PayPal (PYPL), Square (SQ) Consumer mentions of investing in cryptocurrency […]

Block (SQ) is giving mixed signals

Block Inc. (SQ) reported record-breaking Black Friday and Cyber Monday activity in 2024, with a 17% year-over-year increase in transactions. Block noted positive holiday trends including a 10% increase in Afterpay (BNPL) transactions and larger online cart sizes. The company also saw an unexpected boost in restaurant spending.

Concurrently, analysts have upgraded Block's price targets, citing growth in the Square merchant business and Cash App platform. SQ shares have traded 46% higher over the past six months.

However, LikeFolio data reveals some mixed signals.

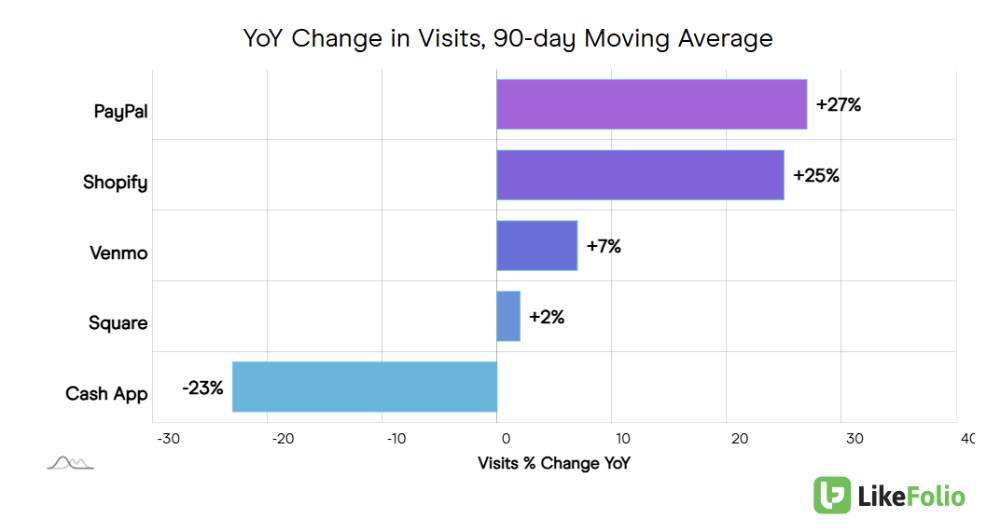

We're tracking underperformance in the Square merchant business, with only a 2% year-over-year increase as Cash App web activity plummets.

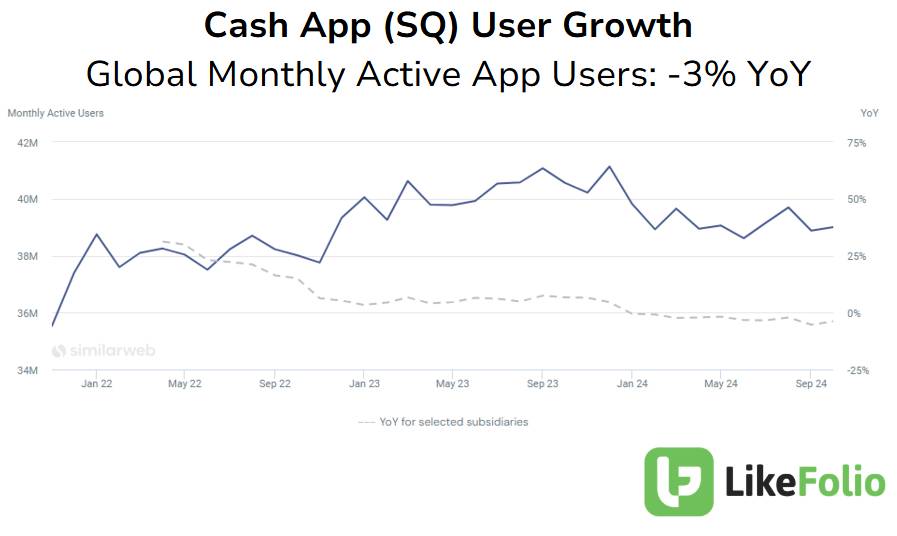

The Cash App platform is also showing signs of a slowdown, with web visits declining significantly year-over-year and monthly active user growth trending -3% lower YoY.

While the holiday numbers are a bright spot, the recent performance is likely already reflected in the stock's valuation.

Furthermore, Block reported weaker-than-expected revenue in its third quarter. Gross payment volume came in at $62.4 billion, missing the $64.3 billion target analysts were looking for.

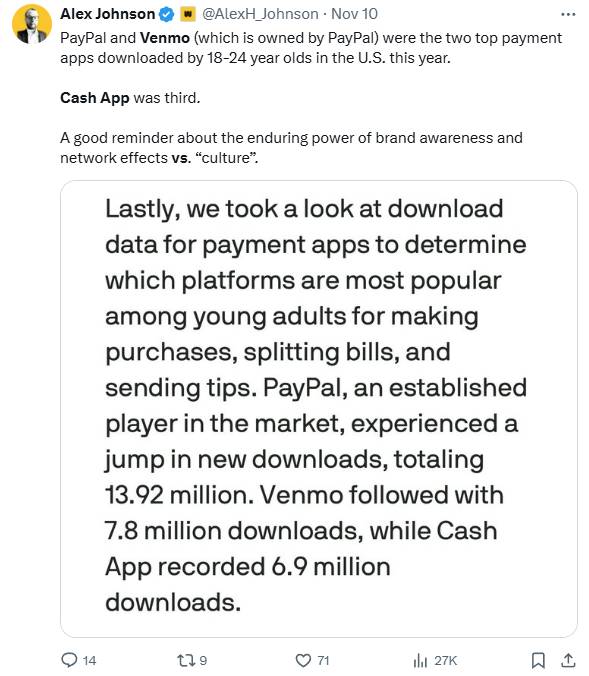

Looking ahead, some analysts wonder if SQ will follow in the footsteps of competitor PayPal and expand into the advertising business.

However, for now, Block appears to be playing catch-up to PayPal and other fintech providers.

Given the mixed signals, investors may want to...

This section is restricted to LikeFolio Pro Members only.