COVID-19, like many previous American hardships, hit us in the […]

Visualizing Consumer Momentum: $GPS and $TJX

Visualizing Consumer Momentum: $GPS and $TJX

Last year at this time, the top two growing trends were working from home and working out from home.

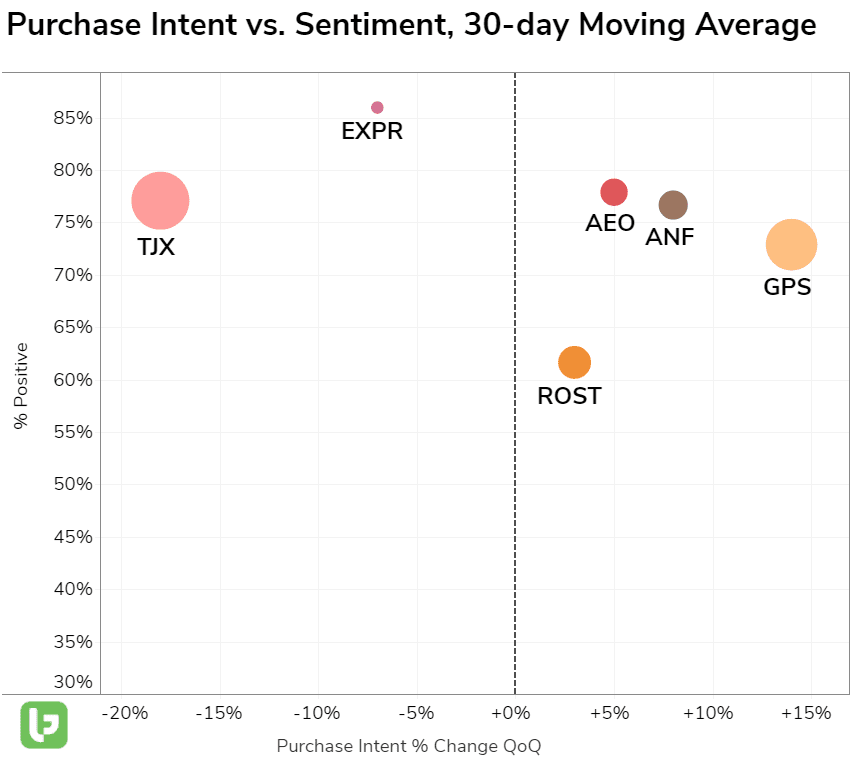

This year, it's apparel and travel. So naturally, we're looking at the names in these spaces to understand which companies are benefitting from macro tailwinds. Today, we're tackling shopping for new clothes. When you're trying to understand the consumer health of a company, it helps to view the company with the same lens vs. peers. This is exactly what the outlier grid allows you to do. The view displayed is a near-term outlook. It's plotting at the 30day Moving Average, QoQ, and is a really good gauge of momentum.

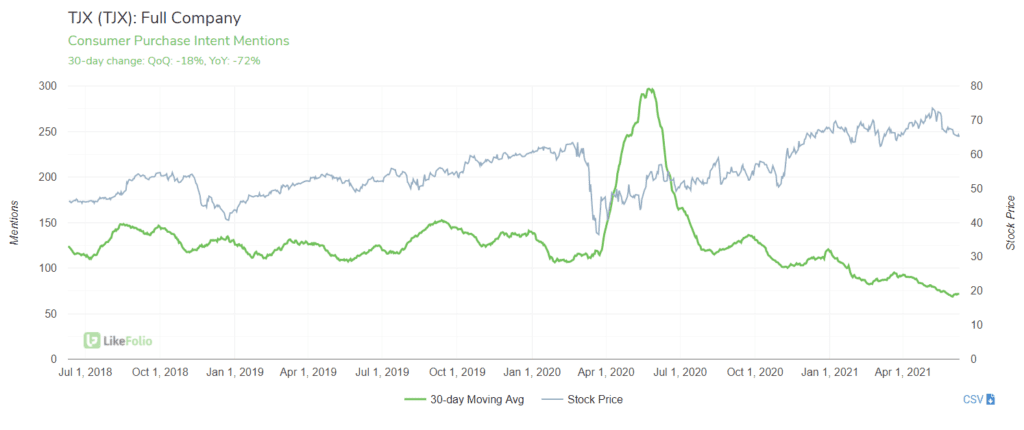

You can see two companies are located at opposite ends of the x-axis, displaying consumer Purchase Intent growth (or decline): GPS and TJX. What's going on? TJX is losing steam with consumers. While the company benefitted greatly from home renovations in the last year thanks to its HomeGoods brand, this growth is waning. You can see this demand surge bump on the chart below.

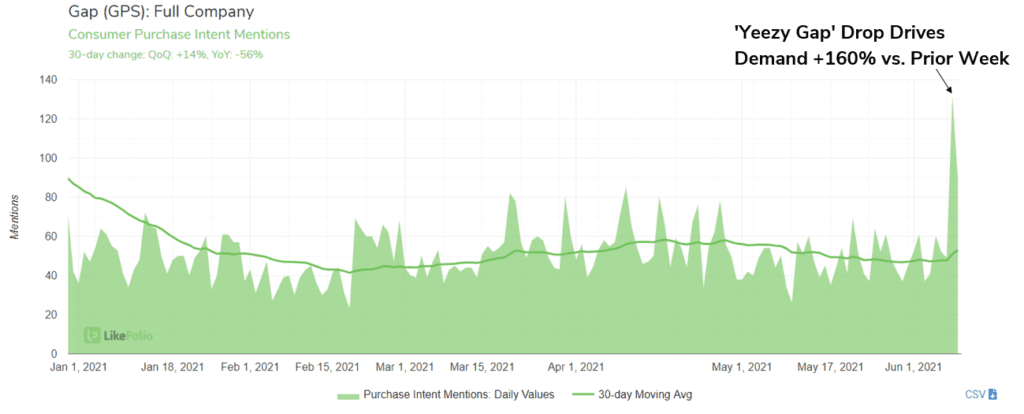

Now, HomeGoods Brand Purchase Intent Mentions are pacing -31% QoQ, -56% YoY. And T.J. Maxx brand mentions aren't faring any better. Much of this has to do with the fact that the TJX did not pivot well to eCommerce. Even the company admitted: "We see our stores as a desirable destination for consumers seeking some stress relief or “me-time” and also a great place to shop when they are seeking inspiration and looking to discover new things, which is difficult to replicate online.” On the other side of the coin, Gap is gaining momentum. Strategic product drops and alignment with celebrities like Kanye West and Simone Biles have consumers talking about the company again.

- In April, Gap announced it was partnering with world champion gymnast Simone Biles and releasing a new performance wear line (just in time for the Olympics)...She left Nike for this.

- And earlier this week, Gap released the first "drop" of its Yeezy Gap line -- a single blue puffer jacket, at 3 in the morning, in the heat of Summer -- and it sold out in hours

Aside from new product drops, Gap's Old Navy brand is also showing signs or returning consumer demand: +14% QoQ We'll continue to monitor both names to see if TJX can turn it around and if Gap can maintain its momentum with consumers. But for now, the path diverging in the woods is only getting wider.