Trend Watch -- Looking Ahead We knew this day would […]

Zoom – The Challenges Still Remain

Zoom stock was a darling of the pandemic…

With people stuck at home, Zoom video calls became the go-to product for businesses globally.

Investors, as they do, caught onto the trend very quickly, and the stock hit a high of $588 in October 2020.

Since then, it’s been almost all downhill, and Zoom is now -73% from its 52-week high, trading around the $109 mark.

So why such a significant fall?

The reasons, of course, can be found in the data…

Purchase Intent for Zoom has been declining since June 2020 and based on a 90-day moving average, growth is still decelerating at Zoom +13% QoQ and -53% YoY.

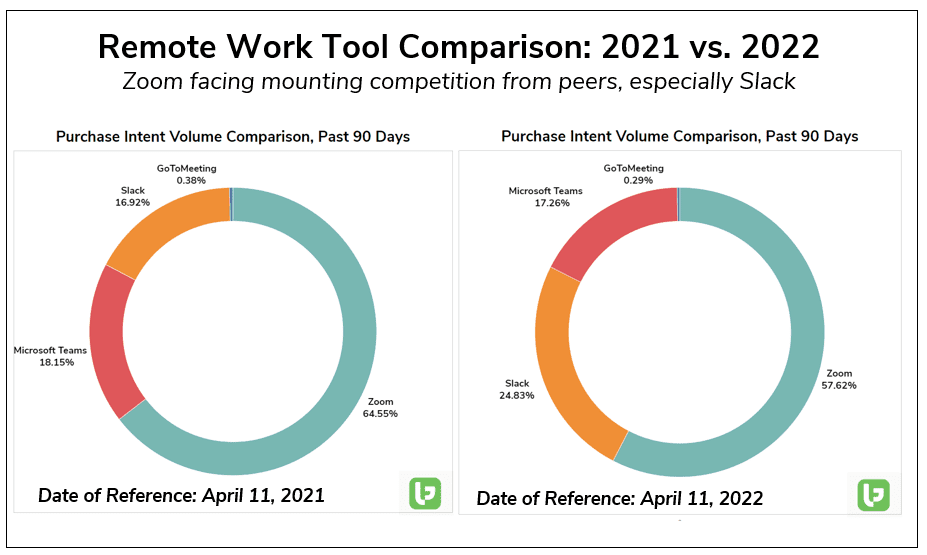

However, Zoom still holds the majority of market share compared to other remote work tool competitors:

But Slack especially seems to be a growing threat to Zoom... Just look at that Purchase Intent Volume growth that Slack has put up in the past year.

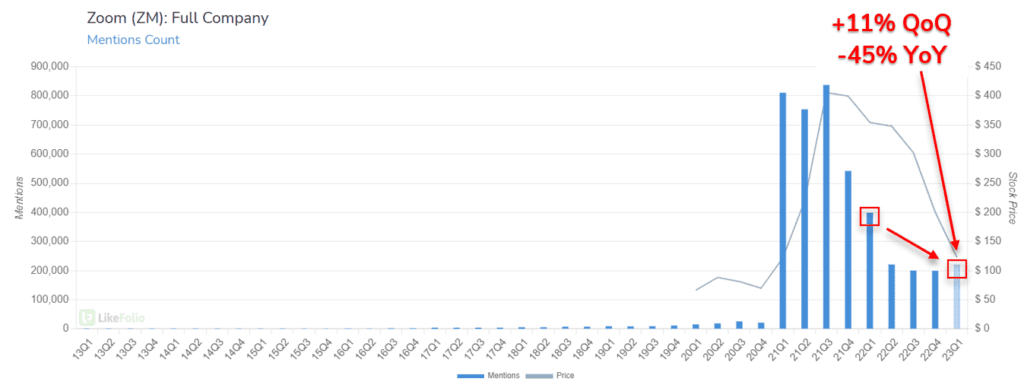

In addition, Overall Mentions have not performed any more favorably for ZM:

Zoom's Mentions Count is currently pacing at +11% QoQ and -45% YoY.

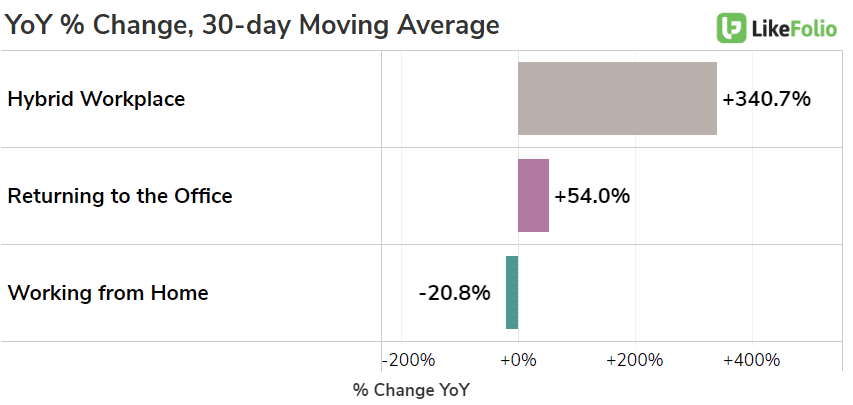

To add salt to the already open Zoom wounds, current work trends are also not helping its cause…

Working from Home has hit a post-covid low: -21% YoY...

However, the need for remote working tools hasn't dissipated completely. These metrics remain much higher vs. pre-pandemic levels…

WFH mentions are currently down -59% vs. 2019, while the Returning to Office trend has increased +67% vs. 2019.

Bottom Line: Zoom benefited from the pandemic, setting record highs. But its revenue growth is poised to slow as consumers resume travel and return to the office.

The company is facing tough comparables, but it has done a great job attracting and expanding its enterprise users, which is key considering the hybrid work model is sticking around.