Ulta is Making Strategic Moves ULTA is gaining momentum in […]

ULTA Demand is Picking Back Up…

Ulta Beauty, the American Cosmetics & Fragrance retailer reports 21Q4 earnings March 10 after the bell.

And macro-environment considered, they should crush it.

Just look at all a few of the macro trends elevating potential consumer demand for makeup and skincare products:

- Mall Shopping: +15% YoY

- Going to a Bar/Restaurant: +58% YoY

- Returning to the Office: +70% YoY

- Attending a Music Festival or Event: +152% YoY

But the market may already be onto this…

Ulta shares have been largely unaffected in comparison to the market as a whole, and are currently trading around +5% higher than they were a year ago.

Does LikeFolio data suggest the market is in for a surprise?

Not necessarily.

Here’s what we’re watching:

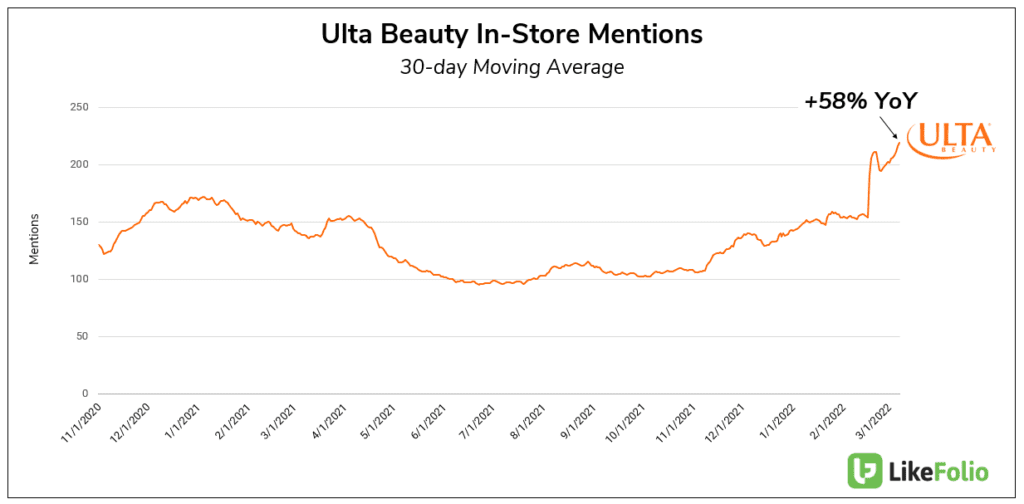

1. Consumers are returning to the store! Consumer mentions of making a trip to Ulta have increased significantly YoY:+58%.

Comprehensively, Ulta Purchase Intent Mentions are ramping, currently pacing +30% on a QoQ basis. But these mentions don’t reflect demand levels recorded prior to the pandemic.

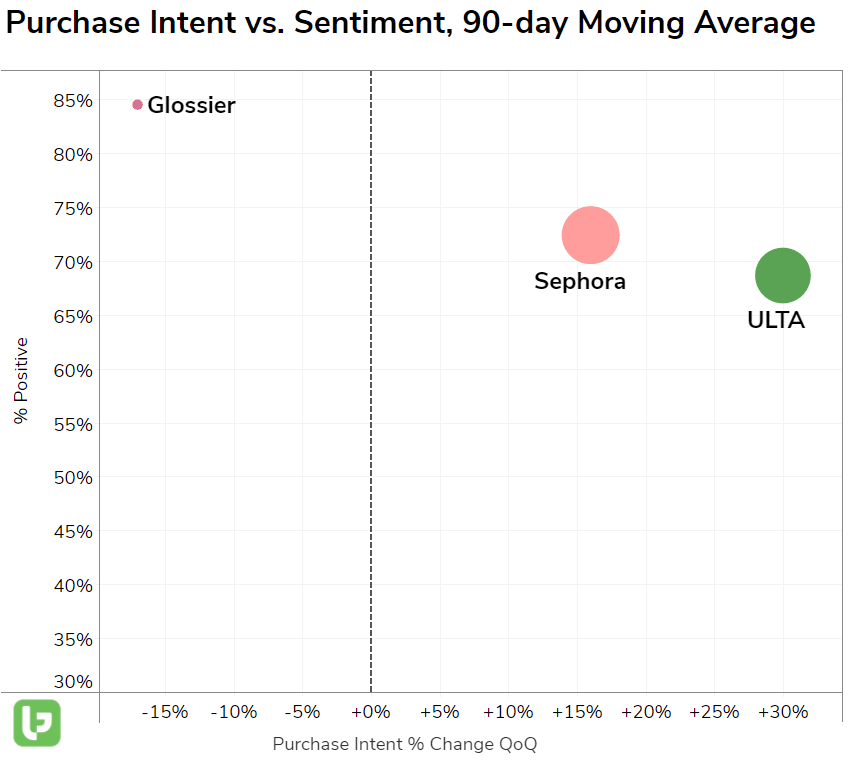

2. Ulta's Happiness is Consistent. Mentions have remained steadily positive for the company.

However, this happiness is lower than peers.

Ulta’s drugstore x prestige combo has a hard time stacking up to Sephora’s prestige-forward brand portfolio and Glossier’s unique brand components.

So, while Ulta is showing signs of resurging demand for its cosmetic and makeup products as consumers re-enter society, we think the market expects it.

We’re sidelines for this event and expect the company to post a solid report.