Trend Watch -- Looking Ahead We knew this day would […]

Is Zoom (ZM) the next big AI Winner?

LikeFolio data suggests…

Is Zoom (ZM) the next big AI Winner?

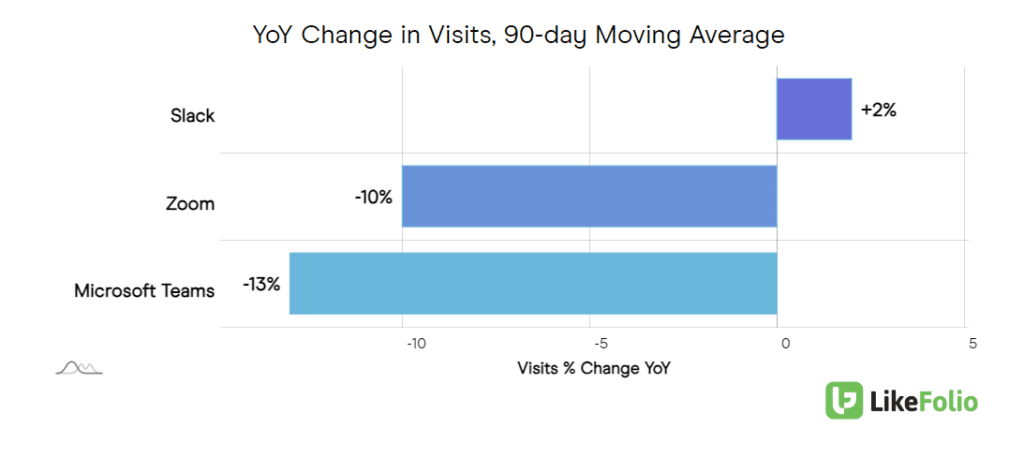

Zoom as a remote work solution finds itself currently in the middle of pack when it comes to consumer momentum vs. other WFH darlings like Slack (now CRM, formerly WORK) and Microsoft Teams (MSFT).

Zoom web visits have slipped by -10% YoY, which could spell trouble for guidance.

But forward-thinking funds like Cathie Wood's ARKK are betting big on this name.

ZM is currently the 7th largest holding in the Ark Innovation ETF, behind COIN, TSLA, SQ, ROKU, CRSP, and PATH -- names LikeFolio members should be very familiar with by now. However, it is relevant to note ARK has been decreasing its ZM position, selling the equivalent of $16.8 million in ZM shares earlier this month.

What's the bet?

That Zoom can effectively leverage AI to retain (and grow) its customer base.

The introduction of the Zoom AI Companion (formerly Zoom IQ), a generative AI digital assistant, is a recent example of Zoom's attempt to leverage AI technology.

Available at no additional cost for customers with paid services, AI Companion is designed to increase productivity, enhance skills, and improve team effectiveness across the entire Zoom platform.

For Zoom Meetings, it enables users to catch up on missed meetings through automated summaries and next steps, and even provides real-time feedback on presence and conversational skills. In Zoom Team Chat, it assists in drafting messages and summarizing chat threads.

Additionally, Zoom Whiteboard users will benefit from AI-powered idea generation and organization. Upcoming features include draft email suggestions and the ability to generate new images for whiteboards.

Qualitative mentions show mixed reviews, and competitive callouts.

Aside from AI hype, the company is taking cost cutting measures much like the rest of tech. Earlier this month ZM announcing it would cut 150 jobs (or 2% of its workforce) earlier this month. This comes on top of 15% workforce layoffs in February 2023.

Last quarter we saw ZM reap the benefits of its operational efficiency improvements: while sales increased ~3% YoY, earnings rose +21%, sending shares higher after earnings.

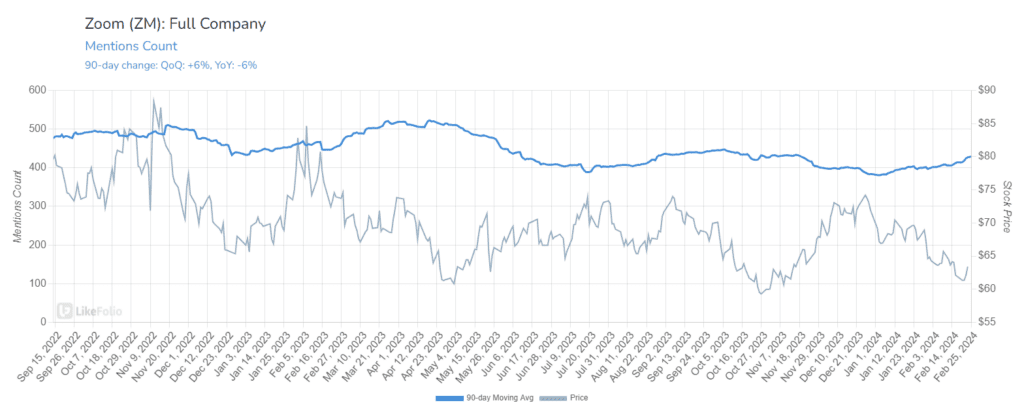

This quarter, investors are tuned in to guidance. Are the AI improvements enough to spur growth? Or is the company expecting growth to temper? LikeFolio data shows a loss of momentum across all major metrics -- mentions at large are down -6% YoY.

However, the bar is low. ZM is down -10% YoY and -90% from pandemic highs. Our signal is cautiously bearish.