LikeFolio's Consumer Happiness data on Papa John's has been incredible […]

Are we Bullish on Pizza (DPZ)?

If we've learned anything over the last few weeks, it's that stocks trading high can always go higher.

So where does this mantra place us ahead of DPZ earnings as its stock trades nearly +50% higher than it was a year ago?

On the cautiously bullish side of the fence. Look at these charts and you'll see why….

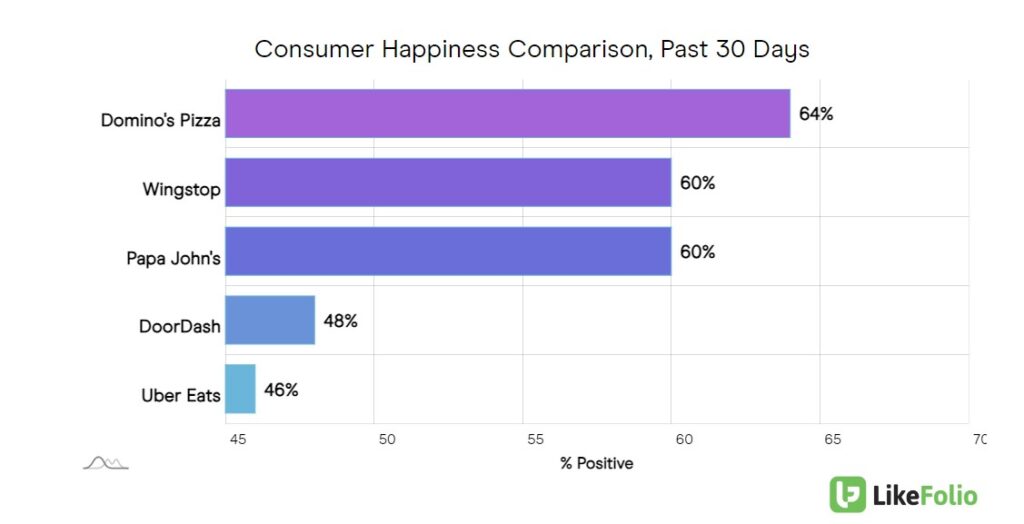

- DPZ happiness sits at 64% positive -- 4 points higher vs. Papa John's and Wingstop.

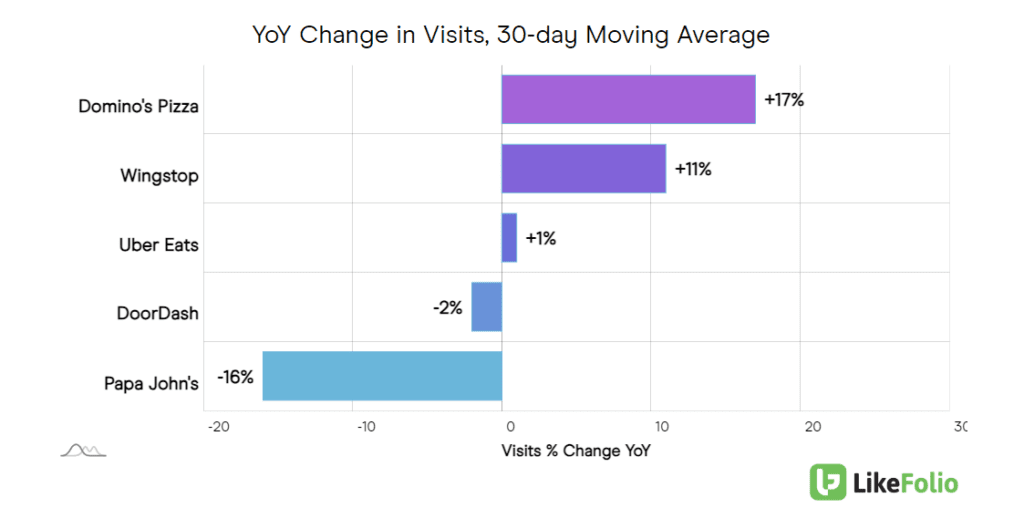

- DPZ web visits are also rising at the fastest rate: +17% YoY.

These charts are especially powerful because they give us an excellent point of reference: DASH, WING, and UBER all reported earlier this month.

- DoorDash (DASH) shares fell nearly -10%following its report that featured more customers but wider losses than the market expected driven by high labor costs.

- Uber (UBER) shares popped then settled nearly flat after a report that beat on the top and bottom lines.

- Wingstop (WING) shares are higher following an initial dip after the company posted record sales and the strongest year ever in 2023.

LikeFolio data suggests that based on LikeFolio’s consumer-driven data and peer benchmarks, DPZ may surprise the Street.

Last quarter, the company was hurt by the closing of 143 stores in Russia.

On the flipside, the company noted momentum in its carry-out and rewards offerings, and its integration with Uber Eats (finally!).

By lowering the dollar-level of the rewards entry threshold from $10 to $5, the company effectively brought in "lighter" users and carry out customers.

The company's value proposition is obviously resonating with consumers, as web visits and happiness overperform.

Officially, our earnings score for DPZ is +2, accounting for international headwinds. But we are expecting a strong report and wouldn't be surprised to see a move to the upside.