Celsius (CELH) Demand is Strong Ahead of Earnings Underlying consumer […]

Celsius (CELH) is Heating Up

Celsius (CELH) is Heating Up

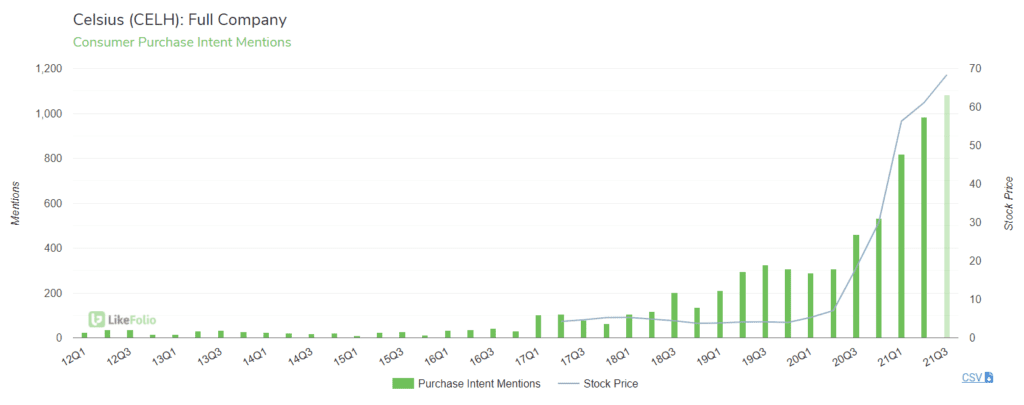

Yesterday, Monster Energy results were better than expected, driven by strength in the energy drink category: Q2 Net Sales increased 33.6% to $1.46 billion. But something caught our ear on the company's Earnings call, related to another player in the Energy drink industry... According to Neilsen, "Sales of Monster increased 59.9%. And its share was 28.1%, down 7.8 share points versus the same period a year ago. Red Bull sales increased 109.4%, and its share was 16.6%, up 0.4 points. Celsius' sales increased 133.1%. And its share increased 1.8 points to 14.3%." We've been keying into this growth for months. We added Celsius to coverage with a Bullish rating when shares were under $6. Then we doubled down, issuing a Bullish opportunity alert in April, when shares were below $60. Now, LikeFolio data shows continued strength in consumer demand.

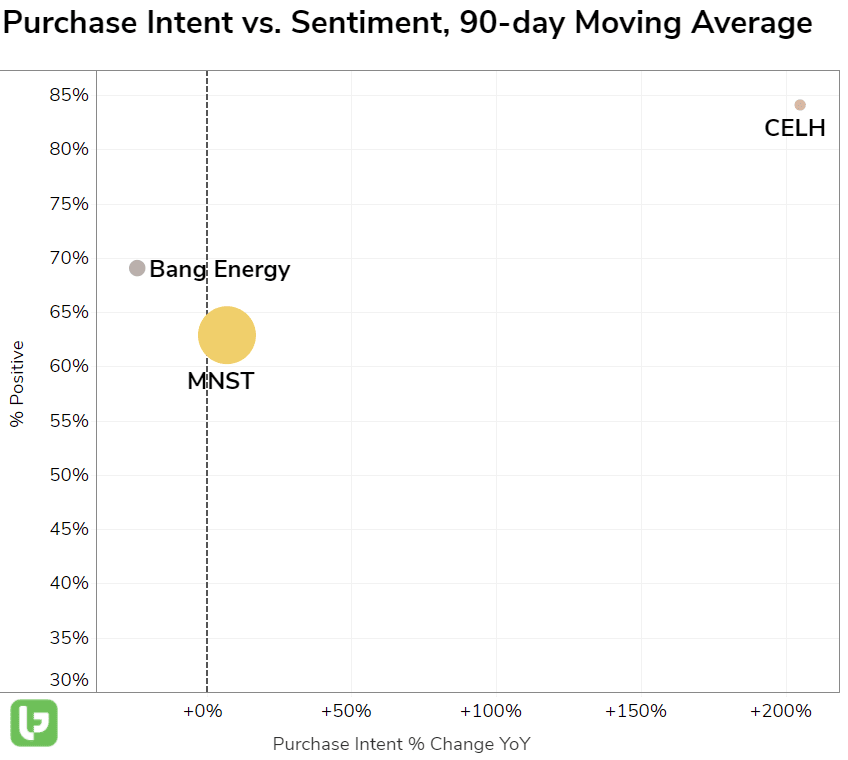

Demand growth in 21Q2 accelerated: +221% YoY (vs. +182% YoY in 21Q1). Meanwhile, Consumer Happiness is extremely high: 84% positive.

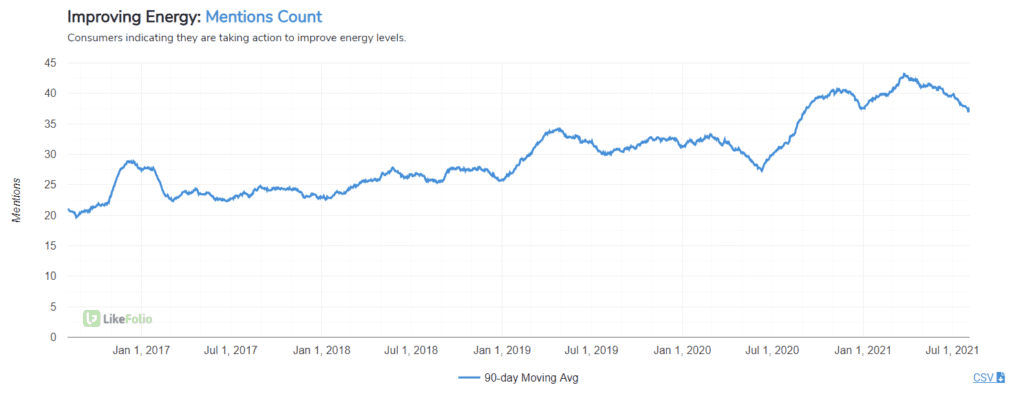

You can see this outperformance on the scatter chart above. What's going on? Celsius has carved itself a niche for health-conscious consumers looking to improve energy. These mentions have increased +13% YoY.

In fact, Celsius labels itself as a "fitness drink". Products are marketed as "thermogenic" meaning it helps to increase your heart and metabolic rate by raising your body temperature...the name makes sense, right? Tweets often feature mentions of consumers drinking these beverages prior to a workout, as part of a healthy lifestyle. While we can't predict logistical hurdles related to aluminum can supply/cost, consumer demand for Celsius is hot.