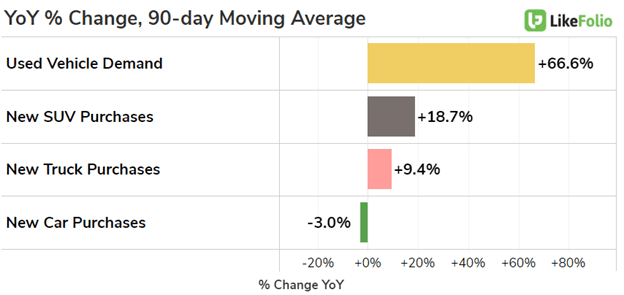

Used-Vehicle Demand is Surging A worsening chip shortage and corresponding production drop are expected to […]

Are CarMax Earnings an Early Sign? ($KMX)

The used car market in the last few years, like the housing market, has been on fire. Demand for used cars has increased significantly due to lasting supply chain issues.

The main culprit: the global chip shortage.

The chip shortage is causing a slow-down in the production of new cars, which has driven the secondary market higher. Companies like CarMax and Carvana both benefited from this.

But earlier this week CarMax earnings were less than great.

They reported earnings on Tuesday at $0.98 cents per share, while Wall Street expectations were at $1.27 a share... Needless to say, that was all it took for the stock to trade lower.

Now could this be an early warning sign for other companies as well? Or is the data still supporting the used car market?

Let’s dive in.

CarMax Purchase Intent Mentions have increased +36% YoY on a 90-day moving average.

That’s still extremely strong despite the stock selling off a bit.

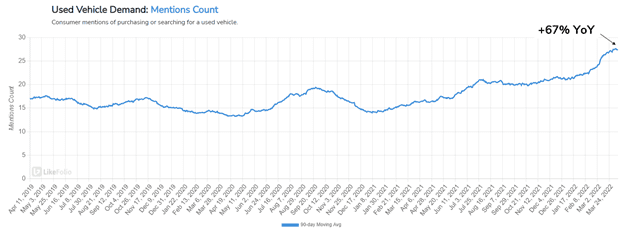

Now, let’s look into used vehicle demand data as well.

Mentions for Purchasing or Searching for a Used Vehicle are +67% YoY.

That is still extremely strong, so that could also be a good sign for Carvana, which reports earnings at the beginning of May.

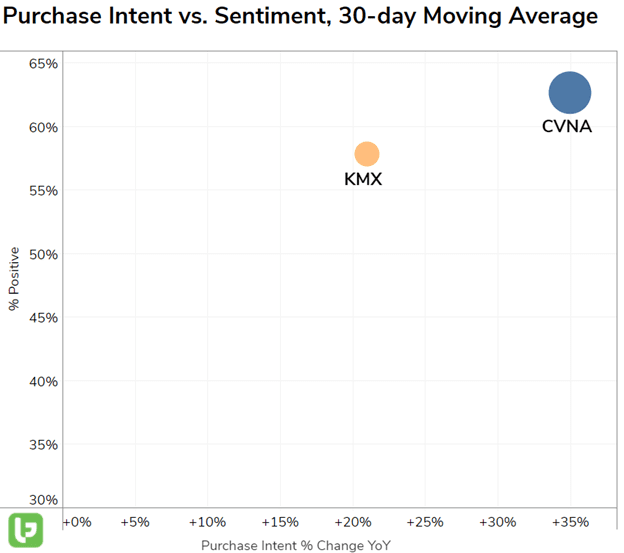

In fact, Carvana has a slight edge vs. KMX right now in demand growth AND overall happiness levels.

But there is one more set of data I want to bring to your attention.

The bottom line is that KMX missed expectations, yes...

But the data still shows no signs of used car demand slowing anytime soon. Buckle up.