Twitter shares are on track for the largest single-day gain in company […]

5 Stocks to Watch This Week (FDX, NKE, TSLA, SKX, MAT)

December 19, 2022

Here are some names that are poppin' in the LikeFolio universe this week:

FedEx (FDX)

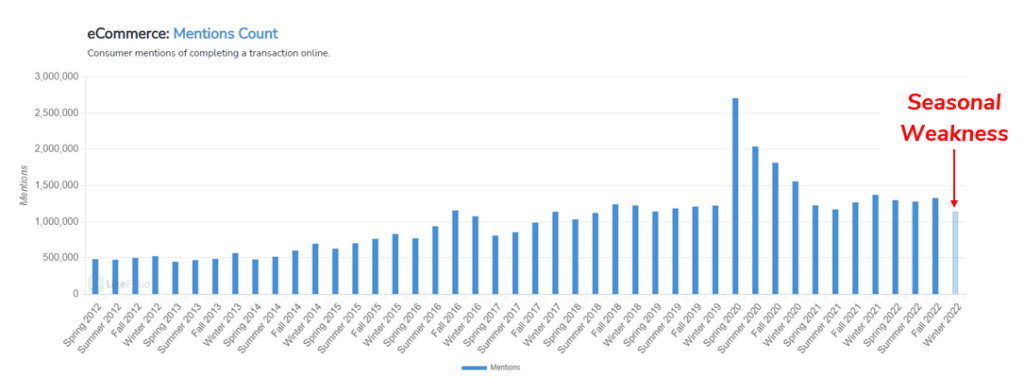

- FedEx is facing an uphill battle in the 2023 holiday season. Online shopping habits are dropping in the month of December (-17% YoY) as many consumers opt for in-person shopping outings instead (+3% YoY).

- This consumer behavior shift is impacting FDX more than UPS, according to LikeFolio data. FedEx demand has slipped -46% YoY compared to -9% for UPS. In addition, the consumer happiness gap remains wide between the top carriers, with UPS boasting sentiment levels +14 points above that of FDX.

- FDX web data also displays seasonal weakness. Global page views (think of consumers going to FedEx to print out shipping labels or check on the status of a package) have dropped -8% YoY on a 90-day Moving Average. This drop is more severe in the last month, with page views slipping -24% YoY in December.

- Last quarter FDX shares sank -21% following the company’s report featuring global softness. The company also announced cost-cutting measures, including closing 90 offices, five corporate locations, and deferring hiring.

- LikeFolio data shows the pandemic “unwind” is continuing in the current quarter. While we can’t quantify how effective cost-cutting measures prove to be, consumer demand weakness supports a bearish lean into earnings.

Nike (NKE)

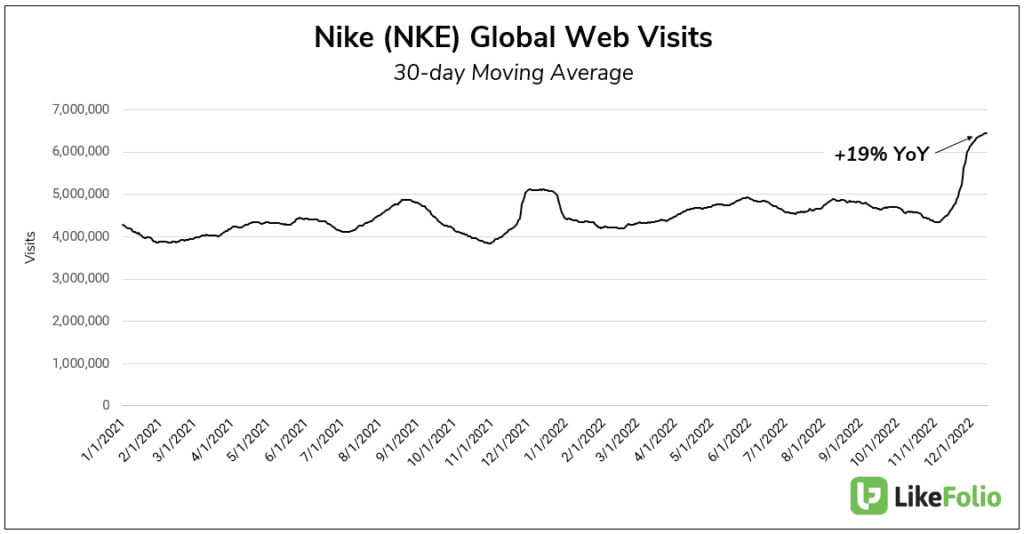

- Nike DTC activity is picking up in December as the company builds on a strong showing in 2021. Global web visits are up +19% YoY.

- Top gift mentions include Air Jordan 1’s and Air Max. Jordan brand demand grew +14% YoY in the second quarter and Air Max demand is gaining steam in the near term, currently pacing +10% higher YoY.

- Last quarter Nike beat revenue estimates with $12.69 billion in sales. However, profits slipped as inventory and supply chain issues weighed on its balance sheet, sending shares lower.

- Heading into earnings, we are neutral with a slightly positive lean. North American demand and DTC channels look strong, but it remains to be seen if the company has rectified inventory problems and weakness in China.

Tesla (TSLA)

- $TSLA cashtag chatter is spiking following expectations that Elon Musk will step down as CEO of Twitter. Investor mentions have spiked +103% in the last week vs. volume recorded in the prior month as investors rally around the prospects of a “focused” Musk.

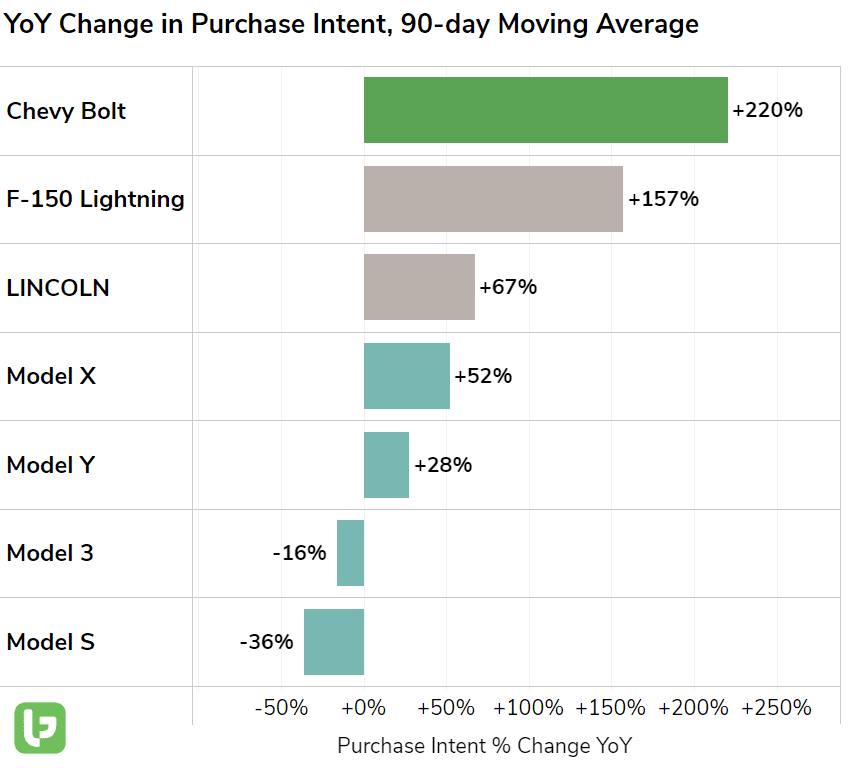

- Electric vehicle demand remains elevated (+87% YoY) even as gas prices fall. Regulatory changes incentivizing EV ownership alongside price and performance parity have helped to drive EV saturation in the U.S. higher, reaching 6.7% in the first half of 2022 vs. 1.8% in 2019.

- Tesla demand growth is tempering in the fourth quarter. The current growth pace stands at +10% YoY. This is a slow-down vs. +14% YoY in Q3 and +30% in Q2. Brand analysis shows that weakness in forward-looking Model 3 and S demand is driving this weakness.

- TSLA earnings aren’t expected until January, LikeFolio’s current score is neutral: +12. While TSLA remains the market share leader in electric vehicles, we’ll be monitoring the rise of competent competition, namely from Ford and GM EV offerings.

Skechers (SKX)

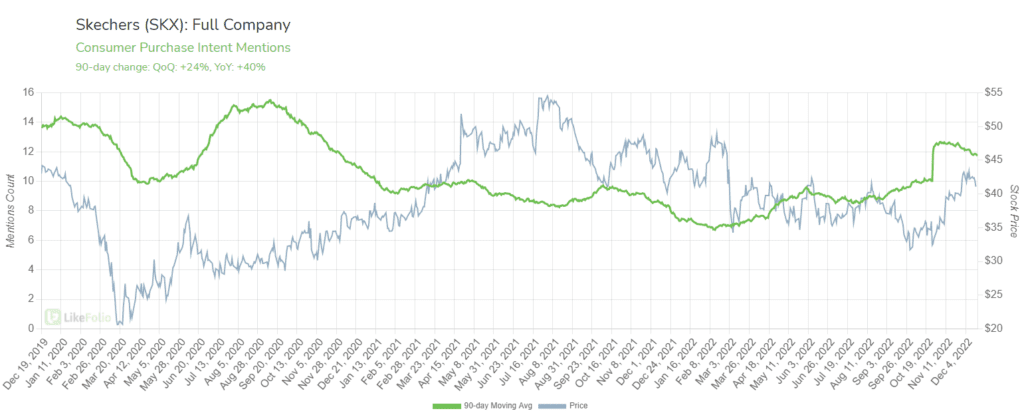

- Is Skechers poised for a comeback? Demand momentum suggests that SKX could be well-positioned for growth in 2023 thanks to its focus on improving the omnichannel experience for customers and expanding its international footprint.

- Skechers Purchase Intent mentions have increased +24% QoQ and +40% YoY, boosted by the brand’s successful alignment with the hottest new sport, pickleball (we touched on this in September, well before the stock’s rally), and current footwear trends. Mentions of Comfortable Work Shoes and Retro Shoes are both up +20% YoY, respectively.

- Skechers doesn’t report until early February, but LikeFolio’s current earnings score suggests continued upside with a current score of +23.

Mattel (MAT)

- Divergence is forming in Mattel as demand grows and the stock falls. MAT purchase intent has increased +23% on a YoY basis, driven by renewed consumer interest in classic brands including Barbie and Fisher-Price.

- The live-action Barbie movie trailer was released at the end of last week (Dec. 16). Since then, Barbie fans, younger and older have taken to social media to express excitement for the film starring a nostalgic childhood toy for many – and this has translated to Purchases this holiday season.

- We featured Mattel in our August MegaTrends report – a forward-looking snapshot of companies with high-brand value. In 2023, Mattel will assume the licensing rights for Disney Princess and Frozen franchises from Hasbro after winning the deal back earlier this year. MAT lost these rights to Hasbro in 2016, a positive tailwind for future growth.

- The bar is low. Last quarter Mattel cut its annual profit forecast and noted it would increase promotions in the Holiday season due to the impact of inflation on consumer spending. We’ll be monitoring for near-term implications through the end of this month, but current demand levels may be setting up for a positive surprise.