Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

5 Stocks to Watch This Week

May 31, 2022

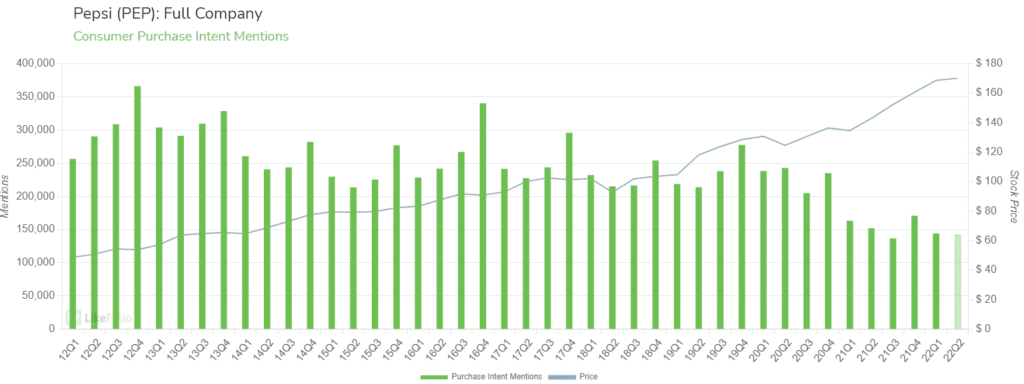

| Here are some key stats and data points on stocks we’re watching in this shortened trading week: PepsiCo/Coca-Cola (PEP/KO) |

- Both PepsiCo and Coca-Cola are in focus this week with an interesting divergence developing between the two for both Overall Mentions and Purchase Intent.

- Consumer Purchase Intent for PepsiCo is declining. 22Q2 demand is set to close at -1% QoQ and -6% YoY.

- On the flip side, Coca-Cola demand is pacing +17% QoQ and +11% YoY.

- With PEP stock rising just under 6% in the last week, is it time for a turnaround? Or will Coca-Cola demand begin to decline as well?

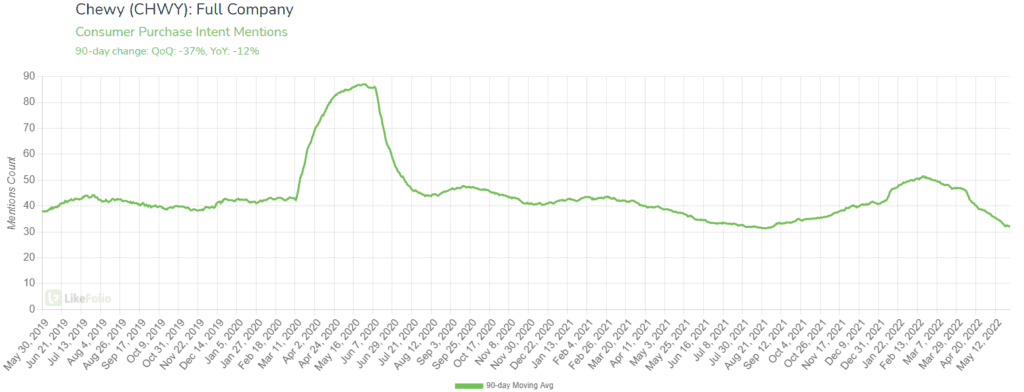

Chewy (CHWY)

- The pet product eCommerce company Chewy will report earnings after the close on Wednesday, June 1st.

- While the company has a strong business model that previously resulted in strong demand growth, we see demand slow with Purchase Intent Mentions pacing -37% QoQ and -12% YoY.

- Overall Mentions are also declining at -17% QoQ and -3% YoY.

- The key point here is that many eCommerce companies are now experiencing a demand dip now that the pandemic is behind us.

Lululemon (LULU)

- Lululemon will post earnings data for the latest quarter aftermarket Thursday, June 2nd.

- Despite recent positives for the company, metrics are relatively flat with Purchase Intent at +5% YoY and not yet fully recovering from the pandemic slump.

- Lululemon’s share price is down almost 25% in 2022, despite good results and Morgan Stanley recently saying the company is trading at a discount.

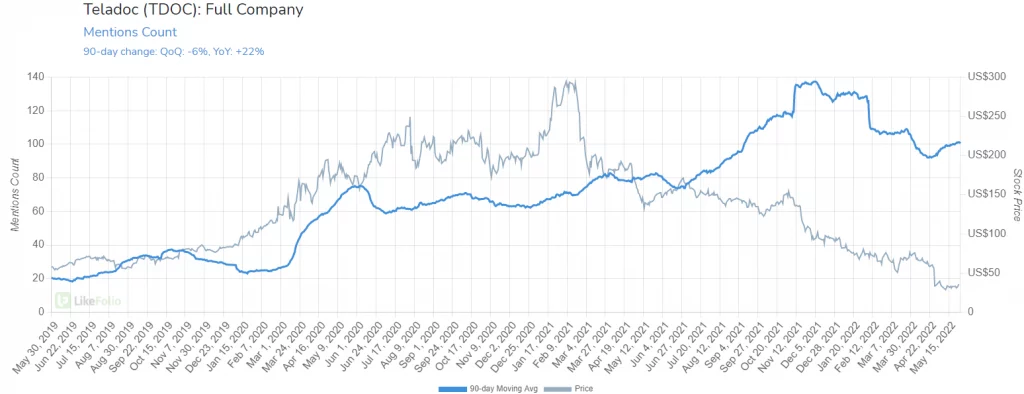

| Teladoc (TDOC) |

- Teladoc makes for interesting reading this week

- The company’s stock recently plummeted 40% after disastrous Q1 earnings in which it reported a net loss per share of $41.58, driven by a non-cash goodwill impairment charge of $6.6 billion.

- However, revenue increased by 25%. Teladoc Purchase Intent, while falling from recent highs, is trending +24% YoY, and Consumer Buzz is at +22% YoY.

- With the stock down 61% in 2022, is it now providing an attractive risk-reward?