Roku makes streaming devices that allow its customers to stream […]

Was Home Depot (HD) the Canary in the Coalmine?

Scrolling through my news feed, you’d think the world could end this summer.

Many will look at these headlines with a sense of doom – the German’s have a word for this: Weltschmerz.

But as a trader, I actually feel empowered – mostly because I have LikeFolio data to help sort through the noise and measure changes in consumer behavior as they’re happening.

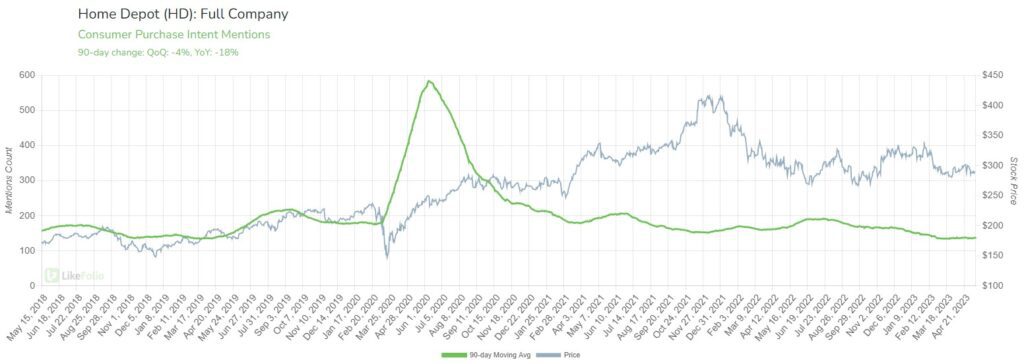

This real-time data is exactly how our team saw Home Depot’s disappointing earnings looming on the horizon – check out the downward slope of demand momentum.

Today we learned that HD demand IS cooling as consumers postpone projects and put off big ticket purchases.

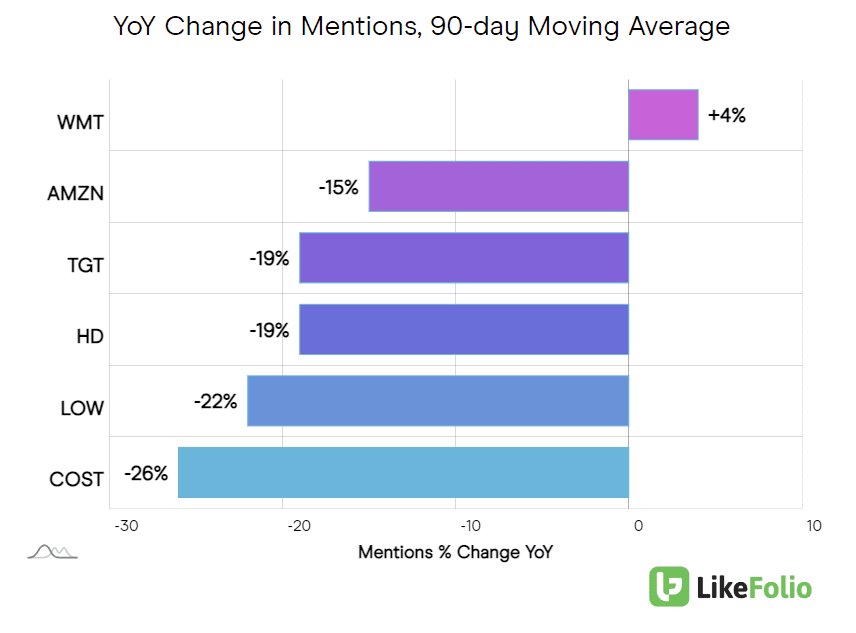

So – are all retailers in the same boat with Home Depot?

Let’s check the data…

- Walmart is emerging as a positive outlier this earnings season. This is the only company to record YoY growth in Mention volume. Much of this can be attributed to strength in consumer staples, like grocery purchases. Higher end shoppers made up nearly half of the gains Walmart posted in the U.S. last quarter…and this behavior was present in its bulk retail arm, Sam’s club, too.

- Amazon’s prime subscription model is showing some signs of resilience. AMZN demand (which is heavily tilted toward its eCommerce arm) is holding up better than other big box stores. In addition, Amazon’s Prime membership happiness levels have popped +5% higher on a YoY basis as consumers report deals and improved shipping experiences.

- Target is facing an uphill battle, especially as consumers report a decrease in spending that once lifted it above peers, like trendy home décor and high-quality private label clothing brands. Consumer mentions of shopping for apparel have dropped by nearly -30% on a YoY basis. TGT and HD have near-mirrored data, so we’re not betting on a surprise to the upside tomorrow morning.

- Costco demand is finally normalizing from covid-induced highs and may be best positioned for long-term recovery. While the company’s mention decline appears to be the most dramatic on the chart above, Purchase Intent mentions are showing some signs of improvement on a QoQ basis (+7%). Consumer mentions of bulk purchases are also on the rise, and Costco touts the highest happiness level of the retail group, at 73% positive.

- Lowe’s appears to be in the same-if-not-worse boat than Home Depot. The company is likely to suffer from the same pull-back in consumer projects as its home renovation peer – though its stock is already trading in sympathy.

Bottom line: discretionary spending is being tested, but this isn’t news for members. By understanding how retailers stack up, traders can make informed decisions on potential surprises (WMT), likely disappointments (TGT), and convincing long-term bets (COST).