PepsiCo (PEP) The quarantine 15 didn't materialize out of thin […]

Why did Pepsi buy into CELH?

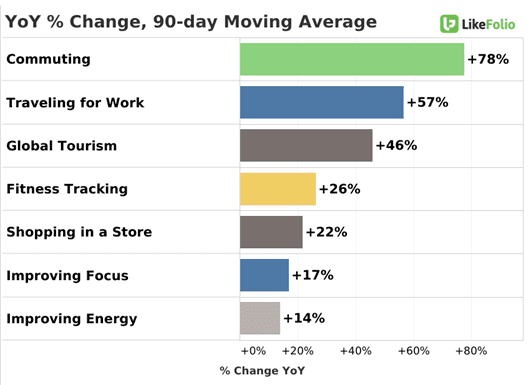

| We weren’t surprised to learn that Pepsi took a stake in healthy energy drink company Celsius Holdings, nor would we be surprised if Pepsi eventually acquires them. After all, the classic beverage maker is presumably looking at a lot of the same consumer trends that we are. Across seemingly every food & drink category, unhealthy is out and healthy is in. But with the industry prone to fleeting diets and sudden taste shifts, do the trends that attracted Pepsi to Celsius have staying power? Based on LikeFolio’s proprietary tracking of social media sentiment, better-for-you products, like Celsius drinks, are here to stay! Let’s crack open a refreshing can of the latest consumer insight... 1. What is Driving Demand for Energy Drinks? Before employers wised up to activity tracking technology, taking a midday nap was a viable option for sleepy at-home pandemic workers. Then offices reopened, forcing people to act (or at least look) the part. Taking a George-Constanza-Esque nap under the desk was a novel thought, but the logistics were tough. Less insulated from what Zoom hides, the global workforce has since accepted the reality that alertness is back in style. Alllright, time to stock up on the caffeine! Kidding aside, the return of the office (or hybrid) worker is a big reason why energy drinks are in greater demand these days. Not that it ever went away. Sipping on a coffee, soda, or energy drink throughout the day was part of our daily routines well before Covid. But with in-person meetings and business travel ramping (not to mention post-work social events), the need for a boost is real. Longer work hours + more social engagements = greater demand for extra energy. As the trends below indicate, Americans are indeed on the move again! |

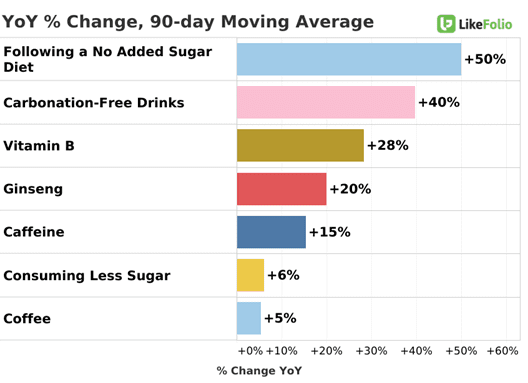

| Sedentary habits are giving way to active lifestyles in both our professional and personal lives. Whether for work, school, travel, social gatherings, or errands, people are discussing being ‘on the go’ more often. Toss in the daily fitness routine and our fast-paced, action-packed lives are back with a vengeance! It makes sense then that social media is also talking about ways to improve focus and energy. Power naps are off the table for most, the quick, convenient fix is the energy drink. According to Mintel’s 2022 U.S. Energy Drinks Market Report, 52% of energy drinkers are consuming energy drinks multiple times per week. Occasionally grabbing a Red Bull at 7-11 to get through a tough day is being replaced by more frequent consumption and bulk purchases. Alongside milk and bread, energy drinks are finding their way onto the weekly shopping list. Not all energy drinks are created equal though. Modern consumers are gravitating toward beverages that match their overall health and wellness goals. As a result, a new class of energy drinks is taking over. 2. What Matters Most to Energy Drink Consumers? Flavor? Taste? Performance? Cool label graphics? We don’t doubt that all factor into many energy drink purchase decisions. And in an inflationary environment, price certain matters too. Brand switching to save money or take advantage of the latest 2 for $5 convenience store deal is probably also commonplace. Yet when it comes to what energy drinks consumers want to pour into their bodies, ‘better-for-you’ products are stealing the show. It’s no secret that soda companies are scrambling to reduce sugar content and expand their non-soda offerings in response to consumer preferences and regulatory pressures. A growing distaste for sugar is apparent in LikeFolio’s mentions of sugar-free diets and cutting back on sugar intake. Moving away from unhealthy carbonated drinks is another clear trend. |

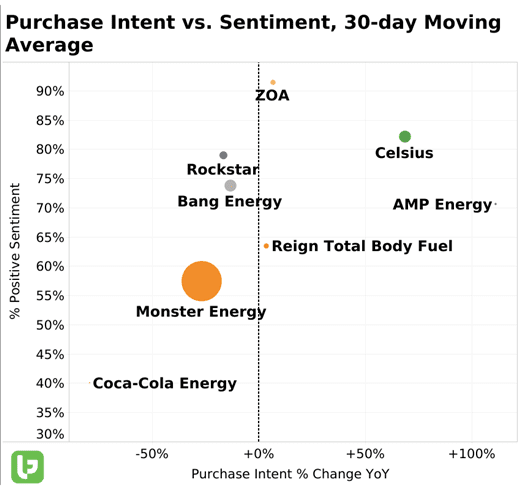

| Regular soda consumption has been on the decline for some time now. The shift towards healthier alternatives was only accelerated by the pandemic. Consumers have become more aware of the health consequences of high-calorie, high-sugar diets, most notably diabetes. More are striving for balanced diets and active lifestyles. From Red Bull and Monster to Coke and Pepsi, major beverage companies are hustling to eliminate artificial additives and make low sugar, sugar-free, and zero-calorie products bigger parts of their respective portfolios. Acumen Research & Consulting forecasts that the global energy drinks market will roughly double from 2021 to 2030 and reach ~$150 billion. The 8% projected growth is one of the highest in the food & beverage space. Even more reason for beverage makers to make sure their energy drink game is in tune with consumer preferences. With the anti-sugar shift well underway, healthy nutrients like ginseng and vitamin B are taking center stage. Mentions of both are up significantly YoY on a rolling 90-day average. Before only devout nutrition label readers found out about the vitamin content of energy drinks. Today it's hard to pick up a can without seeing Vitamin B highlighted as a key ingredient. This isn’t to say that everyone has abandoned ‘traditional’ brands like Red Bull, Monster, and Rockstar. These still appeal to a broad, loyal set of consumers and benefit from widespread distribution networks. What we are noticing though, is that in an increasingly crowded space, the ‘better’-for-you’ brands are resonating with a growing mass of health-minded individuals. We think they’ll continue to chip away at the big dogs’ market share. 3. Which Energy Drink Brands are Winning? When we evaluate what brands are attracting energy drinkers, (with a can of Celsius Mango Passionfruit in hand) we focus on two important factors. 1. What is the trend in consumer demand? 2. Are consumers happy with the product? When we take a broad swipe across the energy drink landscape, some eye-popping data presents itself. The chart below plots consumer purchase intent (PI) mentions and sentiment for 8 popular brands. |

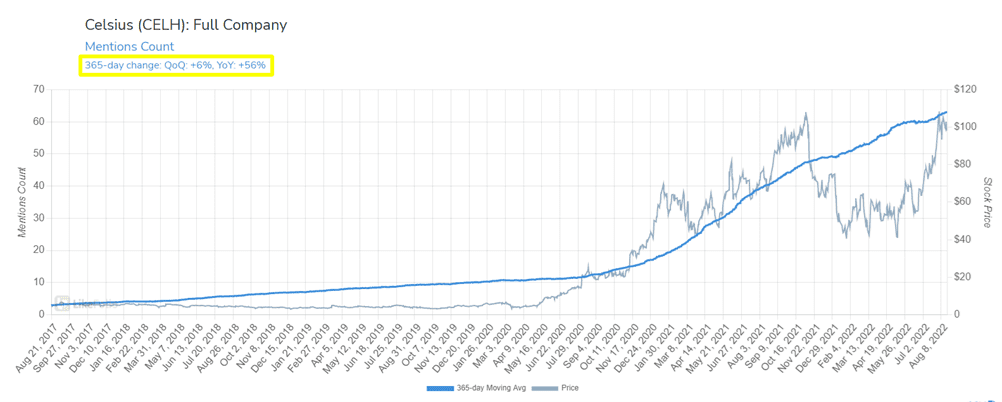

| The ideal chart positioning is the upper right where high levels of happiness meet high demand. As expected, Celsius bubbles up in this region. More on that in a minute. The monster in the room is that Monster PI mentions are down -22% YoY on a 30-day moving average. While Monster has its share of sugar-free and non-carbonated drinks like the rest of the competition, the sugary, carbonated nature of its core products appears to be putting it out of favor. Monster’s hookup with Coke should help but it’ll have to adjust to the consumer trends. The even bigger monster in the room is industry leader Red Bull. The privately held company basically created the energy drink category when it launched in Austria in 1987. Red Bull is still growing nicely. In 2021, it sold 9.8 billion cans, a +24% YoY increase, and posted record sales and profitability. An extensive lineup of globally recognized athletes and sporting events is tough to stack up against. Still, even an incumbent like Red Bull is recognizing the need to get healthier with products like Organics by Red Bull. This leads us to wonder… Are Red Bull and Monster’s brand images already cemented and the opportunity for challengers to capture the healthy alternative reputation available? Yes, and yes! Rockstar is in the same boat as an early market entrant that consumers largely perceive as unhealthy. Pepsi acquired the brand for $3.85 billion in 2020 and has struggled to reinvent it. We can understand why. In its Q2 earnings call, Pepsi’s CFO acknowledged that sugary products are losing ground losing in saying “the non-sugar portfolio is excellent“ and noting that the company is “changing some of the formulas” in reference to Rockstar. Then there’s Coca Cola which has a notoriously low share of the faster-growing non-soda market. It appears late to the party with Coke Energy and Coke Plus Coffee neither of which have found much success. Keurig Dr. Pepper was recently rumored to be buying Bang Energy parent VPX Nutrition. KDP was quick to squash the speculation, but it showed that buzz is still circulating around energy drink takeovers. Monster and Constellation Brands were in merger talks for a long time but that has fizzled. Heck, even beer maker Molson Coors is getting in on the energy drink game with sugar-free ZOA. Co-founder and ‘Chief Energy Officer’ Dwayne “The Rock” Johnson is a social media force to be reckoned with and we are seeing this in ZOA’s happiness data. (Then again, posting something negative related to The Rock is a dangerous move!) This brings us back to Celsius. The brand continues to win over consumers—and hit it out of the park with its financials. 4. We are Still Energized by Celsius! Celsius sells a mix of carbonated and non-carbonated energy drinks with one common denominator—they’re all better for you. With the science to back it, Celsius, Celsius Heat, and Celsius BCAA are proven to accelerate metabolism and burn body fat. The fitness crowd loves it as do we. As frequent taste testers, we can attest that the flavors are amazing! Another testament to how in-tune Celsius is with consumers’ taste buds, is expanding its lineup of Stevia-sweetened drinks, naturally caffeinated with green coffee bean extract. No surprise that mentions of Stevia, coffee extract, and natural ingredients are all up significantly. As the chart below confirms, consumers are enamored with Celsius like never before. As brand awareness has grown over the last few years, so too has the social media buzz. On a long-term basis, Celsius mentions are up +56% YoY and trending at an all-time high. |

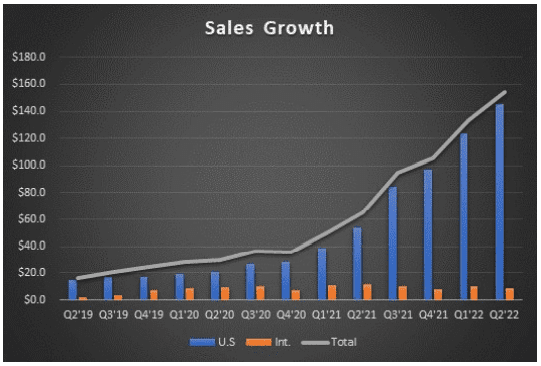

| It’s also not surprising then that Celsius is killing it in the financial department. In Q2, revenue was up 137%—and with 94% of revenue derived from North America, the international expansion opportunity is huge. Wow, the sales growth trajectory below speaks for itself! |

Some of the other stats that have us pumped about the company:

- Nielsen scan data revealed that Celsius sales were up 185% in Q2 crushing the energy category’s 8% growth.

- On Amazon, where the company gets about 10% of its sales:

- Celsius was the 2nd leading energy drink for the 4 weeks ended 7/30/22 (right behind Monster and with a market share that was twice that of Red Bull)

- During Prime Day week, Celsius sold more energy drinks than anyone grabbing nearly 32% of the market

Celsius is now in more than 169,000 stores, 54% more than a year ago. The new distribution agreement with Pepsi should only accelerate the expansion!

It’s also cool to see that 175 BJ’s Warehouse locations were added to the Celsius network in Q2. BJ’s is another name we’re bullish on.

We added Celsius to our coverage in May 2020 and took an immediate liking to it. Back then, consumer demand and happiness looked fantastic, and it still does today!

Our bullish stance has been well founded. CELH traded around $7 a share back then. It just jumped to an all-time high above $110!

A bevy of supportive macro trends has us believing that this bevvy maker has plenty more in the tank.

Our eyes will remain focused on what consumers are saying about Celsius and other players—we’ve got a lot more energy. ⚡