Rivian is an American automaker specializing in electric vehicle production. Today, […]

3 Reasons to Pay Attention to Rivian ($RIVN)

There was a time when Rivian Motors was one of the most valuable auto-makers in the world. The Company, which IPO’d last fall, was backed by Amazon and Ford and had an unreal start post-IPO with an almost parabolic price chart.

But since then, the stock price seems to have come back down-to-earth a bit... But does that really matter?

No, and I’ll show you 3 reasons why that is.

In a regulatory filing last week, the company blamed Russia/Ukraine on its supply chain woes, along with pandemic issues, stating “disruptions and delays” are affecting operations.

But mentions are absolutely surging.

1. Consumer Mentions of Rivian are up +143% YoY, on a 90-day moving average.

And contrary to what you might read or think, electric vehicle demand is not at all slowing down.

2. Consumer Mentions of purchasing an Electric Vehicle have risen +187% YoY, on a 90-day moving average.

Just look at that upward trajectory...

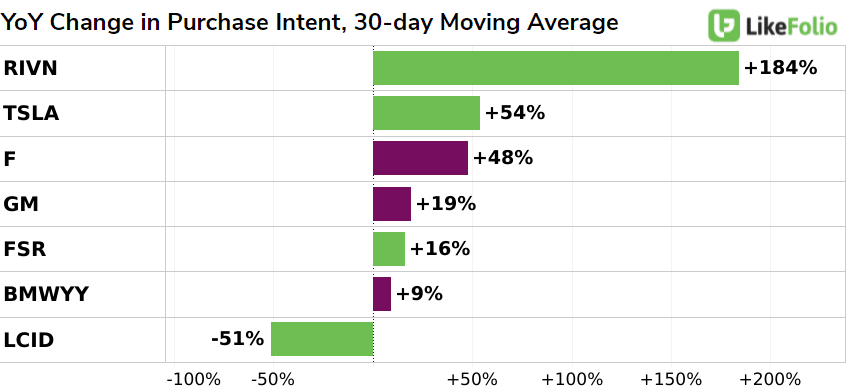

3. Rivian's demand is outperforming other competitors in the electric vehicle space.

RIVN Purchase Intent Mentions are trending +184% YoY (30-day MA). Taking a 130% lead in demand over Tesla.

The company's lock-up expiration is May 9th.

This is the end of their 180-day lock-up date, and it’s important to pay attention. On May 9th, insiders are free to sell their shares should they want to.

Now there’s nothing to say that insiders will sell...but if we don’t see some of their major insiders, like Ford and Amazon bail on their positions, that can be seen as a vote of confidence in the company. Even on these new lows.