Crocs: in League of Its Own Thanks to re-opening fueled […]

Walmart Issued a Warning to Investors

Earlier this week Walmart tipped its hand…its not-so-great hand, at that.

The retail giant lowered its profit outlook for Q2 and Fiscal Year ’23.

The cause: the comparable sales mix is shifting heavier in favor of goods and consumables. (We noted this shift on the July MegaTrends report).

The bad news: rising food inflation is impacting the ability of consumers to purchase other general merchandise items…specifically apparel. Which has resulted in markdowns to control inventory. And lower profit margins across the board.

This has us wondering…is Walmart’s warning a canary in the coal mine for weakness across the apparel sector?

Demand for Apparel Shows YoY Weakness Across the Board

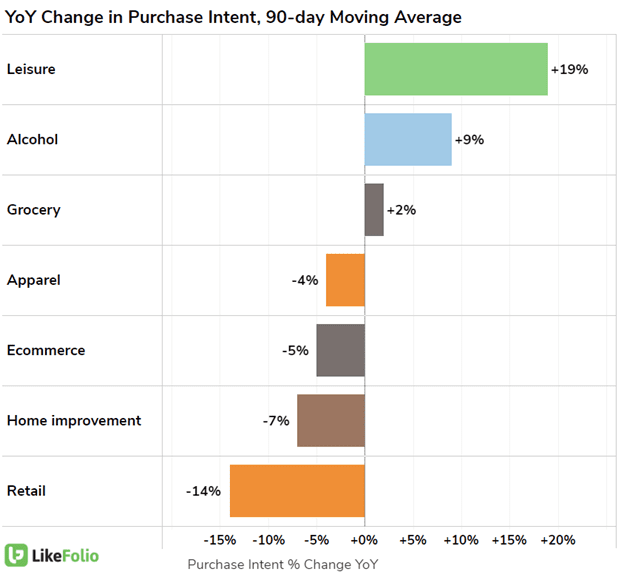

To understand sector demand, we aggregated purchase intent mentions for all companies who sell apparel and tallied the total change.

And it is very telling.

You can see the performance for multiple sectors below:

While consumers spend more on experiences and essentials, like grocery, they’re spending LESS in other areas: notably, apparel and home improvement.

Overall, apparel demand fell -4% on a YoY basis (and is continuing lower in the current quarter).

But are all apparel sellers created equally?

Not necessarily. And this is where LikeFolio data can help investors have a serious edge.

Spotting the Outliers in Apparel

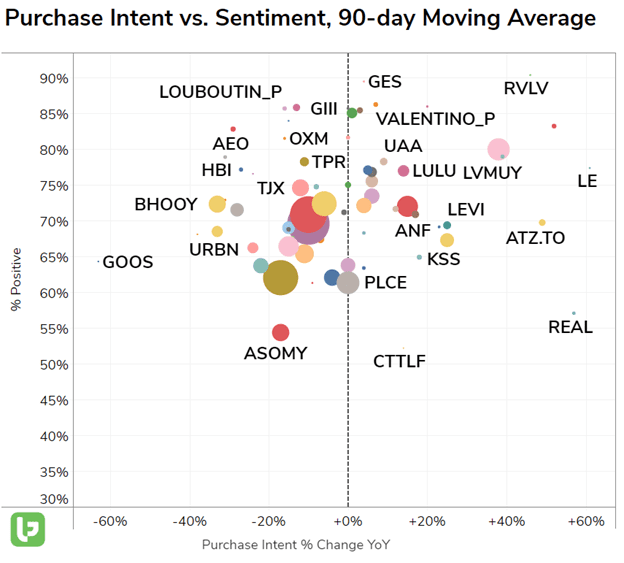

Now that we have an industry-wide goal post, we can use this to gauge company-specific performance.

To give a scale for the breadth of this analysis, take a look at the outlier grid below featuring major players in this space.

Clearly, the performance gap is WIDE. And there is ample opportunity to spot winners and losers.

For example, we’re recording strength from brands like Levi Strauss (LEVI), Lululemon (LULU), and Aritzia (ATZ.TO) that cater to higher-earning consumers seeking high-quality products.

Interestingly, we’re also recording noted strength in the fast-casual segment from brands like Boohoo and Nasty Gal (BHOOY), Asos (ASOMY), and even Shein, suggesting stress on the average consumer.

We’ll be tracking this very closely in the coming weeks to spot additional outliers – for better or worse–and sector-wide performance.

For now, it doesn’t appear that the apparel sector is doomed, but consumers ARE becoming more selective in their spending.