3 Small-Cap Names on our Watchlist

Know your strengths.

Wise advice and also applicable to trading.

Now that LikeFolio has a few seasons under its belt, our team has a good sense of where our data shines.

We’ve discovered LikeFolio’s consumer insights generate a significant edge with small-cap, lesser-known companies that are gaining serious momentum with consumers.

When we pair this momentum with consumer macro trends, it makes spotting an earnings surprise even more likely.

This week we tapped into our long-term signal to identify potential surprises looming on the horizon.

Three names caught our attention, especially considering relative weakness when it comes to stock performance.

Here are the common characteristics for each name:

- Small-cap stock trading under $10

- Long-term LikeFolio score of 50+ (top 5% of all companies in our universe)

- Surprising demand growth

Two of these companies won’t report earnings for another month. But one is on deck next week. Here’s what we’re watching…

Trivago (TRVG) – Long-term Score: +50

Trivago is a travel aggregator that allows consumers to compare costs for listings from hotels, resorts and even other online travel companies to find the best deal.

Demand and Mention Buzz are heading higher in 2023 as consumers continue to prioritize travel and experience but ALSO want to find the best deal.

The company is leaning into its deal-finding value proposition, as evident in its most recent letter to shareholders, “…in the second half of the year, we started to see first signs that travelers around the world are trying to mitigate the impact of higher hotel rates by comparing different hotel offers or searching for cheaper destinations. In this environment, we believe that the value of metasearch has increased, and we have shifted our focus to innovation in our core product and plan to improve transparency of our offering and price comparison functionality.”

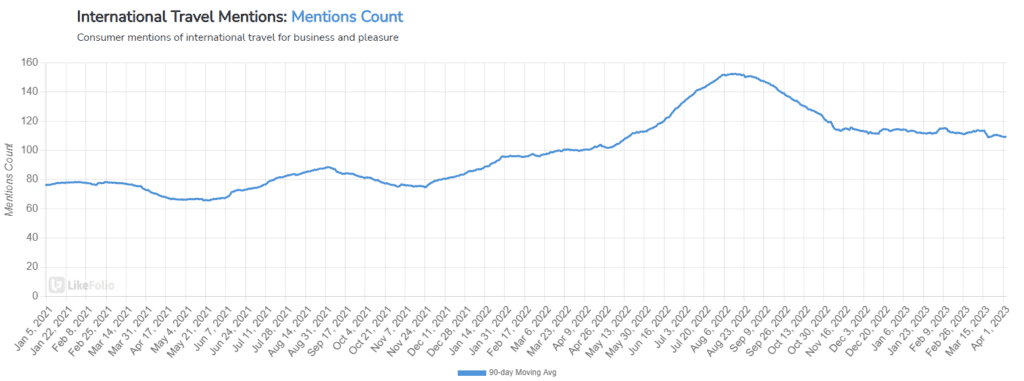

Macro data suggests elevated interest in global travel (+10% YoY) serves as a tailwind for Trivago, which serves the European market and Brazil.

As consumer metrics improve, TRVG is trading near multi-year lows. With diminished expectations, a surprise may be brewing.

Eventbrite (EB) – Long-term Score: +50

Eventbrite, an event-management platform most well-known for locally grown entertainment, has already proven it can outperform.

Last quarter the company posted Q4 earnings featuring higher than expected top-line growth (+20% YoY) and improved guidance, sending shares +12% higher.

LikeFolio data shows that not only did the company maintain this momentum, but demand growth has accelerated since then.

Consumer demand in 23Q1 which just ended on March 31 rose by +42% YoY. For reference, the company’s Q4 earnings surprise featured demand +39% higher YoY.

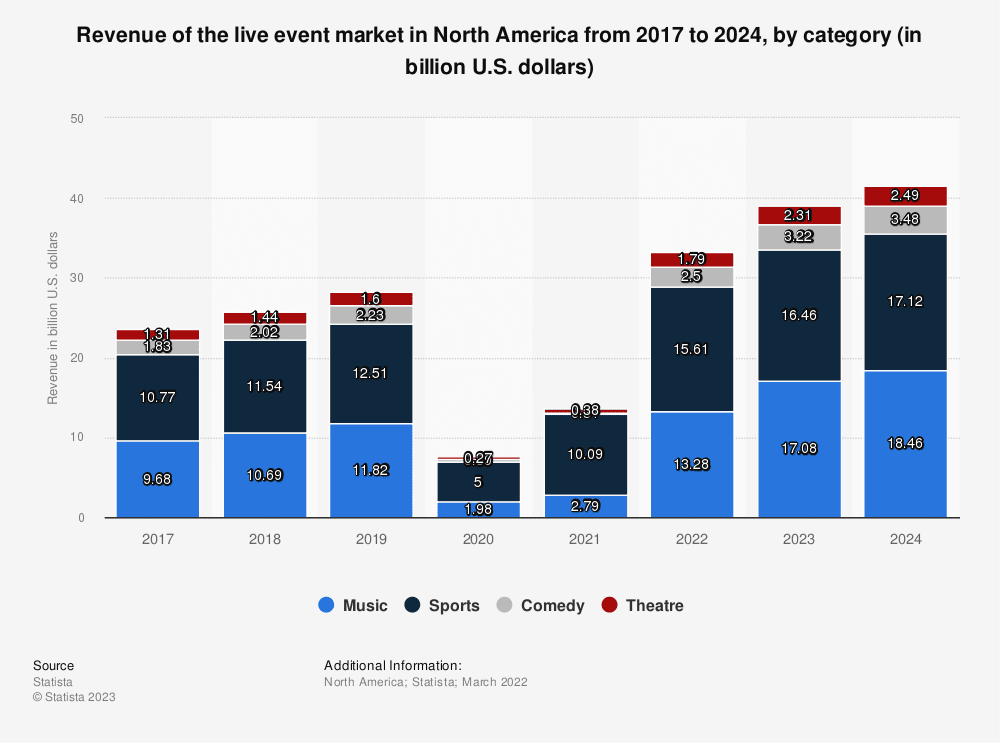

Consumer demand for live events continues to grow in 2023, despite economic headwinds and revenue is expected to increase across all core categories through 2024.

Despite a positive market reaction following its last report, EB shares are trading nearly -40% lower than they were a year ago. Strong consumer data supports a Bullish outlook from here.

Sportsman’s Warehouse (SPWH) – Long-term Score: +55, Earnings Score: Neutral

Sportsman’s Warehouse specializes in all things you may do outside, perhaps on a farm.

We’re talking hunting, shooting, fishing, camping, boating, and just about any other hobby you can imagine that would make a city slicker flinch.

Purchase Intent mentions have increased by nearly +80% on a YoY basis as consumers continue to prioritize their outdoor hobbies.

Last quarter, SPWH shares plunged initially following the company’s Q4 earnings report due to soft guidance and lower than expected demand for firearms coming out of the pandemic.

Looking ahead, the company is focused on expanding its footprint: “As we look ahead, our funnel of real estate remains robust and we are moving with discipline and rigor to accelerate the growth of our store footprint. Our funnel as we sit here today is well over 100 locations and we see a path to our target of 190 to 210 total stores in the fleet by the end of fiscal 2025.”

This growing footprint is helping to expand SPWH’s consumer base and drive demand higher but does increase costs.

In addition, near-term dips in consumer happiness – some of which is politically motivated – give us some pause. But demand growth long-term suggests the bar may be low enough for an earnings surprise.

SPWH reports earnings April 12 after the bell.