PayPal (PYPL), Square (SQ) Consumer mentions of investing in cryptocurrency […]

Can SQ Deliver Again?

Block (SQ) shares are moving higher today after the company announced plans to eliminate 112 jobs at the end of March in an effort to reduce costs.

At the close of Q3, the company's workforce numbered just over 13,000 employees, with a strategic plan to downsize to 12,000 by the conclusion of 2024.

This fits a theme in the financial industry and corporations at large:

And lays the groundwork for Block’s next earnings event.

Block's Q3 2023 earnings showcased robust growth, exceeding expectations with significant increases in revenue and gross profit. The company reported a total net revenue of $5.62 billion, marking a 24% increase from the previous year. Gross profit also rose by 21% year-over-year to $1.90 billion. A key highlight was the announcement of an initial authorization to repurchase $1 billion in shares, signaling strong future confidence.

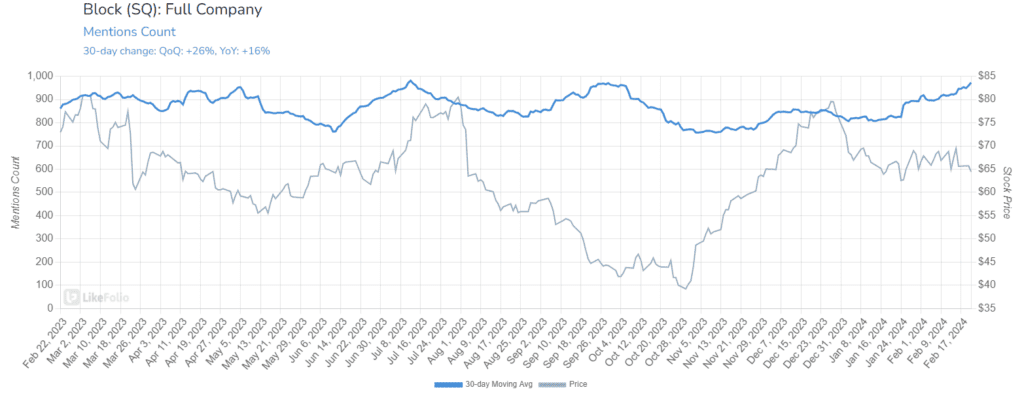

LikeFolio data shows traction for Block on 2 fronts:

- Mention volume growth: +16% YoY

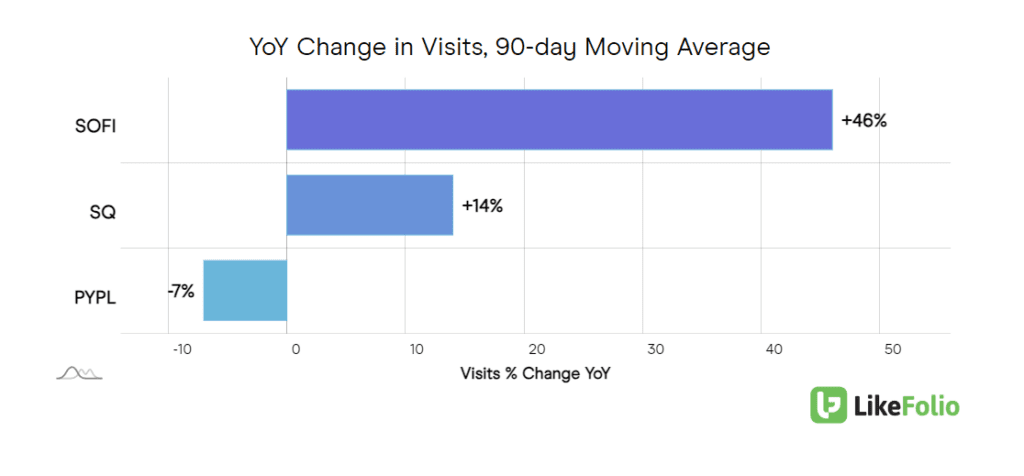

- Web visits: +14% YoY

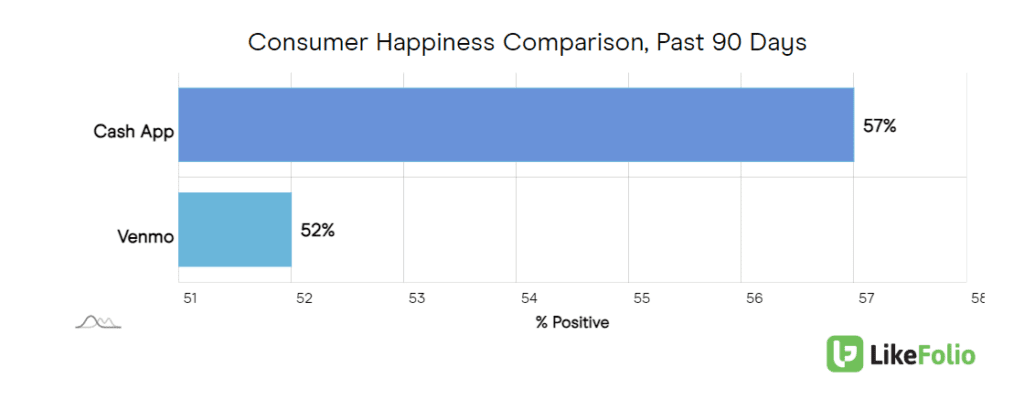

Mention volume momentum is led by Block’s digital wallet, Cash App vs. its business payment unit, Square, who has recently overtaken Venmo in regard to over sentiment levels.

The only problem with these metrics?

The growth rates cited are a bit of a slow down from last quarter – for instance, SQ web visits in Q3 were up +20% on a YoY basis.

This softness could be indicative of weaker-than-expected consumer spending.

We saw the impact of this when McDonald’s reported, its CFO noting, “Consumers are more weary of pricing.”

And when Yeti reported a slow down in big-ticket sales due to “cautious and inconsistent spending.”

On the bright side: it does appear that SQ is getting its business in order, on its path to achieving Rule of 40 in 2026. (According to the Rule of 40, if you add a company's growth rate percentage to its profit margin percentage, the total should be 40% or more, indicating a balanced trade-off between growth and profitability).

But metrics suggest this may take a bit longer than expected. We’re cautious ahead of SQ’s Q4 release, with a LikeFolio earnings score of +11.