Carnival Cruise Lines is starting to show some weakness in […]

Wave Season is Over!

We’re stepping out of a critical peak season for one industry in the LikeFolio universe.

“Wave Season” runs from January through March each year and offers an extremely forward-looking snapshot of future consumer demand.

Any guesses for which industry I’m referencing?

Cruise Line Demand During Wave Season Provides Investor Edge

Wave Season is like a mash up of Black Friday and the Apple Keynote for cruise liners. Its when prices are the lowest and consumers are mostly likely to hit that book button.

Naturally this is when we really dial in at LikeFolio. The formula is simple:

Macro Trend + Company-Specific Demand = Investor Edge

- Macro Trend: Consumers tip their hand, indicating future cruise plans.

- Company-Specific Demand: We map these mentions up to the publicly traded cruise parent – i.e. which cruise lines are outperforming or underperforming?

- End Result: Investors get a consumer-driven edge.

Let’s break it down.

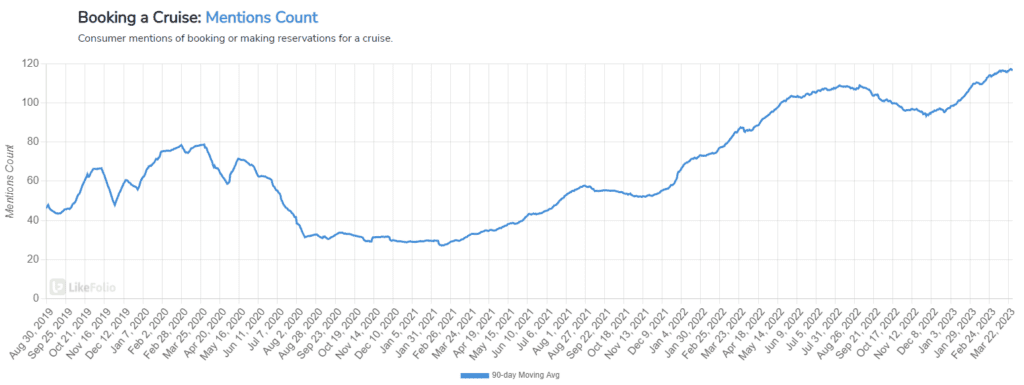

Macro Trend: Cruise Demand Continues to Swell

Consumer mentions of booking a cruise surged during Wave Season.

More than +30% higher vs. last year – and even higher vs. pre-Covid levels.

A cruise revival, if you will.

Key Takeaway: Cruise demand is hot heading out of peak booking season, a positive sign for companies operating in this space for several months to come.

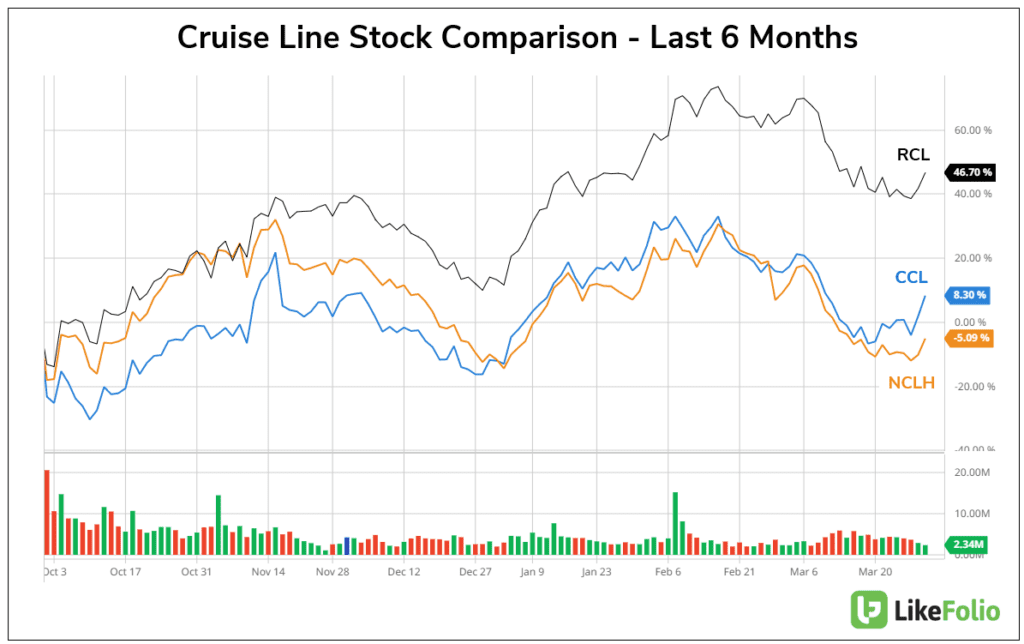

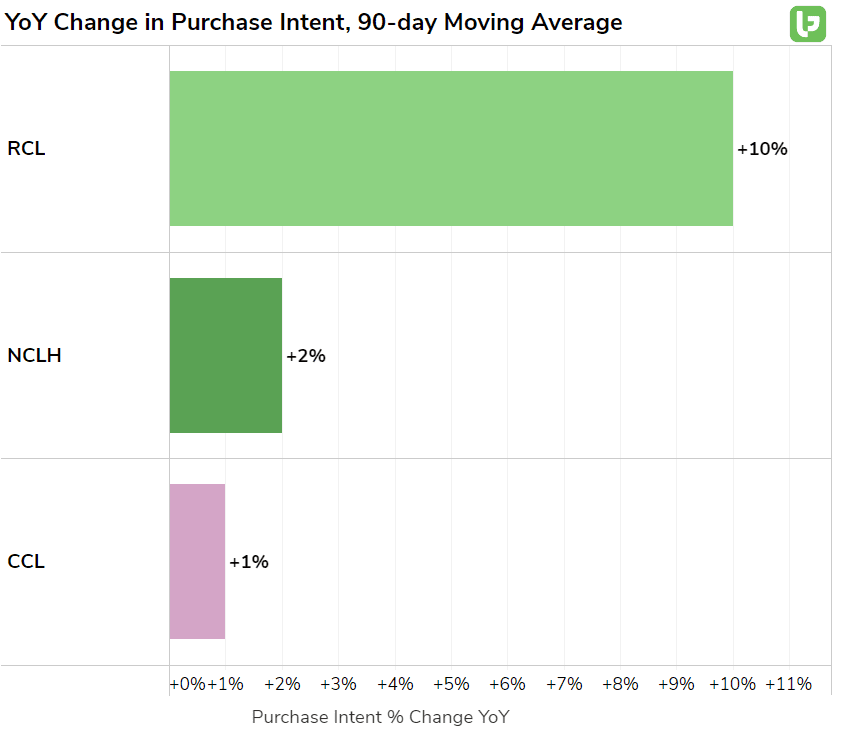

Company-Specific Demand: RCL is Outperforming Peers

It’s evident in company-specific demand that the rising macro-trend tide is lifting all boats in this space…but one has a leg up.

Royal Caribbean (RCL) has a significant demand lead vs. peers Carnival and Norwegian.

Consumer often tout Royal Caribbean’s destinations and on-ship experiences as superior vs. peers.

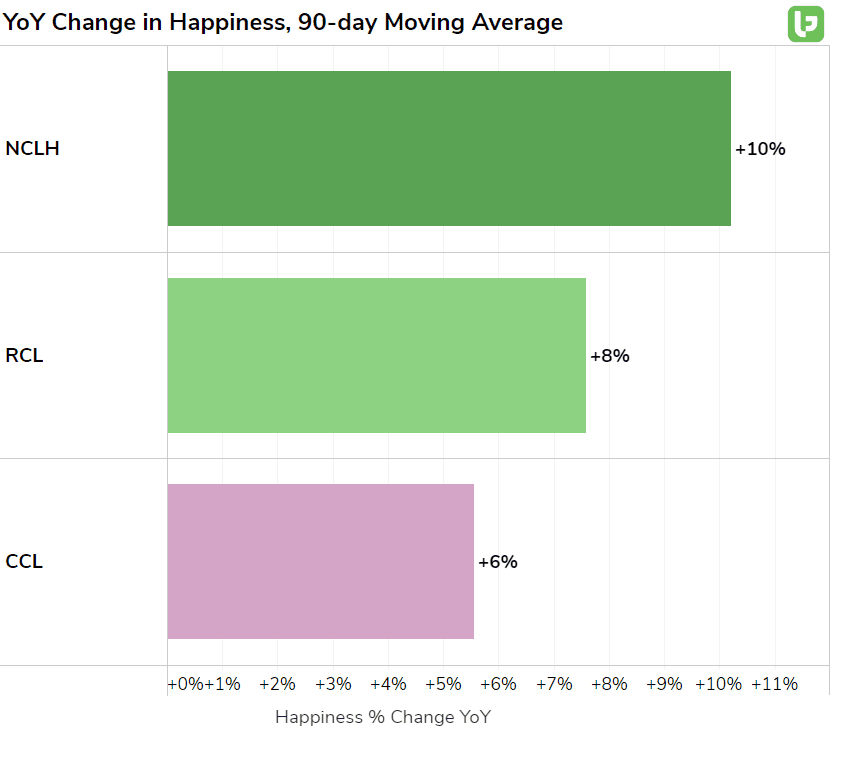

From a happiness perspective – LikeFolio’s most useful long-term indicator – every cruise line covered has a happiness level higher than +80% positive (wow) and all have recorded significant improvements in the past year as consumers return to the sea.

The combination of rising demand alongside rising happiness is a positive long-term indicator for the industry at large.

So how do the opportunities shake out for investors?

Here’s what we know:

- RCL: The company is doing a great job wrangling costs, posting narrower-than-expected losses alongside a strong booking outlook.

- CCL: The company posted a strong report earlier this week featuring improving ticket prices and growth in onboard revenue, but overall booking recovery trailed that of RCL with levels 5 points below 2019 pre-covid levels.

- NCLH: The company is struggling the most to rein in costs and combat debt weighing down its business. It expects improvements in the second quarter.

Here’s what we know, thanks to LikeFolio real-time consumer insights:

Cruise demand is not waning. Consumers are continuing to prioritize experiences when deciding how to spend their money. We expect this to serve as a tailwind for the next quarter.

RCL is continuing to lead the pack in booking recovery thanks to its superior experience and high-value, higher-cost ticketing model. We expect continued near-term outperformance on the consumer front.

CCL looks to be priced about right. The company has room for improvement on the booking front, but demand shows signs of continued recovery. The stock’s near-term recovery is in line with consumer metrics.

NCLH may be overlooked because of its execution. The cruise line touts the highest price-point vs. peers…and if recent earnings results from names like LULU have taught us anything, it’s that the affluent consumer has the most spending power right now. But NCLH shares are seriously trailing peers on a 6-month basis. If the company management can implement cost-saving measures this name could present the most significant opportunity for long-term investors, on the back of strong demand and an even stronger consumer-base.