and which are losing? For that, I plotted the famous LikeFolio Earnings Score for each of the four major airlines over time… looking for a “breakout” in one or more names: |

As you can see above, United and Delta have recently separated themselves from the airline pack.

United’s (UAL) LikeFolio Earnings Score has moved up from -50 (quite bearish) to over +60 (quite bullish) in just the last few months.

Delta (DAL) has seen an increase as well, moving from -40 into the positive range over just the past month.

Meanwhile, American (AAL) and Southwest (LUV) have continued to languish in negative Earnings Score territory.

All of this fits with the macro trend data above: Family vacation travelers that normally flock to Southwest simply aren’t finding the flights they need at competitive prices, while travel-for-work travelers are enjoying the plentiful routes and business services of Delta and United Airlines… despite higher prices.

As we head into this summer earnings season, we’ll be keeping a close eye on the reports of these airline companies to see if our developing thesis has legs.

If LikeFolio data is right (and it usually is!) – the professional traveler is back, and the family is staying home until prices cool off.

This could have huge impacts well beyond airlines – hotels, Airbnb, booking sites, and rental car companies all target different types of travelers in different ways.

Bottom line: Opportunity is brewing in the travel space – but you’ve got to be on the right side of the underlying trends.