Trend Watch -- Looking Ahead We knew this day would […]

Zoom (ZM) Growth is Strong but Moderating

Zoom (ZM) Growth is Strong but Moderating

ZM has some tough comps looming in 2021.

Last quarter, Zoom revenue increased +367% YoY. This was a steeper growth rate vs. Q2 and Q1. Shares fell ~5% after hours when company acknowledged this growth rate wasn't sustainable. The company projected revenue to increase between 328%-331% in Q4.

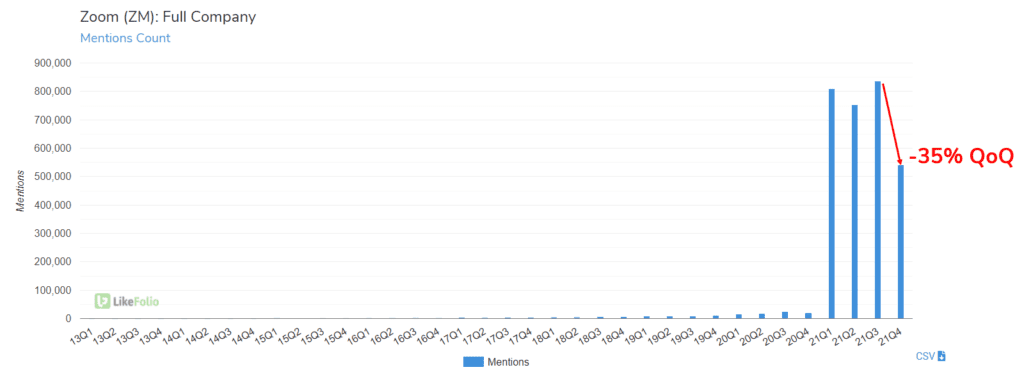

LikeFolio data confirms moderation in Q4. Purchase Intent (mentions of downloading or using the video conferencing software) fell 33% QoQ. Total mention volume fell at an even steeper cliff, visible on the chart below. Note, this YoY growth rate is nearly off the chart.

Zoom plans to expand its service offerings in 2021 by focusing on email and calendar enhancements and improving workflow integrations. This places the company in more direct competition with services like Microsoft Teams.

In the last year, Zoom outperformed Microsoft Teams in regard to new user adoption and sentiment. Zoom Purchase Intent mention volume increased by more than 1,000% YoY vs. Microsoft Teams volume growth of +295% YoY. Zoom Consumer Happiness sits 4 points higher than its Microsoft peer.

One potential blind spot in our data is International Growth. Last quarter, this growth outpaced U.S. growth: +629% YoY.