Happy Thanksgiving! Here are some names and markets that the […]

YETI isn’t out of the woods just yet

YETI is having a gangbuster week.

Shares have risen by more than +42% as the company benefits from an overall market rally and a third quarter report that topped revenue expectations.

Revenue growth (+20% YoY) was driven by DTC channel strength as well as international market expansion.

This near-term rally has been a welcomed reprieve for long-term investors. Even with recent gains, YETI shares remain -42% lower YTD.

But LikeFolio data suggests Yeti may not be out of the woods just yet…here’s what we’re watching:

YETI Demand is Slipping in a Critical Holiday Shopping Quarter

To be fair, it is still early in the holiday shopping season.

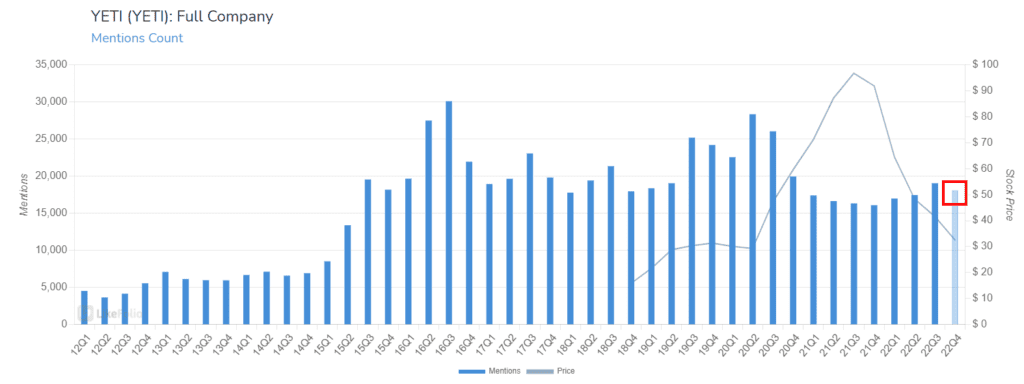

But Yeti’s quarterly mention volume is slipping.

Yeti product buzz grew by +17% YoY in Q3, almost exactly in line with the company’s reported revenue.

But that growth rate has slowed by -5 points in the last month and a half.

Actual purchase intent mentions have dropped by an even steeper clip, currently pacing -11% lower YoY.

The company did caution that a “heightened level of uncertainty” persists across the market.

At LikeFolio, we’re dialed in to see if the company can position itself as a top gift in the upcoming season.

And something caught our attention…

Stanley Outdoor’s YETI Alternative is Flying off Shelves

While YETI may be the most well-known tumbler around, it certainly wasn’t the first.

The original Stanley bottle design was invented more than a century ago to keep drinks hot and was marketed to campers and adventurers.

But recently, this target audience has shifted to one of the most powerful demographics in our universe: Suburban moms.

How did Stanley expand its core audience from rugged camper to the mom next door?

You can read a full thread here…it’s a fascinating story:

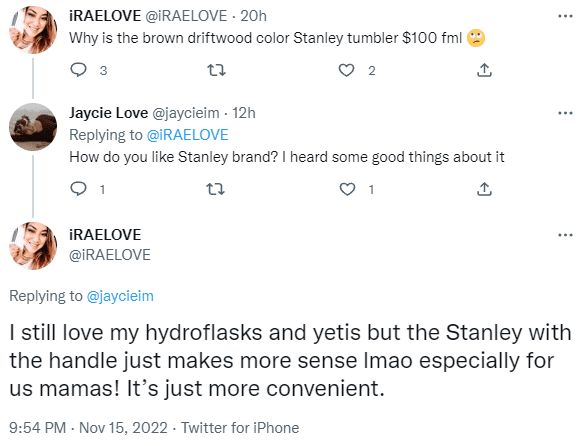

| The cliff notes version: a group of ladies discovered how convenient, portable, and stylish the Stanley tumbler’s design was…and that it functioned better than more “trendy” peers like Yeti and Hydroflask. |

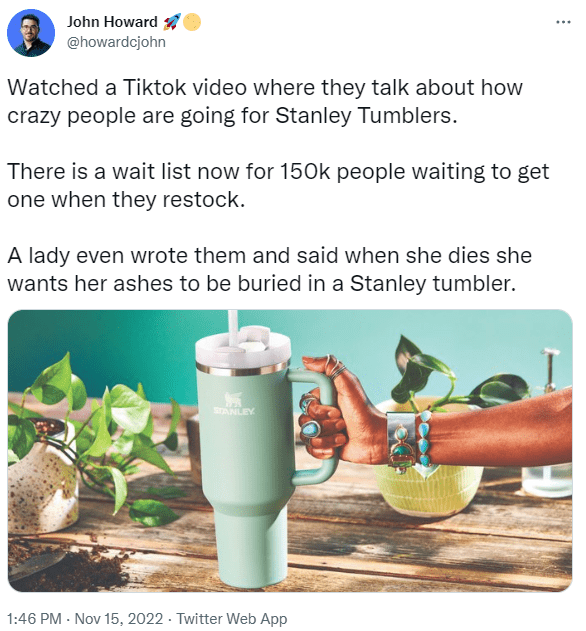

The Stanley brand went viral.

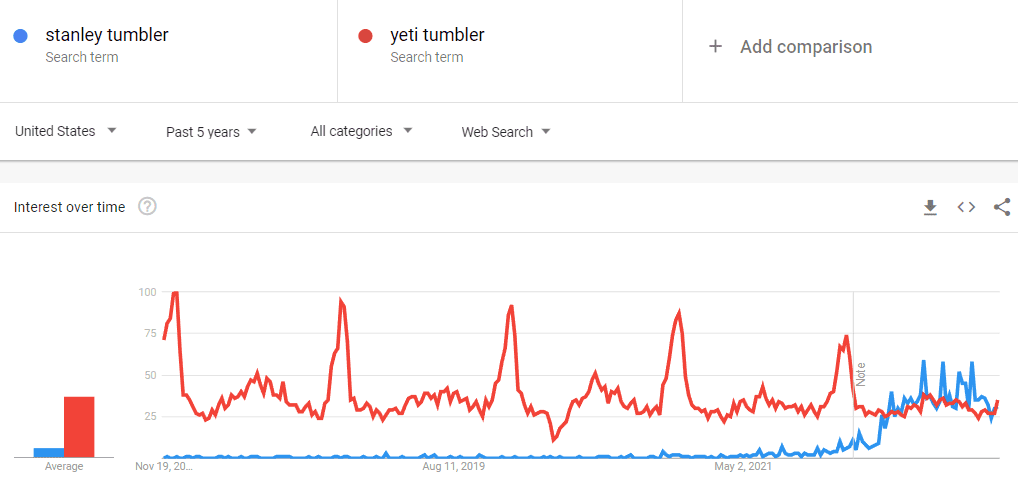

And you can see the potential implications for Yeti in Google Trend results…

The main point: although YETI has been the consumer bevvy holder of choice over the last few years, this isn’t a given moving forward.

It’s important to watch out for major disruptors with the potential to steal market share, as Stanley appears to be doing.

So what does this mean for YETI moving forward?

Keep an eye on YETI Sentiment and Holiday Demand

Luckily for Yeti, it has more products in its arsenal than drink tumblers.

But expectations have been reset higher after its last report.

This Holiday season will be a critical proof point.

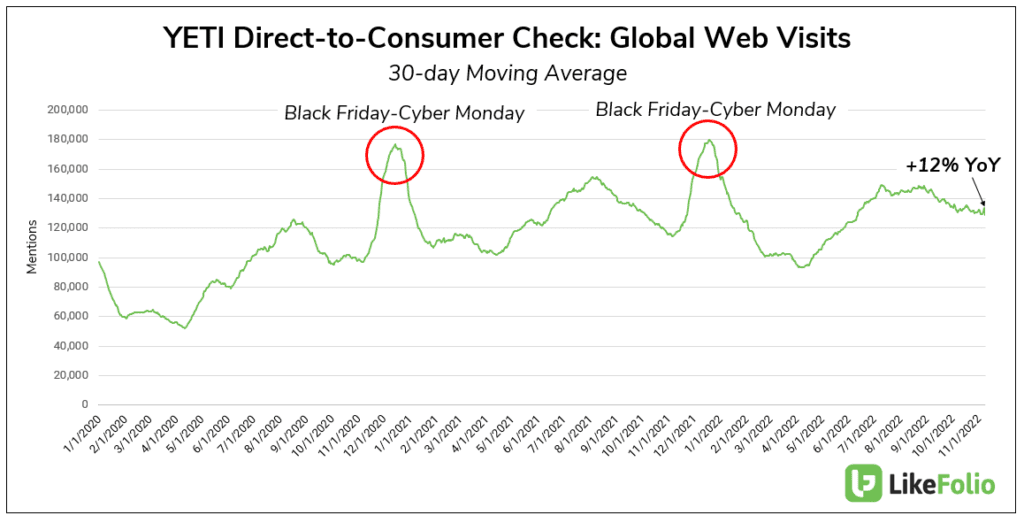

We’re tracking DTC performance closely via the company’s global web visits to Yeti.com.

You can see the largest weekend of the year is Black Friday through Cyber Monday (circled in red on the chart below)…which is just around the corner.

| Yeti also boasts high levels of consumer happiness, currently registering 79% positive. Any changes in this (positive or negative) will be a longer-term indicator of future purchases and overall brand health. Stay tuned to see how this develops in the coming weeks…there could be a surprise brewing. |