Trend Watch -- Looking Ahead We knew this day would […]

What does the Future Hold for Zoom? ($ZM)

What does the Future Hold for Zoom? ($ZM)

Zoom Video Communications (ZM) became an overnight sensation last year thanks to the arrival of the COVID-19 pandemic and the ensuing lockdowns.

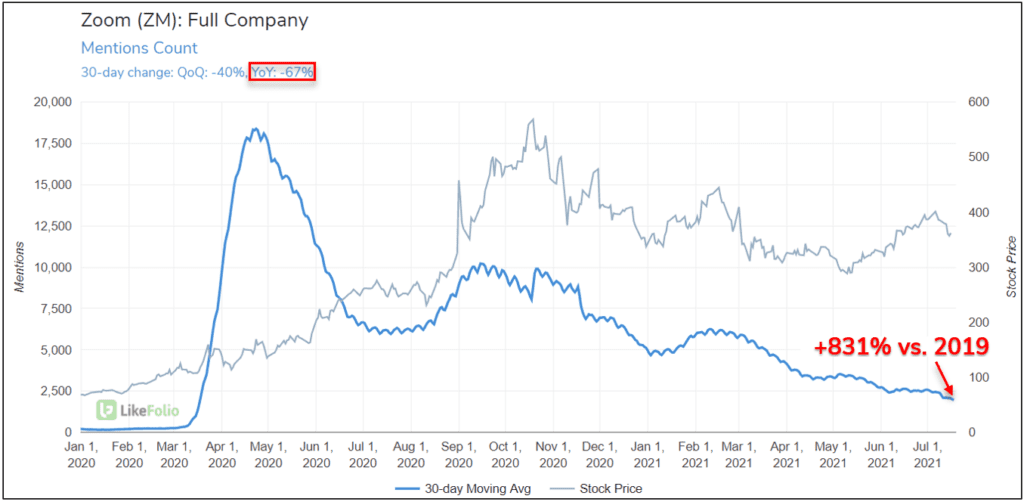

Now re-opening is taking place across the United States, including a return to in-person work and meetings. Unsurprisingly, LikeFolio data shows a massive pullback in ZM’s Mention volume, which is down -67% YoY on a 30-day moving average.

It’s important to note that Mention volume is still up +831% vs. pre-COVID levels on the same trendline. And, Zoom’s management team isn’t going to let the brand (currently worth $100 billion) fade into obscurity.

Loaded with cash in the wake of its record 2020 performance, the company is turning to M&A to maintain longevity.

Last night, ZM announced a deal to acquire the cloud contract center Five9 (FIVN) for $14.7 billion. The all stock transaction represents a 24% premium on FIVN’s current market cap.

According to Zoom’s CEO, Five9’s infrastructure will “help redefine how companies of all sizes connect with their customers.”

This represents a massive bet on the B2B side of the business, with long-term success dependent on lasting changes to workplace norms.

On the consumer side of things, LikeFolio data suggests some staying power with "working from home." While many consumers are returning to work (mentions +45% QoQ), working from home remains significantly elevated vs. pre-covid levels.

Many companies are embracing "hybrid" work models moving forward. This could continue to support the retention of services like Zoom.