Roku makes streaming devices that allow its customers to stream […]

Will Streaming Ad Spend Rocket Roku?

Will Streaming Ad Spend Rocket Roku?

For Roku, it's all about ad dollars. Last quarter ROKU shares popped after hours. Even though Q1 active account growth slowed (+2.4 million, significantly lower than pandemic-driven growth), revenue soared +79% YoY, driven higher by ad sales. This quarter, many investors have their eyes on Roku's number of active accounts (users who have streamed content over the last 30 days). More streamers mean a higher user base and thus, advertising pool.

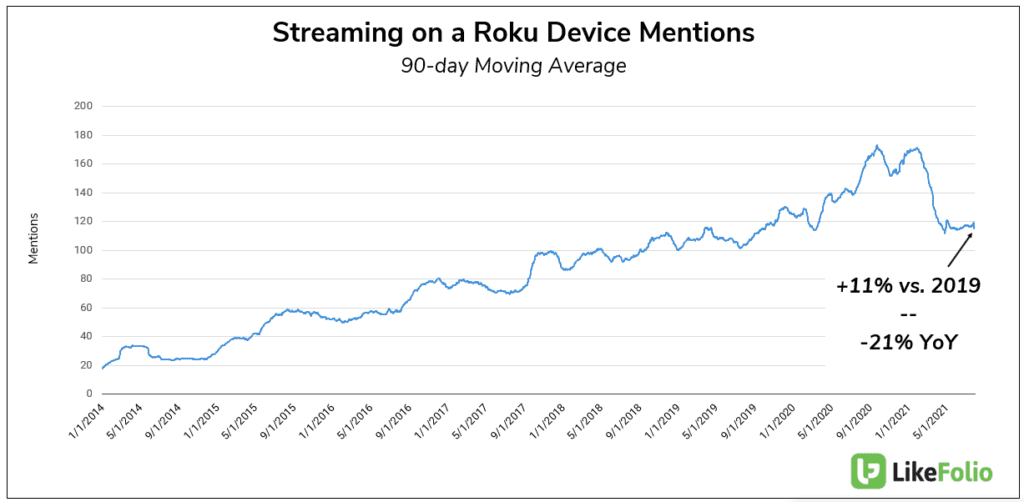

LikeFolio data shows that consumers discussing streaming on a Roku device have increased QoQ and remain +11% higher vs. pre-Covid levels. Another positive sign for potential advertising capture is the growing consumer buzz surrounding the Roku Channel.

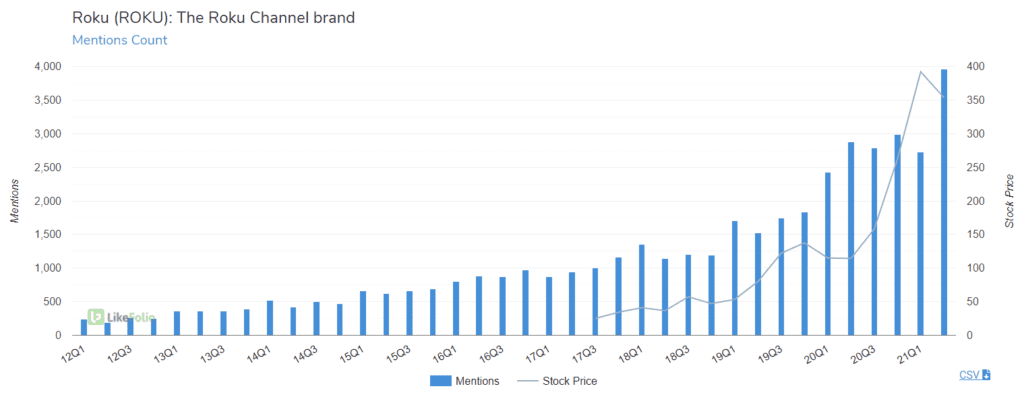

The Roku channel just posted the highest mention volume we've ever recorded, driven higher by its syndicated and original content: +37% YoY, +45% QoQ. Last quarter, the Roku Channel reached ~70 million users, double the amount from a year prior.

We're also monitoring 2 headwinds for Roku moving forward: competition and carriage disputes.

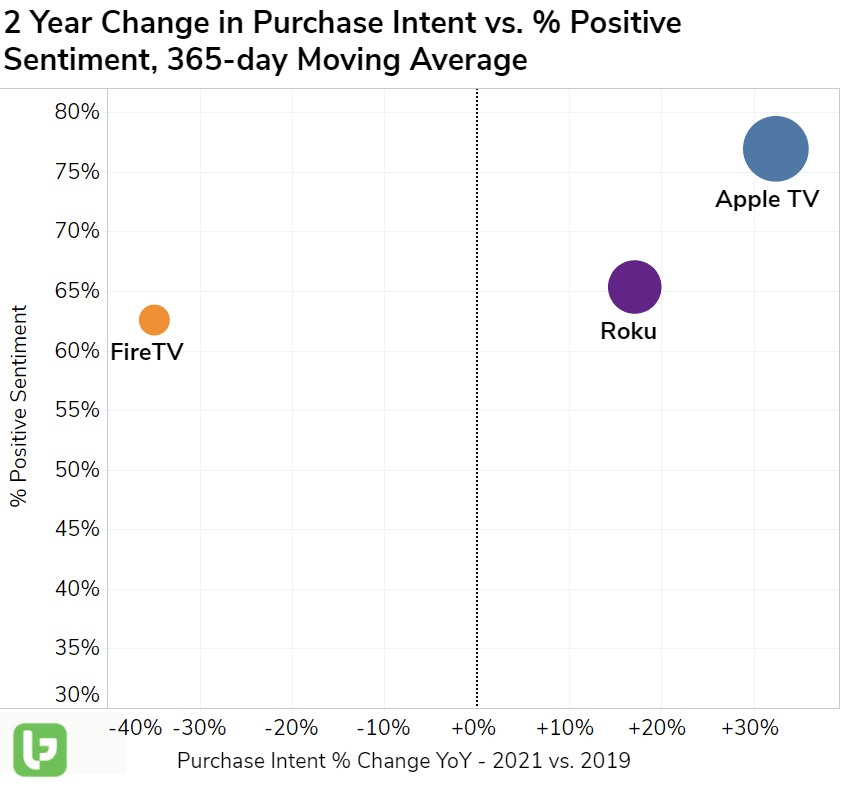

Watch out for competition from Apple TV. While it's tough to separate Apple TV content from device mentions on the brand scatter chart below, the end result is that Apple is receiving a lot of interest from consumers. In contrast, Amazon's FireTV/stick is losing.

Carriage disputes have a big impact on sentiment. When Roku announced it was removing YouTube TV from channel store in a dispute with Google, consumer sentiment for Roku dropped -12 points. Sentiment has since normalized, but qualitative analysis reveals consumers are still frustrated when they can't stream their desired content.

We'll be listening when Roku reports August 4 after the bell to see if the name can continue to capture a growing amount of streaming ad spend.