Stitch Fix (SFIX) Last quarter, SFIX shares fell 14% after […]

Weekly Preview: SPY, SFIX, ULTA, GAP

Market Overview: Easy money has been made.

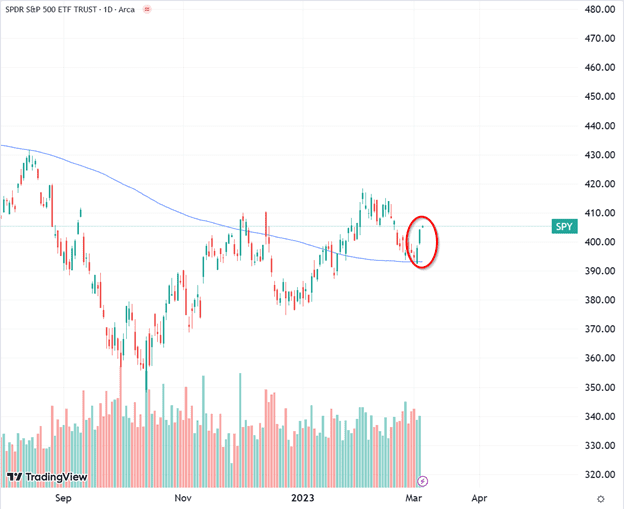

S&P 500 (SPY): Late last week we got the rally off that we’ve been anticipating, popping by more than 3% -- right off of the 200-day moving average (393 or so)…

Congratulations to all who played this move along with us… but what now?

We believe the easy money has been made, and the risk/reward ratio for the market has become decidedly riskier as we’ve moved away from the comfort of the 200-day moving average support level.

We’ve got a highly event-driven schedule for the next few weeks, as highlighted by this chart of implied volatility:

By using future options pricing as a guide, we can see the “events that matter” over the remainder of March:

- Wednesday, March 8: Fed Chairman Powell will testify before the Senate beginning at 10am ET. Wall Street will be watching for clues as to the FOMC’s mindset regarding further interest rate hikes.

- Friday, March 10: The February Employment report and unemployment rate are released at 8:30am ET. Markets are expecting 225,000 “Non Farm Payroll” jobs added and a stable 3.4% unemployment rate. This event is abbreviated as NFP on the chart above… and while likely to move markets significantly, is predicted to be only the third biggest event of March.

CPI, the Consumer Price Index is the next big potential market shockwave, set to be released at 8:30am ET on Tuesday, March 14.

The FOMC is scheduled to meet and announce changes to the Fed Funds rate on Wednesday, March 22… which is predicted by options markets to be the most volatility-inducing event of the month.

Earnings on tap:

Weight Watchers (WW) reports Monday after the market closes, and has finished in the red for the week of each of the last 4 reports.

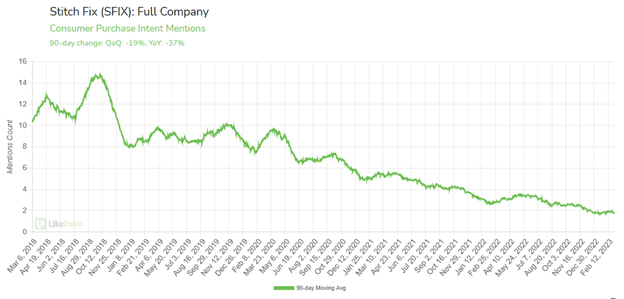

Stitch Fix (SFIX) has also disappointed investors for the past year of earnings reports as the subscription clothing retailer has had trouble living up to lofty expectations set during the shopping-restricted pandemic days.

Build-A-Bear (BBW) has moved big on its last four reports, with its smallest move being -9.9% during the earnings week one year ago, and its biggest move being +34.5% during the earnings week last quarter. With an expected move of only +/- 8.7%, options traders may consider a straddle or strangle play to bet on a larger-than-expected move when it reports earnings on Thursday morning.

Thursday after the market closes, we’ll get reports from Ulta (ULTA) and Gap (GPS), which could both be in for an inventory-meets-declining-demand shockwave. Of the two, GPS seems like the better bearish bet if you consider Abercrombie & Fitch (ANF)’s earnings as a warning signal that companies are having a tough time maintaining expected profitability levels.

LikeFolio Live

Here are this week’s likely topics for LikeFolio’s appearances on TD Ameritrade Network’s Fast Market:

Mon: Dick’s Sporting Goods (DKS)

Tue: Teladoc (TDOC)

Wed: BJ’s Wholesale Club (BJ)

Thur: DocuSign (DOCU)

Fri: Surprise

To catch the action live, tune in to the TD Ameritrade Network on weekdays around 12:30pm ET, or subscribe to our YouTube channel.