Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Will Supply Chain Pressures Ding Deep Discount Retailers?

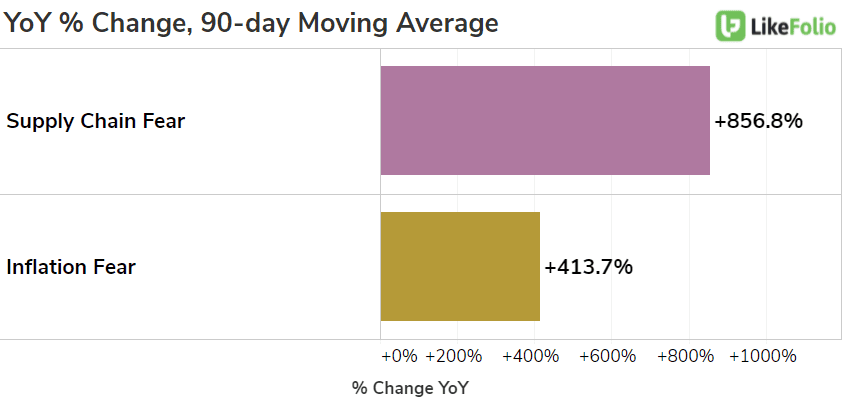

As supply chain pressures mount and inflation fears rise, investors are closely watching the deep discount retail segment.

After all, deep-discount retailers cater to price-sensitive consumers and already balance tight margins. How much can you squeeze out of a $1 price tag alongside increased freight and labor costs? As Dollar Tree recently demonstrated, not enough. The company announced it is increasing its standard price from $1 per item to $1.25, and that so far this has not impacted foot traffic. This move bucks a three-decade-long $1 philosophy, but will allow the company to re-stock products canceled due to increased production and distribution costs. DLTR shares popped on this news, but have since normalized. LikeFolio data did pick up on rising consumer demand for Dollar Tree stores ahead of the company's earnings release last week. Now, three peers are on deck to report: Dollar General (DG), Five Below (FIVE), and Big Lots (BIG). How do they stack up? Take a look...

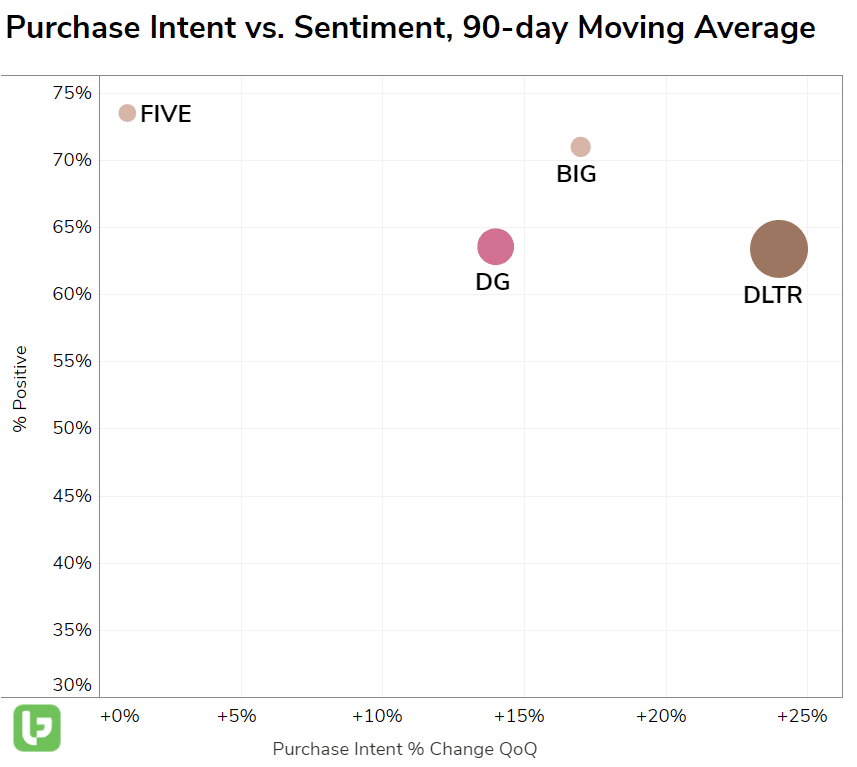

The chart above showcases near-term consumer demand momentum on the x-axis and consumer happiness on the y-axis. Key Takeaways:

- Big Lots demand is gaining steam. Purchase Intent mentions have increased +17% QoQ into the Holiday Season. The company has beefed up its online offerings, increasing available products for purchase by +40% and adding additional payment options including Apple Pay, Google Pay, PayPal, and even PayPal's Buy-Now-Pay-Later service 'Pay in 4.'

- Dollar General demand is building, but not as sharply as Big Lots or Dollar Tree. In addition, DG consumer happiness levels lag peers. Qualitative analysis reveals consumers are happy with Dollar General grocery options, but often times disappointed with the cleanliness and organization of stores. The company has focused recently on expanding its cooler (perishable) food experience, and leveraging DG Pickup and mobile checkout.

- Five Below boasts the happiest consumers, but seasonal growth is lackluster vs. peers. While FIVE did record a strong Black Friday showing (featured earlier this week) this did not factor into the current quarter earnings analysis. FIVE is following a similar path as Dollar Tree in regard to price increases, aiming to buffer profit margins with its expanded $10-and-below section. While Big Lots and Dollar General feature more consumer staples, Five Below is pushing into premium segments like electronics, video games, home furnishings, and even collectibles. Five Below's high level of happiness alongside increased prices demonstrates loyal customers and should be considered.

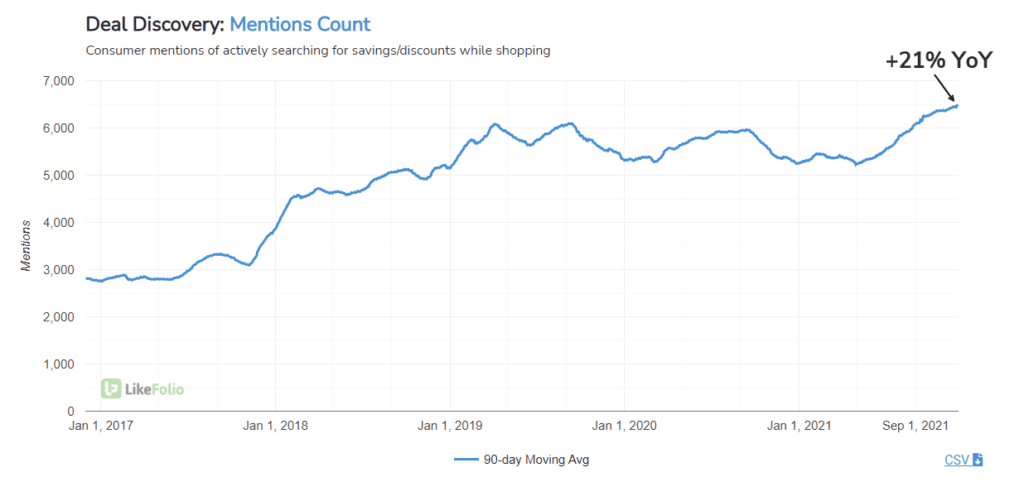

Demand for all of these retailers is being propelled by consumers increasingly seeking deals in a perceived inflationary environment.

Investors will be closely monitoring margins when each name reports. Companies that effectively manage inventory and pricing are likely to be rewarded.