IMPORTANT NOTE: This is a recap of purely PUBLIC predictions. […]

Macy's Earnings: To play or not to play?

Macy's reports earnings on August 15th. The stock has run from $17 to nearly $42 since late 2017. Is there more in the tank, or is the stock ready for a breather?

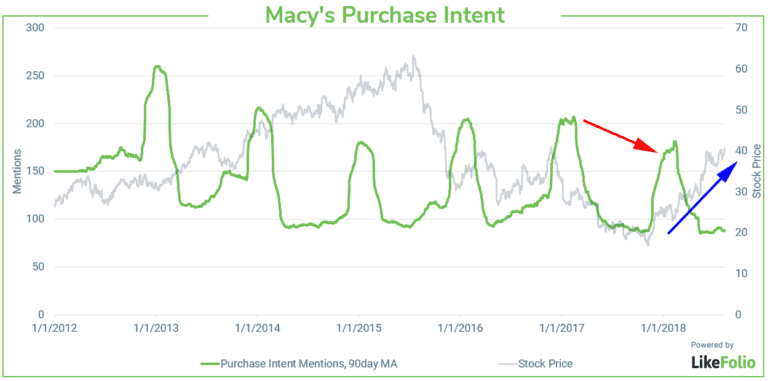

To find out, let's dig into Likefolio Purchase Intent data for Macy's:

As you can see, purchase intent mentions for Macy's have been in decline over the past year (red arrow), while the stock has rallied over 120% (blue line).

Normally we would view this as a divergence opportunity, but in this

- The 2nd quarter is probably the least important quarter for Macy's, which is an extremely cyclical business

- Quite frankly, this is one of the companies on our coverage list that our data is the least predictive for. We're more interested in investigating and fixing that than in trading it.

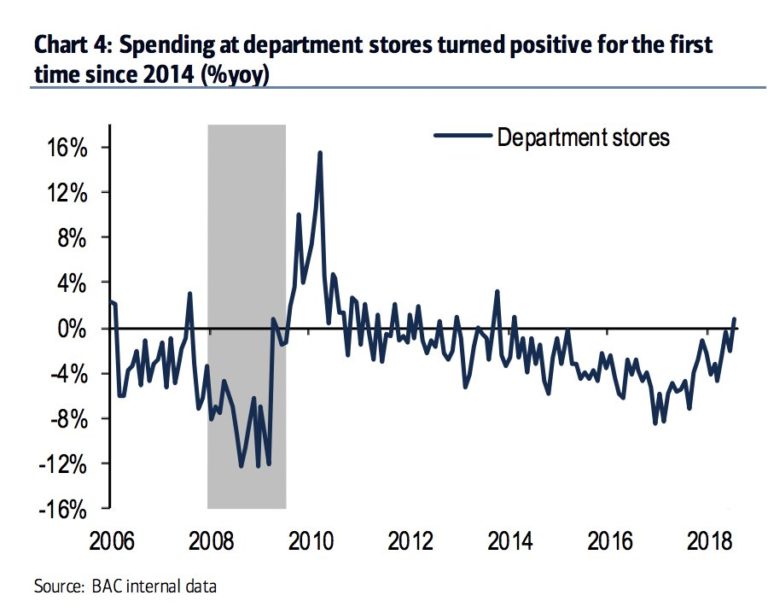

- Michelle Meyer of BofA Merrill just put out a note that spending at department stores turned positive (YoY) for the first time since 2014, which is going to give retailers like Macy's a tailwind.

Putting our neck out there

If we absolutely positively HAD to guess what will happen with Macy's earnings report tonight, we would say the following: Macy's revenue and sales either in-line or a slight beat, but with some acknowledgement of headwinds heading into the next quarter.

If we had to play the stock, we'd be slightly bearish, only because expectations are so high for this name after being one of only a handful of retailers not to selloff after the prior quarter earnings reports.

But trading stocks isn't about swinging at every pitch. It's about making money. That's why Macy's won't be going out as an Opportunity Alert today to LikeFolio members. There are plenty of better trades to be had, especially in the next couple of weeks of retail earnings reports.... and we'll be ready to make them!

You can watch our founder discuss Macy's on the TD Ameritrade Network.