Helen of Troy (HELE): Hydro Flask In August of 2019, […]

Will Helen of Troy Beat Earnings Expectations Again? ($HELE)

Will Helen of Troy Beat Earnings Expectations Again? ($HELE)

Helen of Troy Ltd. ($HELE) is scheduled to report 22Q2 earnings results tomorrow morning before the bell...LikeFolio data suggests a bearish outlook. Helen of Troy markets a variety of different consumer goods under 3 divisions: Health & Home, Housewares, and Beauty.

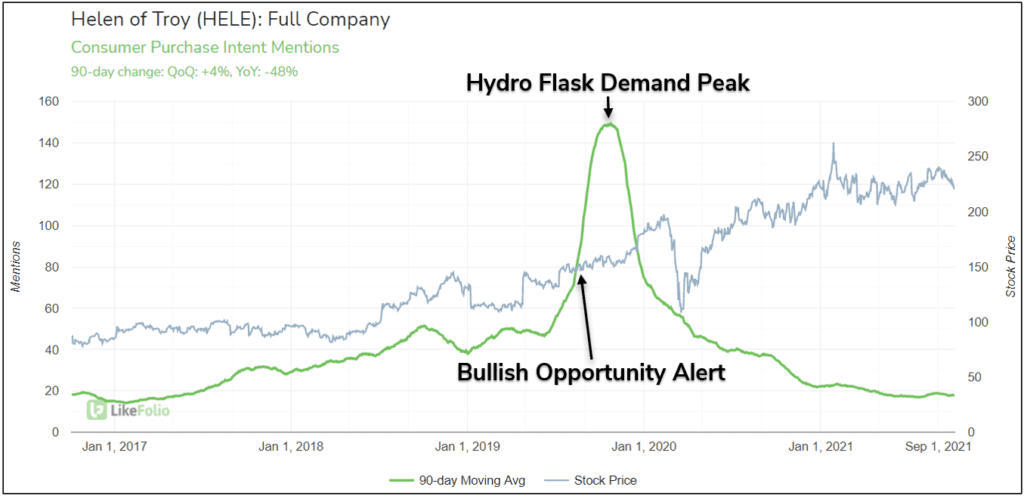

In 2019, we identified a massive surge in underlying Purchase Intent Mentions for HELE, a result of viral popularity gained by the ‘Hydro Flask’ brand (part of the 'Health & Home' Division). Although our bullish alert performed admirably in the following months, Hydro Flask demand has since relaxed and we’re seeing weakness across the entire brand portfolio – HELE Purchase Intent Mentions are trending -48% YoY on a 90-day moving average.

HELE managed to surpass revenue and EPS estimates on its most recent report (21Q1), but there’s was a notable shift in the sales mix.

The Health & Home segment, which still makes up the largest portion of total sales, saw revenues grow +2.1% YoY, accounting for just 17% of operating income. Conversely, Beauty segment revenues grew nearly +80% YoY, accounting for 40% of operating income.

Continued outperformance from the Beauty segment will be critical. But, underlying mentions for the division suggest a near-term slowdown: -16% QoQ (90d MA).