Despite recent market volatility and some arguing for a bear […]

We’re Bullish on Pinterest (PINS)…Again

August 3, 2022

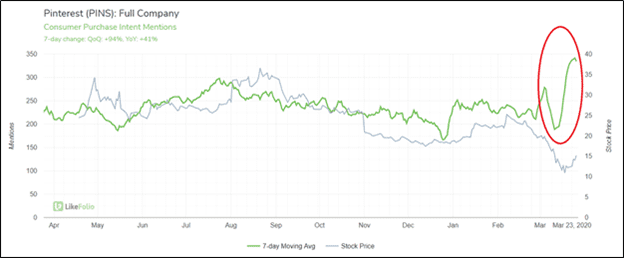

| I’ve got a love/hate relationship with Pinterest (PINS). I loved it during the pandemic – when LikeFolio data clearly showed us a major opportunity driven by captive consumers stuck at home. Here’s what we were watching: |

| Since targeting this pandemic winner in March 2020, shares surged from $15 to just above $80 through February of last year. More than +430% gains in less than a year. After peaking in 2021, PINS shares gave back nearly all of the pandemic-driven gains as consumers resumed “normal” life activities out in the world and dust gathered on their keyboards at home. But at LikeFolio, we never stopped listening to those consumers. That’s why we were Bullish ahead of the company’s earnings report earlier this week: |

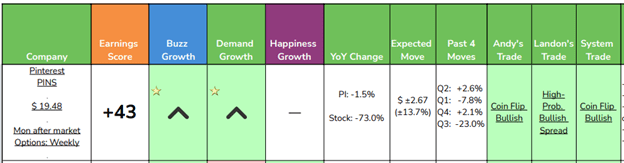

| Mention buzz and demand growth were improving again…for the first time in months. And more importantly: the company proved its platform was valuable to advertisers as second-quarter sales beat expectations. The company also received a vote of confidence from its largest shareholder, Elliot Management who touted the company’s ideal positioning at the intersection of commerce, search, and social media. In fact, it’s precisely these three reasons Pinterest could be a major winner…yet again. Commerce: Consumers are Embracing Shoppable Content |

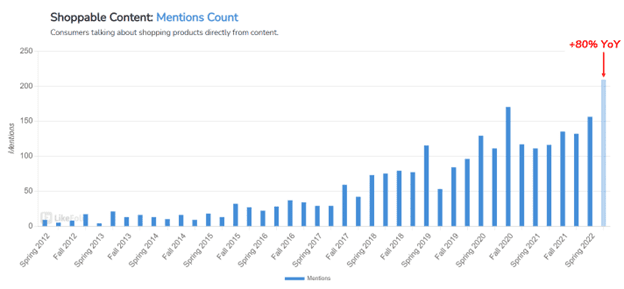

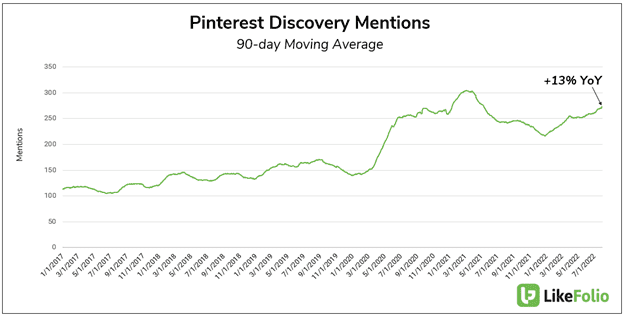

| Mentions from consumers completing a purchase directly from the source of content consumption – be it Pinterest or another social site like META’s Instagram -- are at all-time highs, currently pacing +80% higher this summer. Pinterest touted its shopping ads as a major driver of revenue on its last report. Shopping ads revenue grew at double the rate of overall revenue on a YoY basis, helping to offset a slide in Monthly Active Users (MAUs). This demonstrates the platform’s proficiency in connecting brands and consumers. How does it pull this off? Search: Pinterest is Built for Product Discovery Consumers intentionally go to Pinterest to discover things – art, recipes, fashion, and home décor. Then users take it a step further, aggregating items of interest onto personalized boards. Product discovery mentions are on the rise again after a lull earlier this year. |

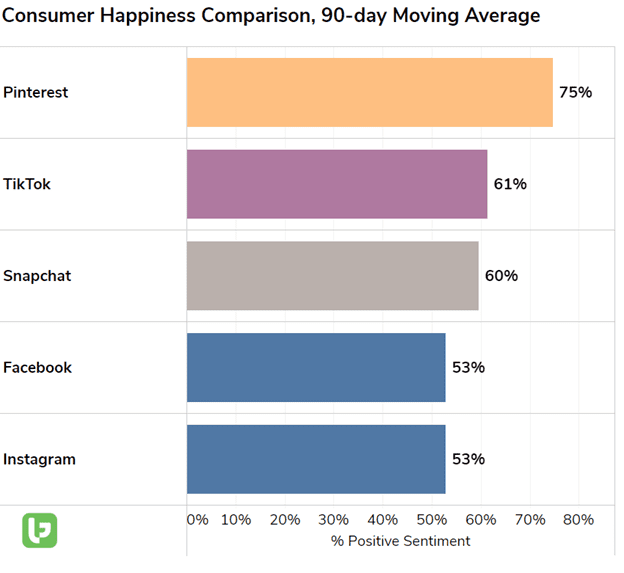

| This search and find functionality is why Pinterest SHOULD be a brand/advertiser’s dream: captive audiences actively searching for product ideas and tipping their hands at the exact products/styles they like. And why ads placed within the Pinterest platform feel less intrusive to users vs. ads placed on other “social” platforms. In a way, consumers are asking for them. Social Media: Users Like Pinterest More than Peers Bottom line: Pinterest finds itself in a unique spot as a “social” platform. The social element of Pinterest (sharing and pinning items of interest from other users) generates a more positive user experience vs. the social experience often reported on other sites. Check out consumer happiness levels for all top social platforms below: |

What’s going on here?

On Pinterest, users don’t feel in conflict with other users -- instead, they’re connected by common interests. A goal all social sites seek to achieve…but Pinterest seems to pull off naturally.

Looking ahead, we’re maintaining a bullish outlook for Pinterest.

The company must prove it can keep users around and continue to connect these users with brands. It also needs to demonstrate that its investments in shopping tech are paying off.

But data suggests it’s Pinterest’s game to lose.