Call it narcissism, or call it knowing exactly what you […]

Wayfair Upgrade: Wishful Thinking?

Wayfair shares have surged +24% today alone after the company announced it was reducing its workforce by 10%, or 1,750 employees. This is one step in the company's plans to manage costs, breakeven earlier in 2023, and a major step toward positive free cash flow.

The company received a double upgrade from a J.P. Morgan analyst in response to its focus on controlling expenses and a long-term consumer shift to online shopping.

Cost-cutting measures are certainly a step in the right direction, but LikeFolio data suggests it’s not all sunshine and roses for the eCommerce retailer…

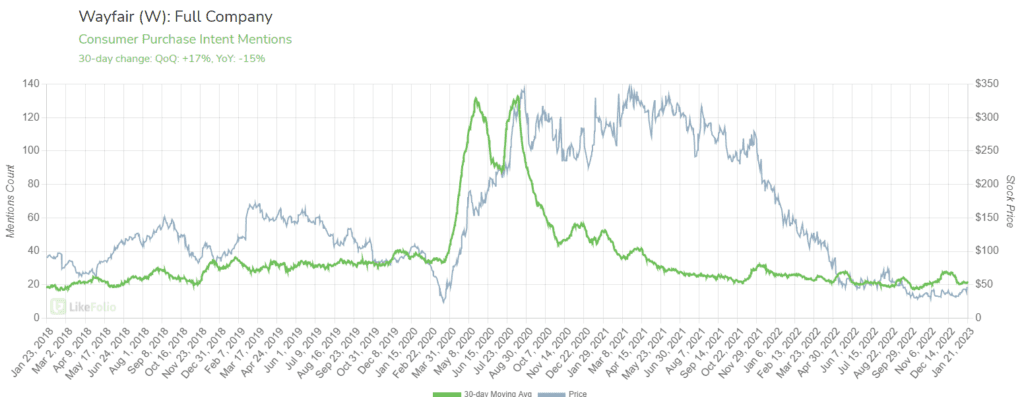

1. LikeFolio data does note some positive demand momentum on a QoQ basis (+17%) but purchase intent levels remain -15% lower YoY.

The last time demand levels were registering at this level (in 2018), Wayfair shares were trading near $80, offering some support to an oversold thesis.

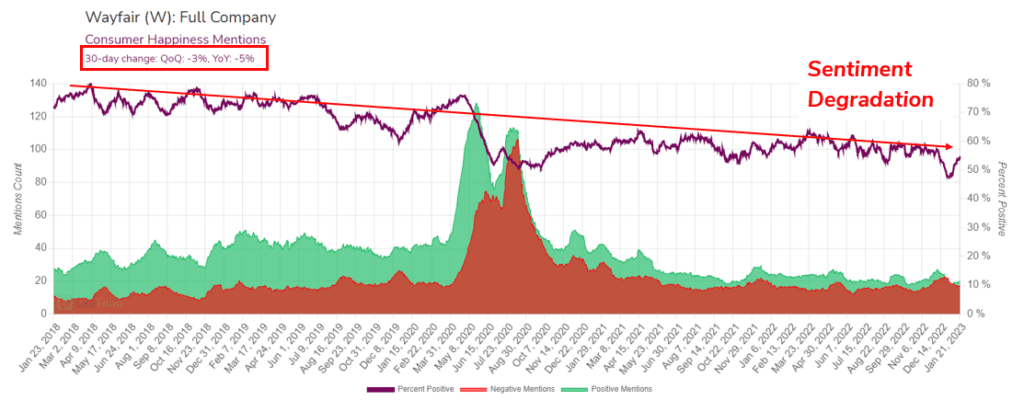

However, Wayfair demand does not appear to be gaining momentum like it was in 2018, and happiness levels have sunk by nearly 20 points in the same timeframe as consumers increasingly note the quality of Wayfair products are less than desired...this rally may be overdone.

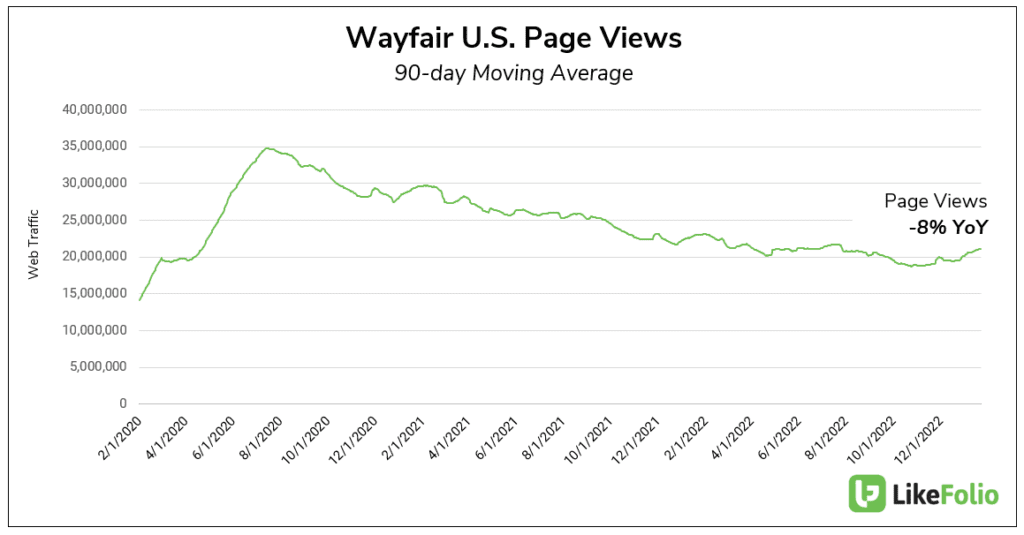

2. Wayfair web traffic trends also mirror YoY weakness, though may have found the bottom. U.S. page views have slipped by -8% YoY but appear to have reached an inflection point around Thanksgiving.

These metrics have proven highly correlated to company revenue, so should be monitored closely to confirm the company can hold on to recent momentum.

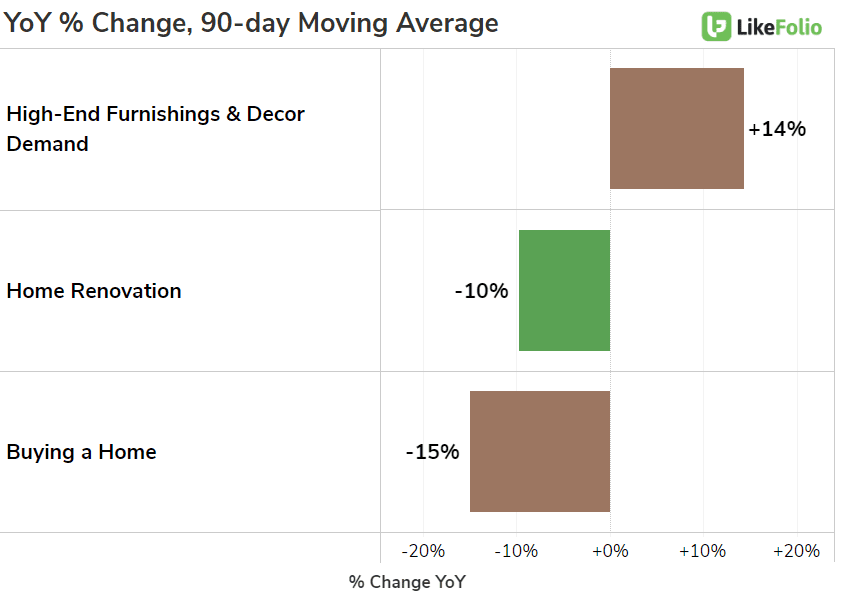

3. Trends continue to support high-end furniture and decor retailers vs. value alternatives, like Wayfair, especially in today’s inflationary environment. In addition, home renovation and real estate trends are likely to serve as headwinds near-term.

Bottom line: we’re not ready to jump into Wayfair just yet.

The company will report Q4 earnings at the end of February…we’ll be monitoring for a rebound in the meantime, and will update members with any changes prior to the company’s report.