Planet Fitness ($PLNT) reports earnings tonight, and analysts are expecting […]

Trend Watch: Fitness Resolutions (PTON, PLNT, XPOF, NLS)

2023… new year, new me.

At least that’s what we seem to tell ourselves each time the calendar turns over.

Regardless of the ability (or lack thereof) to change long-term behavior, resolutions do drive revenue… especially in the fitness category.

With the turn of the new year behind and many resolutions already broken, it’s a great time to take a sneak peek at how LikeFolio data is indicating 2023 might go for the fitness sector.

Be warned – it’s not pretty.

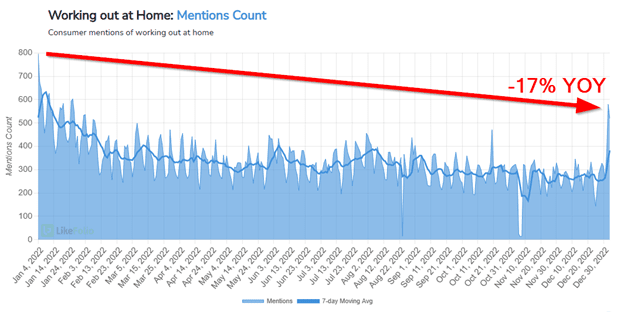

“Working Out At Home” demand continues to drop

Demand deterioration for working out at home continues into 2023 after a monster surge during the pandemic.

This is the largest fitness theme we see continuing into 2023: consumers just aren’t feeling the home gym as much as they used to.

Which naturally leads us to check in on one covid-darling in particular…

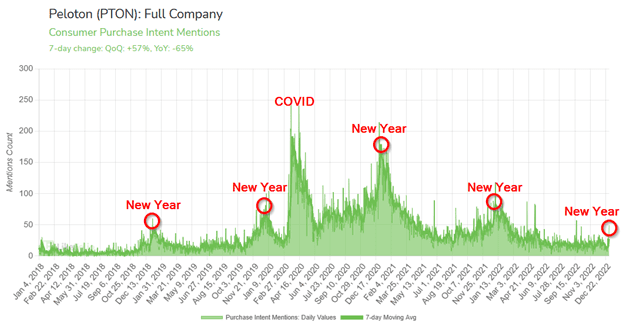

Peloton (PTON) getting almost no “resolution love”

During its pandemic-induced boom, Peloton (PTON) was one of the hottest stocks on the street. Peaking at over $170/share in January of 2021, it had risen by nearly 10x in value in a matter of months.

Since then, it’s been nothing but gravity for PTON, which now trades under $10/share… well below pre-pandemic levels.

Unfortunately, the outlook for 2023 isn’t getting much rosier.

LikeFolio data is showing the lowest levels of New Year’s Resolution season consumer demand for Peloton products in over 5 years.

With organic demand waning, the best bet for PTON shareholders looks to be a bold partnership or acquisition – each of which we feel is more likely in 2023 than ever.

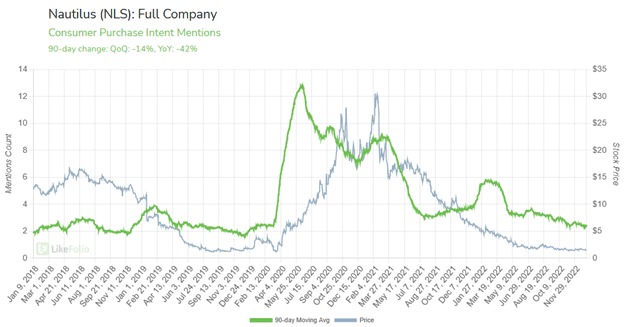

Nautilus (NLS) atrophy continues

One of the biggest “surprise” winners of the pandemic was Nautilus (NLS) – an almost forgotten fitness brand that saw customers flocking to its website in a desperate attempt to establish a home gym that health officials couldn’t shut down.

According to LikeFolio data, those glory days are all in the rearview mirror, with Nautilus experiencing a steady decline in demand for its fitness products.

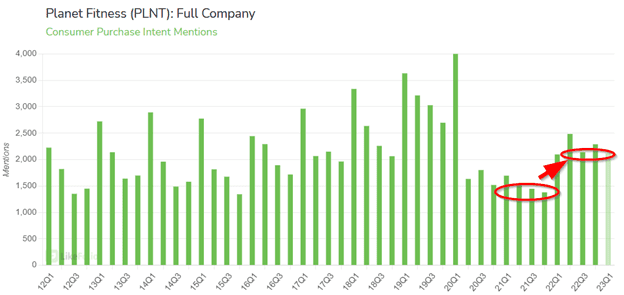

Planet Fitness (PLNT) – growing, but not booming

Planet Fitness (PLNT) consumer demand shows us that the fitness center company isn’t having a booming resolution season, but unlike home-gym companies, is maintaining elevated levels of demand.

What we like about PLNT is that these elevated levels of demand are indicative of new subscribers joining the gym company’s already robust base of revenue-generating members.

And because of the company’s low-price subscription model, churn is less of an issue – meaning every new subscriber is likely to be additional revenue in quarters and years to come.

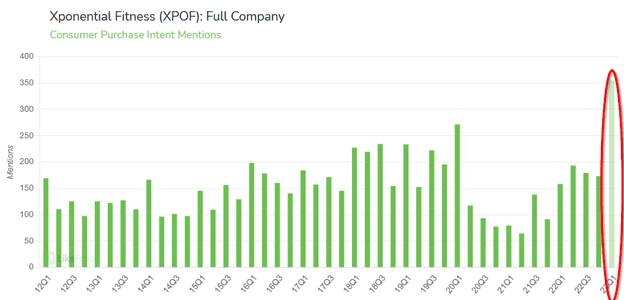

Exponential Fitness (XPOF) is looking sharp

While home gyms are dead, and big fitness centers are holding steady… one area of growth we’re seeing is in group fitness classes.

Specifically, Exponential Fitness (XPOF)’s popular CycleBar and Pure Barre franchises, offer fitness classes that attract a mostly affluent demographic less impacted by inflationary pressures.

Consumer demand (think signing up for a subscription or buying a pack of classes) for XPOF’s signature brands is up over 100% vs. this time last year.

Fitness Bottom line…

- Consumers continue to move away from home gyms and the equipment that supports them.

- We DON’T anticipate a major come-back for equipment manufacturers PTON or NLS.

- PLNT is capturing a large portion of exercisers ready to leave the confines of their basement and the number of health clubs in the U.S. contracts…but it's not the top performer.

- XPOF is the top beneficiary of high-earning consumers eager to attend social workout classes. We like the demand strength building here, and can confidently award this name the top New Year resolution fitness winner of 2023.