Here are some key stats and data points on stocks […]

Could General Mills Break the Steady Mold

General Mills, the American branded foods manufacturer, will report its earnings this week.

The company, which has brands such as Cheerio’s, Cocoa Puffs, Cinnamon Toast Crunch, and Betty Crocker under its belt, has fared better than a lot of other stocks so far this year, down 7.3% so far.

With inflation hitting hard, the company may have been impacted by the rising costs of ingredients and packaging.

General Mills also previously warned investors that supply chain challenges will affect 2 2Q3 which it is set to report on.

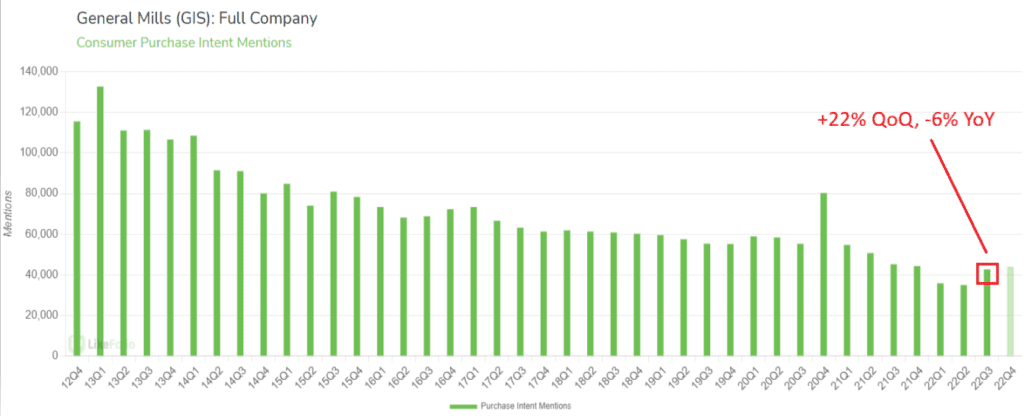

Nevertheless, Consumer Purchase Intent, in other words, Consumer Demand for the company’s products during the quarter increased +22% QoQ. However, it was at -6% YoY after a period of sustained decline since around 2013.

The business is also reshaping itself to align with new growth objectives now that people becoming more conscious about what they eat.

But overall, the stock can be defined as steady, with Consumer Happiness consistently hovering around the 70% mark.

In a recent Barron’s piece, the company, along with other “slower-growth companies” like Kellogg, and Conagra Brands, were described as alternatives to bonds.

Bottom Line: General Mills… a steady stock with steadily declining Consumer Purchase Intent Mentions doesn’t sound like the most attractive investment choice, and the impact of supply chain challenges and inflation doesn’t help. Nevertheless, Consumer Demand did edge higher in the quarter it is set to report on, which may provide a ray of light for shareholders to look to this week.